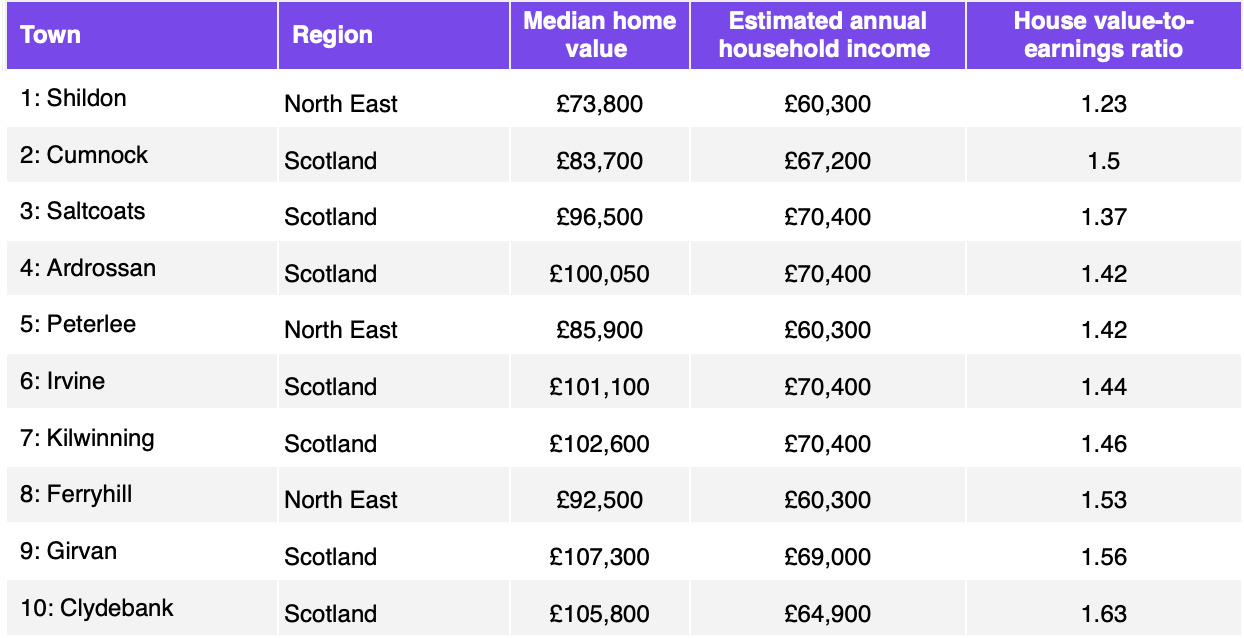

New research from Zoopla shows a deepening divide in housing affordability with the most affordable places to buy clustered in Scotland and the North East, while the South East continues to dominate the least affordable end of the market.

Shildon in County Durham ranks as Britain’s most affordable town in 2025, with a median property value of £73,900 – roughly equivalent to one year of earnings for a two-income household.

All 10 of the UK’s most affordable towns are in either Scotland or the North East, reflecting a stark regional split in house prices.

On average, buyers now need 4.4 times their combined annual salary to purchase a home, slightly down from 4.5 times last year.

LEAST AFFORDABLE TOWN

At the opposite extreme, Beaconsfield in Buckinghamshire is the UK’s least affordable town, with a price-to-earnings ratio of 15.25 and average house prices above £1.1 million.

Other South East commuter towns, including Gerrards Cross and Esher, also feature prominently among the least affordable, with ratios higher than many London boroughs.

Even the South’s most affordable locations highlight the strain on budgets: in Dover and Cinderford, buyers still need to spend more than 3.5 times their joint annual income on a median-priced home.

Zoopla says that these pressures are contributing to rising rents across the country as more households remain locked out of ownership.

CAPITAL CONCERN

In London, affordability varies sharply. Tower Hamlets is the capital’s most affordable borough, with a price-to-earnings ratio of 4.97, helped by higher local wages and a large supply of apartments. Southwark and Lambeth also feature among the more affordable boroughs for similar reasons.

However, even London’s best-value areas remain far less affordable than towns such as Shildon, underlining the widening gulf between regions as buyers continue to face markedly different prospects depending on where they live.

WIDENING GULF

Richard Donnell (main picture, inset), executive director at Zoopla, said: “Our latest Affordable Towns research clearly highlights the wide gulf in the affordability of housing for home buyers across the UK and within regions.

“To have the most affordable town, Shildon in the North East, requiring barely more than one year’s local pay, contrasted against Beaconsfield where the cost is over 15 times average earnings, shows the challenges facing those looking to move home.”

AFFORDABILITY POCKETS

And he added: “Homes are most affordable across Scotland and the North East, but within these regions are pockets where affordability is a challenge.

“For those looking to buy in the South, there are areas which offer reasonably priced homes compared to local incomes, but there are large areas where homes are only affordable to those on higher incomes or with larger deposits.

“The affordability of home ownership and the cost of moving are big considerations for those planning their next move.

“The days of most people moving within five miles of where they live are over. We can see that a growing number of buyers are having to look further afield to find better value for money and they need the tools to make informed buying decisions.”