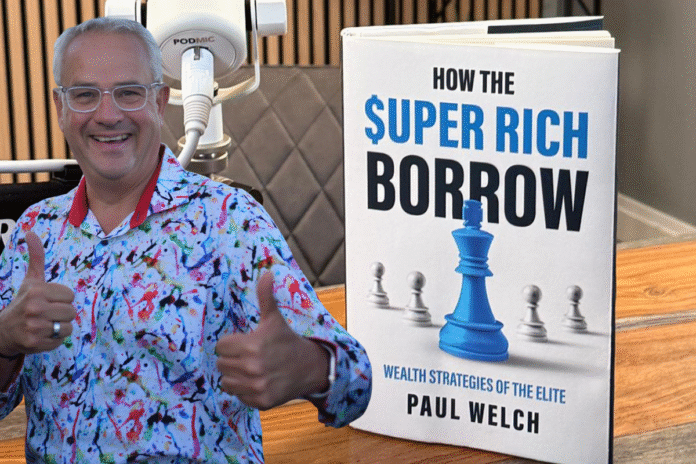

Paul Welch, founder of private finance firm Million Plus, has launched a book claiming to expose the borrowing strategies used by some of the world’s wealthiest families.

How the Super Rich Borrow, published on Amazon, sets out how high-net-worth individuals use debt as a tool for privacy, capital preservation and long-term growth.

Welch (main picture, inset), who has arranged more than £4 billion in lending facilities across property, yachts, art and private banking, argues that the public perception of the ultra-rich as cash buyers is largely misplaced.

Instead, he says, the elite borrow deliberately and systematically to maintain control of their assets and avoid crystallising tax liabilities.

ILLUSION OF OWNERSHIP

The book explores themes such as the rise of private credit, the growing influence of family offices and the use of cross-border lending structures.

Welch also examines what he calls the “illusion of ownership”, in which wealthy families “own nothing, control everything” through trusts and corporate vehicles.

Welch said: “This book pulls back the curtain on a world that doesn’t advertise itself. It’s not about theory, it’s about how the world’s wealthiest actually think about money.”

How the Super Rich Borrow was officially launched this morning and is already attracting interest among entrepreneurs and high-net-worth professionals.

Order your copy HERE.