Almost half of Brits believe that the global economic crisis is forcing people to remain financial teenagers into their late 20s. Research conducted by Skipton Building Society showed that

44% of Britons surveyed think today’s youngsters are finding it impossible to grow up as quickly as they would like.

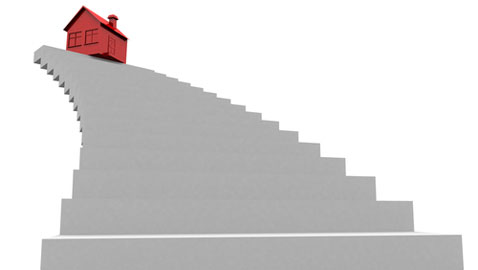

The leading milestone that they are ‘failing to active’ was owning their own home.

Other factors included becoming financially independent of mum and dad, paying into a pension and generally getting to grips with budgeting and being able to manage their finances responsibly.

More practical signs of being a ‘grown up’ include owning a ‘best’ crockery set and being able to bleed a radiator.

The findings emerged in a study of 2,000 people, which uncovered the 50 things which people think show you have become a fully-fledged adult. The research shows most people don’t feel like a proper grown up until they are at least 26 years old.

“Many of the indicators are things which people need to have mastered – such as looking after the house and garden, being able to cook and taking responsibility when it comes to personal finances,” said Tracy Fletcher, head of corporate communications for Skipton Building Society.

“But other factors are the key milestones in life – such as buying a house, getting married and having children – things which are happening at a later age due to economic circumstances, job security and so on.

“Owning a house topped the poll as two thirds of Brits felt this was the most significant factor when it comes to aging and accepting responsibility, and yet it is now harder than ever to step foot on the property ladder.”