Aspiring homeowners looking to live like royalty this Halloween may find the dream of castle ownership comes at a steep price.

New research from Enness Global has found that the average castle for sale in the UK now costs £2.2 million – requiring a deposit of around £333,000 and a monthly mortgage repayment in excess of £10,000.

The high-net-worth mortgage broker analysed current castle listings across the UK and found 11 such properties on the market, with values ranging from under £1 million to over £7 million.

Despite their grandeur, many of these historic homes fall outside standard lending criteria, meaning specialist finance is often essential.

TOP OF THE MARKET

At the top of the market sits Appleby Castle in Cumbria – a 12th-century fortress listed with Sotheby’s at £7.25 million.

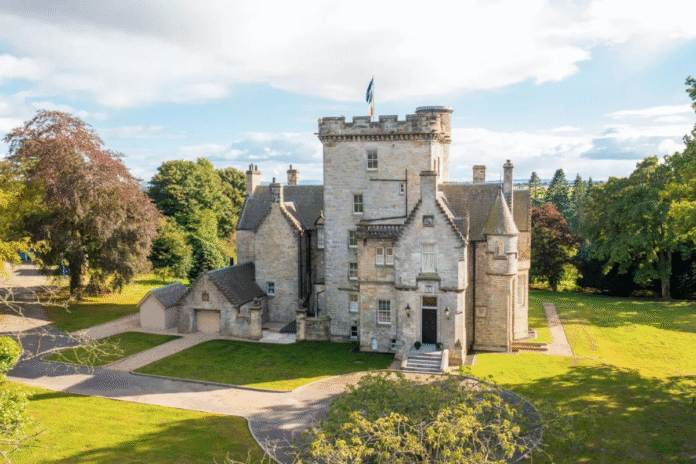

In Scotland, Shuna Castle, complete with its own private island near Oban, is on sale for £5.5 million, while Bogside, a Baronial Castle in West Fife (main picture) offers grand architecture and modern restoration for £3.45 million through Strutt & Parker.

In England, Stowe Castle in Buckinghamshire – a Georgian landmark set amid sweeping parkland – is listed at £3.175 million with Fine & Country, and Bellister Castle in Northumberland, a 17th-century stronghold, is on the market for £2.5 million.

At the more affordable end, Kinloch Castle on Scotland’s Isle of Rum, an Edwardian estate steeped in history, is available for £750,000 through Savills.

BESPOKE APPROACH

Islay Robinson, chief executive of Enness Global, said financing such homes demands a highly bespoke approach.

“Buying a castle isn’t simply about securing a home; it’s about taking responsibility for a piece of living history,” he said. “These properties are centuries old and often sit outside conventional lending frameworks, so they require creative structuring and lenders with experience in heritage assets.”

ONGOING COSTS

Robinson added that while the romantic allure of castle ownership is strong, buyers must account for the ongoing costs of maintenance, insurance and preservation.

“From a lending perspective, castles sit in a category of their own,” he said. “They’re high-value, characterful assets that often generate mixed income through tourism or hospitality. With the right financial strategy, however, owning one can be both a passion and an investment.”