Specialist lender Pepper Money has presented a white paper to Downing Street calling for reforms to shared ownership as the government prepares to publish its prospectus for the next Social and Affordable Homes Programme this autumn.

The paper, Shared Ownership – A Vital Bridge to the Housing Market, argues that the tenure plays a critical role in widening access to home ownership but requires policy changes to remain viable in the face of inflation and changing economic conditions.

Prepared with input from former Bank of England economist Rob Thomas and former Chief Secretary to the Treasury David Gauke, the paper sets out three recommendations.

These include the creation of an independent body to publish regular data on the performance of the shared ownership sector; the annual uprating of income thresholds in line with average earnings growth, rather than leaving them fixed at £80,000 nationally and £90,000 in London; and a review of Homes England’s Capital Funding Guide to establish a more standardised approach that reflects the needs of customers who fall outside traditional high street criteria.

SUPPLY AND DEMAND

Pepper argues that without adjustment, the current thresholds risk excluding households who have no other route onto the housing ladder, undermining both demand and supply. Since the caps were last set in 2016, they have fallen by 35% in real terms.

The lender reported a 21% rise in shared ownership customers last year. It said that shared ownership continues to play a significant role in closing the affordability gap.

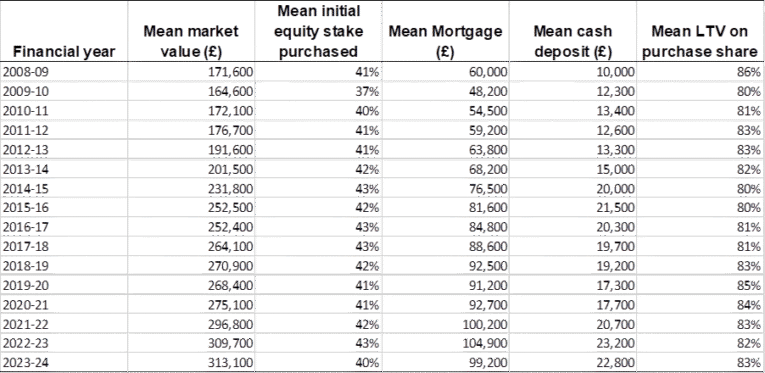

In 2023–24, the average shared ownership buyer acquired a 40% stake in a home worth £313,100, with a deposit of £22,800 and a mortgage of £99,200.

By contrast, the average first-time buyer required a £69,000 deposit and borrowing of £223,000. In London, the deposit requirement rises to £155,000.

VITAL BRIDGE

Rob Barnard (main picture), intermediary relationship director at Pepper Money, said: “Shared ownership offers a vital bridge to the housing market for so many people who otherwise would struggle to buy their own home, but we know without action, this bridge will get harder to use for those who need it.

“Our policy recommendations are pragmatic, cost effective, and provide certainty for the sector to ensure that shared ownership continues to be the vital pathway to home ownership so many rely on.

“The Government has rightly outlined their ambition to build 1.5 million homes by the next election, and that can only be achieved by supporting a range of types of home ownership, including shared ownership.”

UNINTENDED CONSEQUENCES

But he added: “The unintended consequence of the status quo is a less viable tenure, with shared ownership becoming less accessible for financially capable people seeking their own home and has the potential to undercut the Government’s own bold house building ambitions.

“We’ve taken our message and our request directly to the heart of the Government, and into the hands of the Prime Minister’s team, and we urge them to act in the forthcoming Affordable Homes Programme to give certainty and a successful future to the tenure.”

Source: Pepper analysis of DLUHC and MHCLG data