Buyers are returning to city centres across the UK, according to new data from Trussle.

The online mortgage broker found that desire for city centre property declined during the pandemic, as remote working became the norm and amenities remained closed. Instead, there was a trend of buyers across the country moving to more rural countryside locations seeking the good life.

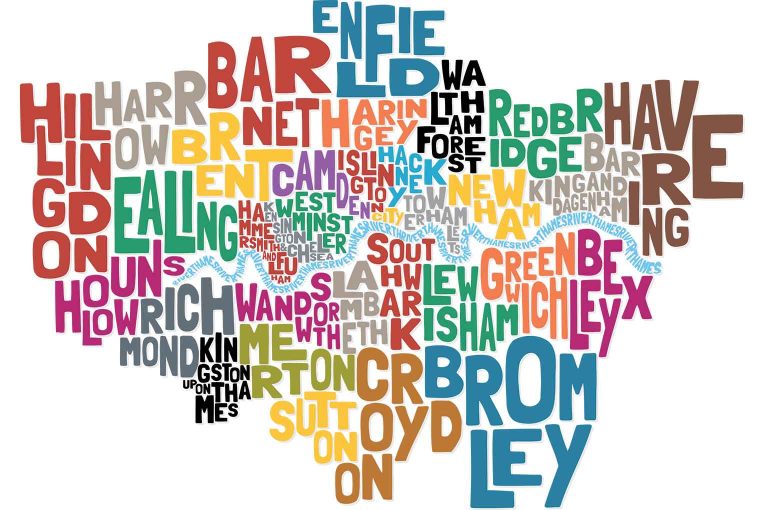

It now appears, however, that buyers are flocking back to city centres as shops, bars and restaurants resume service. Trussle has found that mortgage applications in London now account for 14% of all mortgage applications, a level not seen since December 2019. Overall, applications for mortgages in London have increased by 30% in recent months.

Regional cities, such as Manchester and Birmingham, appear to be even more popular. Manchester in particular is proving an attractive destination for buyers, with demand for mortgages now at double the level compared with 2019. This could be due to more competitive property pricing with the average home in Manchester costing £234,024, compared with London’s £698,289.

Despite appetite for city living returning, the pandemic has left an imprint on what buyer’s look for in a property – what were once ‘nice to haves’ are now ‘must haves’. Estate agents have reported that buyers sounding out the city want more space than previously and are seeking bigger homes as a result. This is likely to account for more working from home, which demands home office space. Property portals have reported similar trends.

Miles Robinson, head of mortgages at Trussle, said: “With high streets back in business, the allure of city living is returning. This is clearly beginning to resonate with buyers, and we are seeing interest in city centre properties up and down the UK either return to pre-pandemic levels, or higher.

“Another reason for this could be the return of office working, albeit in a reduced capacity. While remote working was necessary during the height of lockdown, many businesses are moving to a hybrid model that does require people to be in the office two to three days per week. As such, many people may feel the need to be closer to their place of work than they did a year ago.”