After years of double-digit rises the UK rental market is finally showing signs of easing. The latest data from Zoopla reveals that rents are now increasing at their slowest pace in four years and bringing some welcome relief for tenants who have faced relentless price hikes since 2020.

Annual rental growth slowed to 2.4% in the year to August – less than half the rate seen a year earlier – with the average monthly rent now standing at £1,300, just £30 higher than last year.

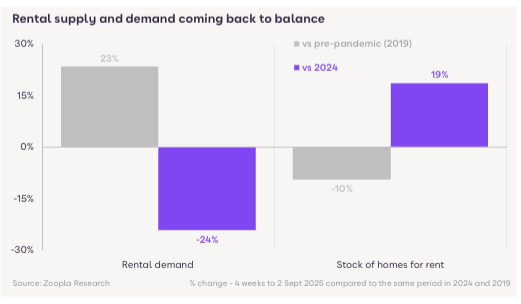

Behind the cooling trend lies a combination of softer demand and stronger supply. Letting agents are reporting 24% fewer tenant enquiries than a year ago, while the stock of rental homes has increased by 19%.

The typical agent now has 19 homes on the books compared to a low of 14 in 2022, giving tenants more choice and more time to make decisions.

EASING MIGRATION

Migration has eased sharply following tighter visa rules, mortgage rates have steadied, and wage growth is enabling more renters to buy.

This shift was supercharged by a rule change earlier this year that boosted borrowing capacity for first-time buyers by 20%, driving a 30% surge in first-time buyer mortgages. As those buyers exit rented homes, supply is freed up for others.

A 36% rise in rents since 2020 has supported yields and encouraged new investment, with buy-to-let loans up 60%. In some regions, the impact is clear: rental supply is up 36% in the South West and 31% in the East Midlands, with many homeowners choosing to let properties rather than sell into a slow sales market.

London, however, remains a special case. Deposit requirements for landlords are significantly higher – £187,000 on average compared with £29,000 in the North East – and 31% of homes for sale in the capital are still ex-rental stock, limiting growth in supply.

While tenants now have more choice, affordability remains a pinch point. Rents are £80 a week higher than five years ago – an extra £4,100 a year.

Growth is slowing, but not reversing, and Zoopla expects 2025 to end with average rental inflation of around 3%. For agents and landlords alike, the market is normalising – but remains tight by historic standards.

AFFORDABILITY CONSTRAINT

Richard Donnell, executive director at Zoopla, said: “Rental market conditions are starting to normalise which will be very welcome news to renters.

“Lower migration and better mortgage availability for first time buyers are easing the scale of the competition for rented homes.

“There is also more choice for renters with more homes for rent as landlords start to buy homes once again and some owners who can’t find a buyer listing their homes for rent.

“The affordability of renting remains a key constraint on the pace of future rental inflation and we expect rents to be three per cent higher by the end of the year at an average of £1,320 a month.”