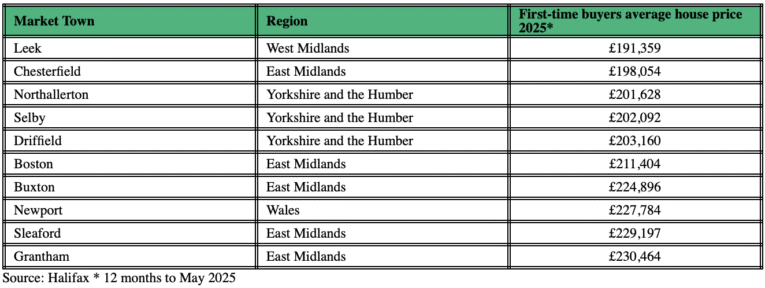

First-time buyers are getting more market town for their money in the Midlands, with average property prices in Leek, Staffordshire, just £191,359, according to new research from Lloyds Bank.

The report shows that six of the 10 most affordable market towns for first-time buyers are in the Midlands, where the combination of relatively low house prices and good transport links continues to attract buyers.

Across England and Wales, the average cost of a home in a market town is now £363,456 – up 5% in the past year and 24% over the last five years.

FIRST-TIME BUYERS

First-time buyers are paying an average of £280,582, up 2% on last year and 26% since 2020, reflecting heightened demand for these historic locations during and after the pandemic.

Immingham, in Yorkshire and the Humber, is the most affordable market town for buyers overall, with an average property price of £176,918.

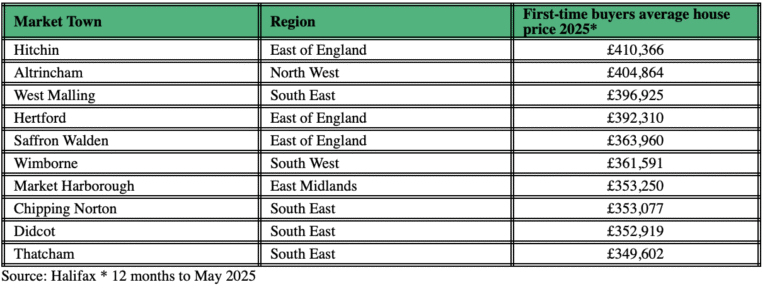

At the other end of the scale, some of the priciest market towns are now among the most expensive locations outside Greater London.

BEST OF BOTH WORLDS

Andrew Asaam, homes director at Lloyds Bank, says: “It’s no wonder market towns have stood the test of time with home-buyers, whether people are stepping onto the first rung of the housing ladder, or are making a move to their next home.

“These charming locations are filled with historic landmarks and architecture, quaint charm and community spirit, offering a calmer pace of life, often within the reaches of bigger towns and cities.

“That ‘best of both worlds’ feeling has led to house prices in these areas holding up – in fact, the priciest market towns are amongst the most expensive locations, outside of Greater London, to settle into a home.

“It’s worth looking beyond the most popular spots as some market towns are great value for money while offering the farmer markets, independent shops and community spirit that make these historic places so appealing.”

HITCHEN PRICIEST

Hitchin, Hertfordshire is the most expensive market town for first-time buyers, with an average price of £410,366.

Amongst all buyers looking for a home in a historic location, Beaconsfield comes out the costliest. A property here, in the South East of England, will set buyers back £839,468 on average.

HELPING FIRST-TIME BUYERS GO FURTHER

To help more first-time buyers live in the locations they want to, Lloyds is making an additional £4billion in lending available, by extending First-Time Buyer (FTB) Boost.

FTB Boost now offers 5.5 times loan to income, easing some of the affordability challenges these buyers experience and helping even more customers get the keys to their first home.

CASE STUDY

Amy Flynn, 26, made it onto the property ladder in Bromsgrove.

“Bromsgrove has everything a young couple could need. When looking to buy our first home, location was very important to us.

“We chose Bromsgrove, a market town, primarily for its connectivity, allowing us to easily commute to work and visit family and friends.

“Beyond logistics, we were drawn to the town’s atmosphere. It has plenty of supermarkets, coffee shops, parks, pubs, gyms, barbers, nail salons and lots of charity shops to browse – everything a young couple could need.

“Plus, the Saturday morning market is an excuse to get out of the house early on the weekend and treat myself to a fresh pastry or bunch of flowers.

“After our university years and busy social lives, having these conveniences and the ability to host friends in our hometown is important to us, to help us entertain and create more memories.

“Being within walking distance of everything we need means we don’t need to spend as much money on petrol or delivery, helping us to save those extra pennies which are very important when navigating bills and expenses for the first time.

“Choosing Bromsgrove means we can still enjoy a fulfilling lifestyle while managing the financial responsibilities of buying our first home.”