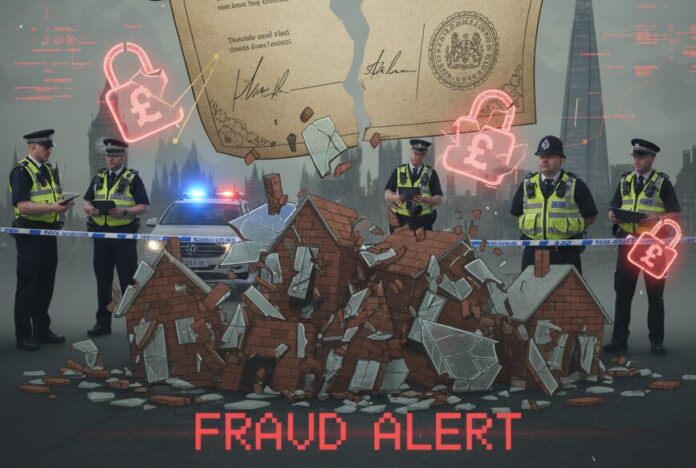

The National Crime Agency (NCA) and The Law Society have launched a joint campaign to protect homebuyers and their advisers from a growing threat: payment diversion fraud.

The crime, which has been on the rise in recent years, targets people at the most stressful and financially exposed moment of their lives – buying a home.

Criminals pose as solicitors, estate agents or buyers, intercepting legitimate correspondence and persuading victims to transfer deposits or completion funds into fraudulent accounts.

Figures from Action Fraud show that between April 2024 and March 2025 there were 143 reports of payment diversion fraud in property sales. Victims lost an average of £82,000, with those in their thirties and forties most at risk.

STOP AND SPOT FRAUD

The new campaign, delivered in partnership with the Home Office’s Stop! Think Fraud initiative, is designed to give solicitors and conveyancers the tools to spot and stop fraud before money leaves a client’s account.

Practical guidance includes urging firms to double-check bank details before transfers, test accounts with small sums first, and never move large amounts until satisfied details are genuine.

Nick Sharp, deputy director fraud at the National Economic Crime Centre in the NCA, said the scale of the losses made this type of crime particularly damaging: “Payment diversion fraud is one of the highest harm types of fraud experienced by victims, and when it manifests during a property purchase transaction, it has a huge impact on those who fall victim.”

ENORMOUS HARM

And he added: “Average losses when this happens during a property sale are more than £80,000 – that is a life-changing sum to lose for most people – but it also does enormous harm to the trust and faith that people place in the legal and financial systems that they rely on.

“That is why the NCA is actively targeting and disrupting the criminal networks behind payment diversion fraud through investigations and intelligence sharing with international partners. However, prevention remains equally as important as disruption.

“This campaign with The Law Society represents a vital part of our strategy – by raising awareness and strengthening defences within the law sector, we can significantly reduce opportunities for criminals to succeed.”

HIGH ALERT

Richard Atkinson, president of The Law Society of England and Wales, said the profession needed to be on high alert: “Payment diversion fraud represents a serious and growing threat to both our members and their clients.

“Criminals are undertaking increasingly sophisticated methods to commit fraud, often targeting the crucial moments in property transactions when large sums are being transferred.

“This joint campaign with the NCA will equip solicitors and conveyancers with the knowledge and tools they need to protect both themselves and their clients from these devastating crimes.”

The campaign will be backed by an information sheet for the profession and a social media push across the NCA and Law Society’s LinkedIn, X and Facebook platforms.