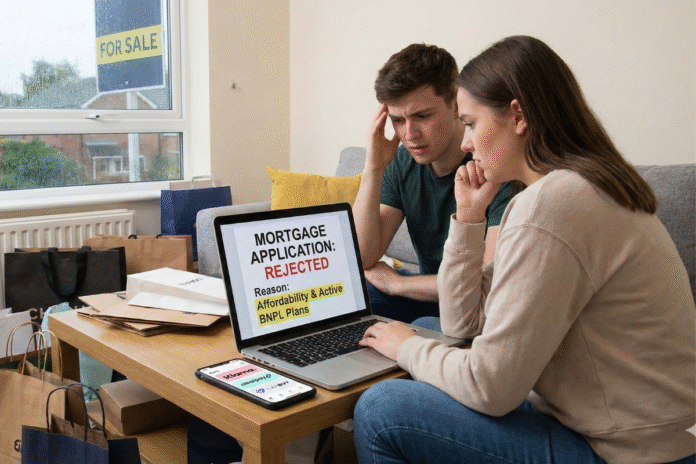

Britain’s rapid uptake of Buy Now Pay Later (BNPL) services is putting a growing number of first-time buyers at risk of reduced mortgage offers or outright rejection according to new analysis from Mojo Mortgages.

An estimated 22.6 million UK adults have used BNPL, making it one of the country’s fastest-growing forms of consumer credit.

Millennials and Gen Z – the same groups now entering the housing market – are among the heaviest users.

The average first-time buyer is now 32 years and seven months, Mojo Mortgages data shows, yet many are unaware that frequent or unmanaged BNPL use can count against them when applying for a home loan.

DEBT EXPOSURE

Mojo Mortgages says that lenders are increasingly scrutinising bank statements for signs of financial strain or reliance on short-term credit, rather than focusing solely on credit scores.

John Fraser-Tucker, Head of Mortgages at Mojo Mortgages, said: “While BNPL is interest-free, lenders see it as debt exposure. When providers report usage to credit agencies, missed payments hit credit scores hard, raising a red flag for banks who seek stability.

“For any prospective first-time buyer, if they can avoid accumulating multiple BNPL balances, do so – the short-term convenience of putting this year’s Christmas presents on there to deal with in a month or two simply isn’t worth risking your long-term dream of securing the best mortgage deal.”

He also warned that affordability assessments are also directly affected. “Every BNPL commitment, whether outstanding or showing up as a regular payment, reduces the amount a lender is willing to lend.

“First-time buyers could effectively lose thousands from their mortgage offer, simply because of a few small, recurring monthly payments.”

AFFORDABILITY CHECKS

The warnings come as lenders tighten affordability checks amid elevated living costs, higher deposit requirements and continued scrutiny from regulators over responsible lending.

Brokers say BNPL liabilities often appear as small, fragmented payments but can accumulate quickly, signalling poor budgeting or excess reliance on short-term borrowing.

With the first-time buyer market already one of the most financially stretched, industry experts warn that BNPL could become an unexpected barrier to homeownership for those who are otherwise mortgage-ready.