First-time buyers are paying more for their homes than they were a year ago as improved mortgage affordability gives them greater borrowing power, new data from Zoopla shows.

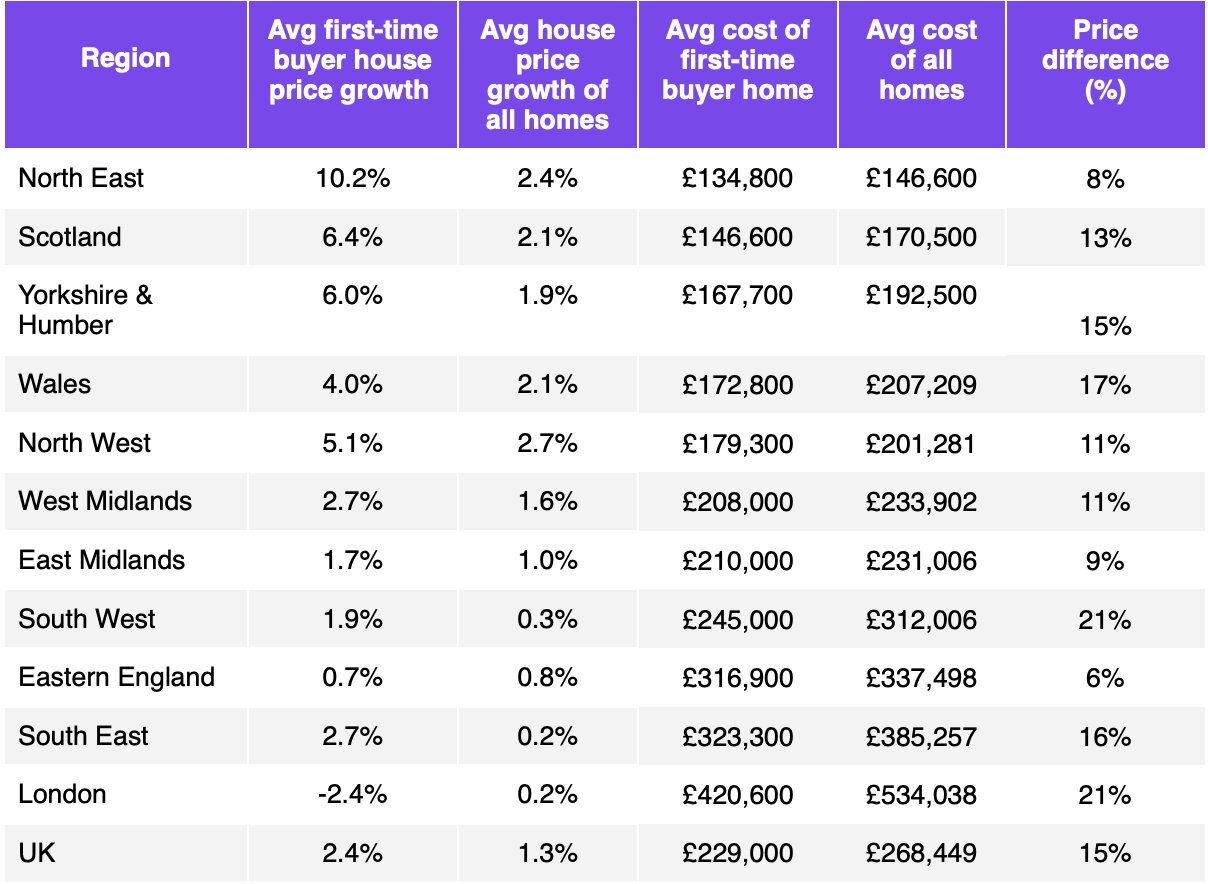

The average price paid by a first-time buyer now stands at £229,000 – a 2.4% annual increase – outpacing the wider housing market, where prices rose by 1.3% over the same period.

Falling mortgage rates over the past six months have boosted affordability, giving buyers using a mortgage around 20% more purchasing power.

This has helped drive a 30% rise in first-time buyer mortgage approvals and pushed demand towards higher-value homes in more affordable regions.

KEY DRIVER

First-time buyers remain a key driver of housing activity, accounting for 39% of all sales and almost half of new mortgages for home purchases.

Zoopla’s data indicates that most are seeking three-bedroom houses, with demand for flats continuing to fall.

Prices for first homes are rising faster than the wider market in nine out of 11 UK regions. The sharpest increase was recorded in the North East, where first-time buyer prices rose by 10.2% compared with 2.4% for the overall market.

Scotland, Yorkshire and the Humber, and the North West also saw stronger growth for entry-level properties.

By contrast, first-time buyers in London are paying less than a year ago, with average purchase prices down 2.4%. Many are opting for cheaper homes to offset higher costs following the end of stamp duty reliefs in April.

Across the UK, first-time buyers typically target homes priced around 15% below local averages. In London and the South East, that discount rises to 21%, reflecting efforts to balance borrowing limits, affordability pressures and upfront purchase costs.

AFFORDABILITY BOOST

Richard Donnell, Executive Director at Zoopla, said: “First-time buyers have had a 20% boost to affordability over the last six months.

“This is enabling them to look at buying higher value homes in the more affordable parts of the country which is supporting faster house price growth across the board.

“In contrast, first-time buyers in London and southern England are looking for cheaper homes than a year ago despite the extra borrowing capacity.

“The ending of stamp duty reliefs since April has added to the cost of buying a home for first time buyers.

HOUSE PRICE DRAG

He added: “Large deposits and mortgage regulations mean a high household income is needed to buy in southern England where affordability remains a challenge and this is acting as a drag on house price growth across southern England.

“The variation in affordability explains why first time buyers across England are looking to buy three bed houses while in London, one and two bed flats remain the primary target for those buying their first home.”