Market Harborough Building Society has secured B Corp certification, marking a significant endorsement of its purpose-led approach to specialist mortgage and bridging lending.

The accreditation places the mutual among a global network of organisations assessed against standards for social and environmental performance, transparency and accountability.

For brokers, the society argues, it offers independent validation of its emphasis on responsible decision-making and long-term growth in the specialist lending market.

While B Corp certification is widely seen as a notable benchmark, Market Harborough said the award reflects an existing culture rather than a strategic pivot.

Iain Kirkpatrick, chief executive officer, said: “Our ambition has always been to put purpose at the heart of every decision we make. Becoming a certified B Corp is a proud milestone for all of us.

“It proves that our purpose of ‘fighting for our customers and communities to thrive’ isn’t just something we say, it’s something we live – including the way we make decisions and support brokers and their clients.

“It shows we are building something sustainable, transparent and people-first, not chasing short-term wins.”

The certification process, overseen by B Lab, examined the society’s approach to colleague wellbeing, customer experience, community impact, governance and environmental responsibility.

Market Harborough said it exceeded the threshold score required and will now be subject to ongoing assessment under the B Corp framework.

REASSURANCE FOR BROKERS

The society said the accreditation should provide additional reassurance to intermediary partners placing complex or higher value cases. It pointed to the independent standards underpinning B Corp status as evidence of a commitment to responsible lending, governance and operational consistency.

Market Harborough has built its recent reputation on handling more intricate mortgage and bridging cases, including non-standard income structures, joint borrower sole proprietor arrangements, multi-generation borrowing and expatriate applications.

THRIVE PROGRAMME

Beyond its lending activity, the mutual has channelled investment through Thrive, its long-term community programme. Under the initiative it has invested £2 million in social housing, made its head office available free of charge to local groups and charities, and expanded colleague volunteering.

The society has also launched Thrive Forward, a programme intended to support 1,000 young people’s wellbeing, learning and future opportunities during 2025 and 2026.

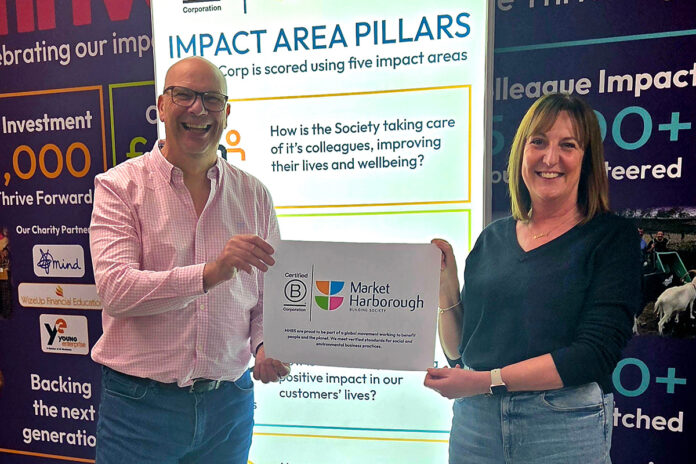

Main picture: Tim Neal, head of footprint and Lesley Vernon, chief engagement officer.