Hilco Real Estate Finance (HREF) has completed a £11.5m bridging loan on The Platform, a 488-unit purpose-built student accommodation building in Liverpool, in just over 14 days.

The 12-month facility enabled the borrower to refinance existing debt on the recently acquired asset.

The transaction marks the second student accommodation loan completed by the lender in the last year.

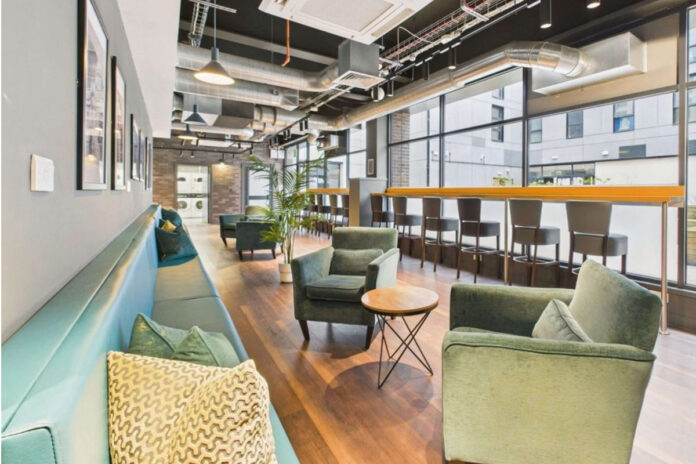

The Platform is located near both the University of Liverpool and Liverpool John Moores University. Constructed in 2021, the building is described as one of the leading PBSA assets in the city and has performed strongly since opening.

Steve Allen, director at HREF, said: “We are seeing more enquiries from borrowers in the student accommodation market, and we are very pleased that we were able to deliver funds so quickly on this loan in the highly dynamic Merseyside market.

“This is the second student accommodation completion for HREF over the last 12 months and we see this as a sector where we can add real value. The sponsor in this case has a strong track record and the asset is well positioned to take advantage of several strong local universities.”

Max Lewis, chief investment officer at HREF, added: “This was a large and complicated transaction that HREF was able to complete in just two weeks, precisely because we are deploying our own capital, and are therefore able to lend with greater certainty and faster. This showcases HREF’s market leading speed of completion and deal execution capabilities.”

Valuations for the transaction were undertaken by JLL, with legal due diligence provided by Clarion.