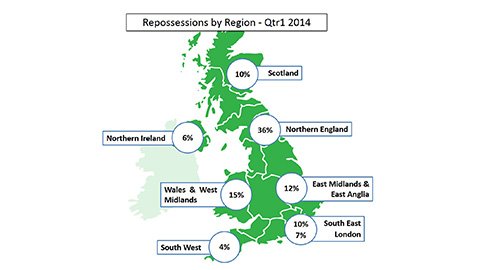

Latest research from the Charlbury Group has shown the regional split in repossessions across the UK for the first quarter of 2014.

Using aggregated data from the Arrears Management System, which lenders use to instruct suppliers in the arrears process, the split per region can be seen as a percentage of overall arrears figures.

Northern England accounts for 36% of repossessions across the UK with the next highest region, Wales and West Midlands representing 15%.

Closely behind in third spot is East Midland and East Anglia which accounts for 12% of all repossessed prospering during Q1 2014.

Faring slightly better are Scotland and the South East which each represent 10% of all repossessions.

The percentage of repossessions in London and Northern Ireland are 7% and 6% respectively. It is the South West that takes the smallest share with just 4% of repossessions happening in that region.

Dave Ford, director at The Charlbury Group said: “This data will support what many have suspected in terms of the worst affected regions of the UK for arrears and repossessions.

“Lender forbearance, low interest rates and significant commitment to treating customers fairly from everyone in arrears process means that overall repossession numbers are below expectations but, based on this data, Northern England is taking more than its fair share.

“This type of independent and aggregated management information acts as tool for lenders both as a part of their overall arrears strategy and also new lending decisions as they can adopt best practice on a region basis if relevant.”