Britain’s housing market has stalled for a third consecutive month as uncertainty over next month’s Autumn Budget and stretched affordability continue to sap confidence among buyers and sellers.

The latest UK Residential Market Survey from the Royal Institution of Chartered Surveyors (RICS) shows buyer enquiries, agreed sales and new listings all in decline during September, with surveyors warning that the slowdown could extend well into next year.

A net balance of -19% of respondents reported a fall in new buyer demand, while agreed sales slipped to -16%, marking a further drop in activity despite a slight improvement from August’s -24% reading.

The number of homes coming to market also fell, with new instructions at -15%, signalling a second straight month of contraction.

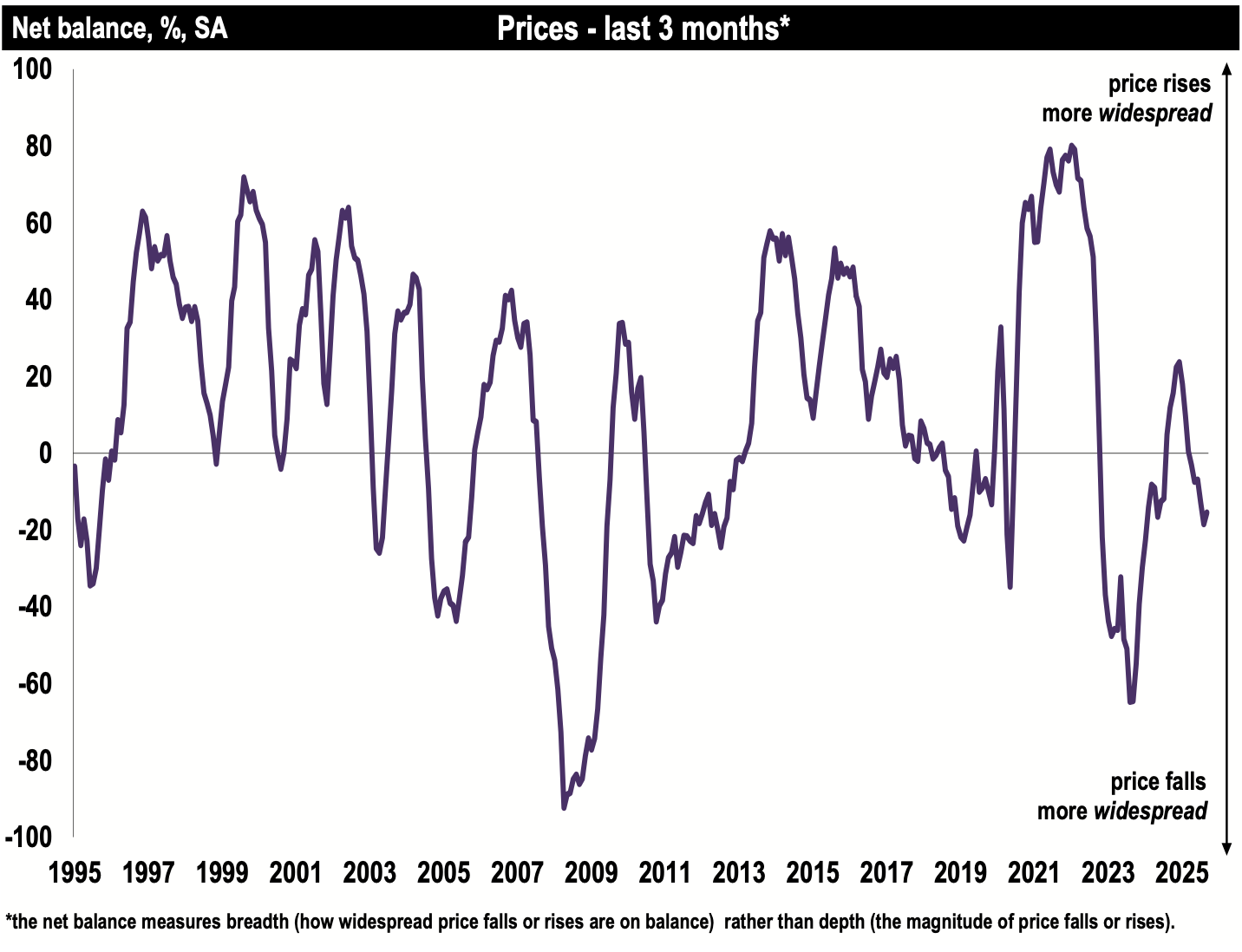

House prices are edging lower across most of the country, with a net balance of -15% pointing to modest declines. The South East and East Anglia saw the sharpest drops, while Scotland and Northern Ireland continued to record small gains.

STRUGGLING FOR MOMENTUM

Tarrant Parsons, RICS Head of Market Research and Analytics, said: “The housing market continues to struggle for momentum, with seemingly no clear catalyst on the horizon to spark a turnaround.

“Ongoing uncertainty around potential measures in the upcoming Budget is also likely adding to the prevailing cautious sentiment.”

Expectations for both near-term and 12-month sales remain negative at -9%, the weakest outlook in more than a year.

“Although short-term price expectations remain subdued, a modest +12% of surveyors expect prices to rise again by late 2026.”

The rental sector remains under pressure, with landlord instructions falling sharply to -38%, the lowest since May 2020, as many investors continue to exit the market amid higher costs and tighter regulation.

RICS expects rents to climb by around 3% over the next year as supply continues to shrink.

The figures highlight the fragile state of the housing market as buyers await clarity from the Chancellor’s first full Budget next month.

WAIT AND SEE APPROACH

Tomer Aboody, director of specialist lender MT Finance, said: “With constant negativity surrounding the upcoming Budget, both buyers and sellers alike are either biding their time to see what materialises, or are trying to be active but at lower asking prices.

“With Kemi Badenoch announcing that a new Conservative government would axe stamp duty on primary residential purchases, could this possibly persuade Rachel Reeves that stamp duty is a huge barrier to the market and should be reduced or potentially restructured?”

UNCERTAIN LANDSCAPE

Emma Cox, managing director of real estate at Shawbrook, added: “Reduced buyer demand and declining sales activity remain symptoms of an uncertain market landscape.

“Although interest rates are more stable, and there are signs of house prices cooling, buyers are not pushing ahead with deals.

“With the Autumn Budget approaching, it’s likely that first-time buyers in particular are holding off in the hope that some form of incentive will be introduced – especially in the wake of the removal of stamp duty exemption earlier this year.

“While rental demand has largely stabilised, it remains high overall – which should encourage landlords, as prospective buyers continue to turn towards the rental market.

“It signals that opportunities remain for professional landlords to add to their portfolios and cater for ongoing tenant demand.”

COMPROMISING CONFIDENCE

Jeremy Leaf, north London estate agent and a former RICS residential chairman, added: “The prospect of higher – not just for property – taxes in the Budget is compromising confidence other than for those who are particularly motivated to move.

“Looking forward, we see little likelihood of change at least until after the end of November. However, in similar circumstances previously, we have often found the weaker the uncertainty, the stronger the recovery.”