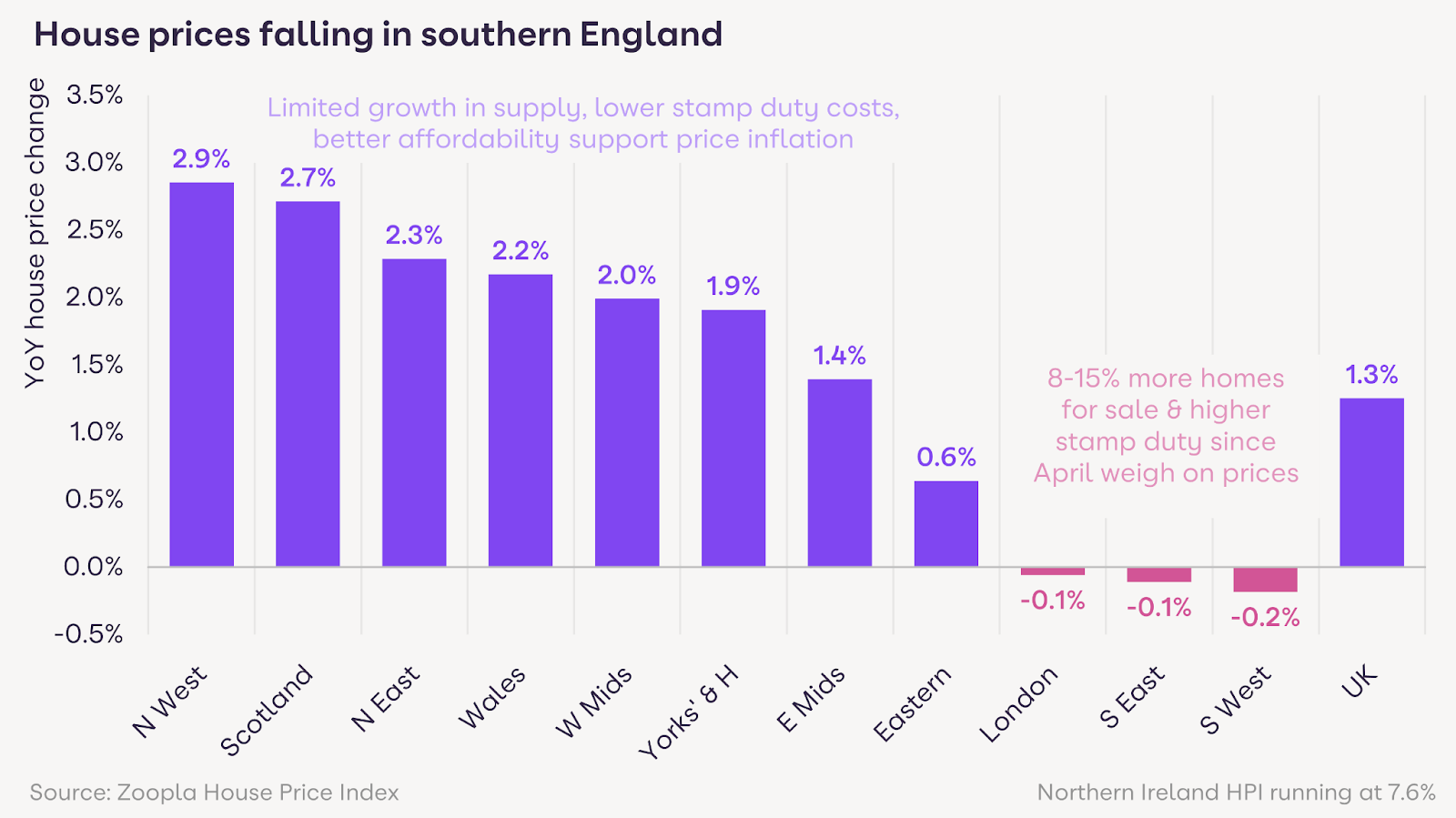

House prices have fallen year-on-year across southern England for the first time in 18 months as pre-Budget speculation over new property taxes dragged down buyer demand, according to Zoopla’s latest House Price Index.

Rumours of additional taxes on homes valued above £500,000 triggered a 12% fall in buyer demand and fewer sales agreed in the four weeks to 23 November.

The uncertainty pushed prices marginally lower in London (-0.1 per cent), the South East (-0.1 per cent) and the South West (-0.2 per cent).

Outside the South, the market continues to show resilience. Average UK house prices are up 1.3% year-on-year, reaching £270,200. Regions with lower-value, more affordable homes are seeing stronger growth, with prices in the North West rising 2.9% over the year.

DEMAND LIFT

The Autumn Budget has now removed the biggest source of market anxiety. Proposals for a new annual property tax on homes over £500,000 have been shelved, a move affecting the 210,000 properties currently for sale above this threshold.

The reversal is expected to lift demand and support activity into early 2026, particularly in southern regions where a higher share of homes exceed £500,000 and prices have come under pressure from rising supply.

Stamp duty, however, remains a structural drag on transactions. Thresholds for existing homeowners have not changed since 2014, while house prices have risen 47% over the same period.

This has pulled more buyers into higher tax bands. Since 2019, the share of homes bought by existing owners where stamp duty exceeds 2.5% of the purchase price has climbed from 21% to 33%.

The rising tax burden on typical purchases is adding to affordability constraints in much of southern England, strengthening calls for stamp duty reform as part of a wider overhaul of property taxation.

BUDGET BARK WORSE THAN BITE

Richard Donnell (main picture, inset), executive director at Zoopla, said: “The Budget bark was worse than the Budget bite for the housing market. Home buyers and sellers will welcome the end of the uncertainty that has stalled housing market activity since the late summer.

“Our data shows the underlying demand to move home remains strong. With greater certainty we expect a rebound in housing market activity that builds into the new year with households who paused home moving decisions over recent months return with greater confidence.”

And he added: “The removal of the threat of a new annual property tax from 210,000 homes is particularly positive for the market and will help revive activity in higher-value areas across southern England where house prices are under pressure.”

MISSED OPPORTUNITY

David Powell, CEO of Andrews estate agent said: “After months of speculation, I am disappointed the Government has missed this opportunity to address the challenges around stamp duty and affordability.

“There will be much disappointment around the £2m+ mansion tax and it’s likely the South will get hit the hardest, we will eagerly await how this impacts the market and the unintended consequences that may follow.

“I suspect house price growth in the South may remain static in the short term whilst the market adjusts to the new normal.

“I expect the market to bounce back from any damage caused by leaked or shelved policies leading up to the Government’s Budget and we will see activity levels increase across the South throughout 2026.”

“The prospect of homeownership continues to prove extremely challenging.”

Nathan Emerson, CEO of Propertymark, added: “After much speculation, we have gained clarity on many future fiscal plans that will affect the housing sector following the Autumn Budget.

“A key takeaway was the proposal of a High Value Council Tax Surcharge, also referred to as a mansion tax, which will mean properties with a value over £2m will see a taxation upwards of £2,500 each year.”

MARKET UNCERTAINTY

And he said: “This is of particular relevance in areas such as London and the South East, and when compounded with a deceleration of house price growth within these areas, has the potential to cause market uncertainty.

“It has also been disappointing not to see targeted support for first-time buyers included within the Budget, with many deposits typically sitting at around £60,000.

“The prospect of homeownership continues to prove extremely challenging for those taking their first steps onto the property ladder. Overall, this may prove to be a missed opportunity by the UK Government to help promote long-term economic stability down the line.”