The mental health of mortgage industry professionals remains a significant concern according to new data from the Mortgage Industry Mental Health Charter (MIMHC) which will publish its 2025 White Paper later this week.

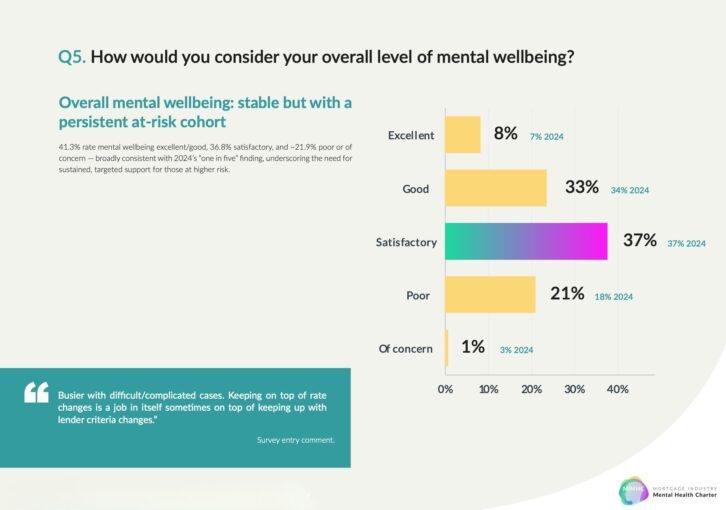

The survey of nearly 400 industry participants found that 22% of respondents rated their mental wellbeing as “poor” or “of concern” – virtually unchanged from last year’s finding that one in five were struggling.

This is despite widespread adoption of hybrid and home working practices and an increase in wellbeing programmes offered by employers.

The survey shows that 41% of respondents reported their wellbeing as excellent or good, 37% described it as satisfactory, while more than one in five continue to fall into the “at-risk” category.

MIMHC said the figures highlight the stubborn persistence of a vulnerable cohort within the sector.

One participant commented: “Busier with difficult and complicated cases. Keeping on top of rate changes is a job in itself sometimes on top of keeping up with lender criteria changes.”

TROUBLING NUMBERS

Jason Berry (main picture, inset), MIMHC co-founder and group sales director at Crystal Specialist Finance, warned that while there is growing evidence of employers taking workplace wellbeing more seriously, the headline numbers remain troubling.

He said: “What we’re going to see is evidence of more companies delivering mental health support with well-being programmes being put into place.

“But however we shape it, we’ve still got 22% of people indicating that they have issues – which isn’t particularly great and more needs to be done.”

He added: “We are seeing evidence of green shoots but can’t take away from the fact that 22% is a disturbing statistic.”

EXCESSIVE WORKING HOURS

The latest findings echo those of the 2024 White Paper, which showed a deterioration in work-related mental health across the mortgage sector, driven by excessive working hours, disillusionment and poor work-life balance.

That survey found 62% of respondents working more than 45 hours per week, while 19% said they were considering leaving their roles.

The persistence of poor mental health indicators in 2025 highlights the scale of the challenge. Working hours, heavy caseloads and sleep deprivation continue to be cited as drivers of stress, with MIMHC warning that systemic change is still needed.

The White Paper, published on Wednesday this week, is expected to reinforce calls for employers to embed long-term support strategies, improve awareness of available resources and ensure regular workplace conversations around mental health.