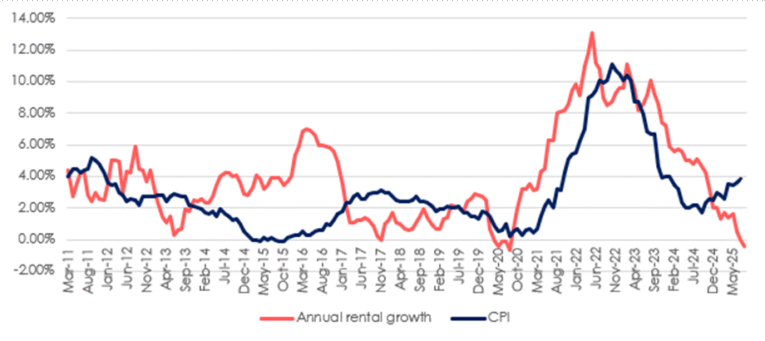

Tenants are beginning to feel some respite as rents across Great Britain fall at the same time as inflation accelerates.

Newly agreed rents slipped by 0.4% in August to an average of £1,387 per month, according to the latest Hamptons Lettings Index.

It marked the largest post-Covid fall and the joint second-biggest decline since the index began in 2011.

London led the downturn, with Inner London rents down 5.8% year-on-year, while four of 11 regions are now recording negative growth.

Source: Hamptons

The decline means rents have now risen more slowly than consumer price inflation for nine consecutive months.

In July, inflation stood at 3.8% against flat rental growth, with August expected to show a further pick-up in the CPI.

Given that housing costs make up nearly a quarter of the basket used to measure inflation, the slowdown in rents is likely to ease upward pressure on the headline rate in the months ahead.

Even so, the moderation follows a prolonged period of strong rental growth. Since 2015, average rents have risen 41%, outpacing the 33.7% increase in CPI. Over five years, rents are up 31% compared with 24.9% inflation.

Had rents tracked inflation, the average tenant would now be paying £1,308 a month – saving £952 annually – or £1,253 under a 10-year horizon, equating to £1,611 in annual savings.

Comparisons with other items in the inflation basket highlight the scale of recent rental pressures.

If rents had followed the same trajectory as airfares since 2020, tenants would be paying £1,934 a month. In contrast, had they moved in line with camera prices, rents would average just £973.

The average cost of renewing a tenancy rose 4.3% in the year to August, leaving tenants paying around £90 a month less than those entering new lets.

While the gap is narrower than the £170 peak in late 2023, it remains well above the pre-Covid average of £10–20.

Market conditions are also beginning to shift. The number of unlet homes available in August was 8% higher than a year earlier, while tenant demand fell 4 per cent. Although supply remains below 2019 levels, the gap is narrowing – a sign that a cooling market may keep rents subdued through the rest of the year.

KEY TO INFLATION

Aneisha Beveridge, Head of Research at Hamptons, said: “For most of the last five years, rapidly rising rents were a key contributor to the UK’s high inflation story. But after several years of rapid rental growth, the tide is finally turning.

“For the ninth month in a row, rents have risen more slowly than inflation – offering tenants a rare moment of financial respite. While the monthly savings may seem modest, they mark a significant shift in the rental market’s role in driving inflation.

AFFORDABILITY STRETCH

And she added: “Over the longer term, rents have consistently outpaced inflation, which means tenants today are paying more than they would have if rents had simply tracked CPI.

“For the most part, this has mirrored the rising cost pressures facing landlords. But this recent slowdown suggests the market is recalibrating. With affordability stretched and demand softening, landlords are having to adjust to attract tenants.

“Like wages, rents don’t often fall. In fact, there have only been six months over the last 14 years when rents have fallen nationally on an annual basis.

“And when they do, it’s usually in real terms, rather than absolute terms. What we’re seeing now is a real terms fall in rents – when inflation and wages outpace rental growth – which leaves tenants feeling better off.

“It’s a sign that the rental market is responding to wider economic pressures, and it could help ease the inflation headache for policymakers in the months ahead.”