The pandemic-era rush out of London is firmly in retreat with new figures showing fewer households quitting the capital and those who do moving much shorter distances than in recent years.

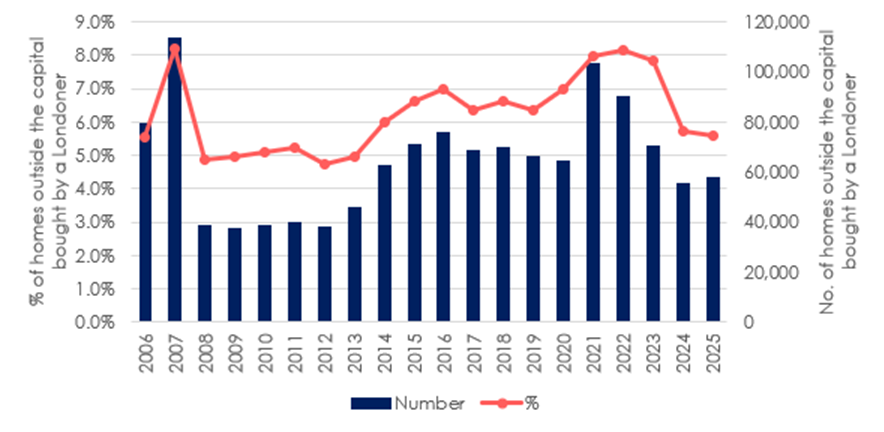

Analysis by Hamptons, drawing on Connells Group data, shows that in 2025 Londoners purchased 5.6% of homes in the rest of England and Wales, down fractionally from 5.7% in 2024 and well below the 8.2% peak recorded in 2022, when buyers sought more space during lockdowns.

In absolute terms, the number of homes bought outside London by Londoners edged up to 57,660, reflecting higher transaction volumes overall but remains far below the 2021 peak of 103,310 and below the pre-pandemic average of around 70,000 a year.

GEOGRAPHIC SHIFT

The average London leaver this year moved 71.6 miles from the capital – 10 miles less than in 2024 and back to 2021 levels.

Source: Hamptons

More than half (54%) of leavers stayed within 50 miles of London, up from 47% last year. First-time buyers also reduced their typical relocation distance to 52.3 miles, down from 54.8 miles when mortgage rates peaked in 2023.

Improved affordability, helped by falling mortgage rates and less stringent stress testing, is allowing more households to remain within the orbit of the capital rather than making long-distance “lifestyle” moves. The partial return to office working is reinforcing that preference for proximity.

MARKET RECOVERY

The Home Counties have been the main beneficiaries. In 2025, London residents accounted for 18.2% of purchases there, the highest share since 2017 and up from 15.4% in 2024.

That marks a sharp recovery from 2022, when London buyers turned instead to the South West, Midlands and North in search of space and better value.

Locations such as Surrey, Hertfordshire and Buckinghamshire are now back in favour among those seeking a balance between lifestyle and connectivity.

REGIONAL BREAKDOWN

Across regions, 68% of London leavers stayed in the South of England – the South East, South West or East of England – the highest proportion since 2021 and up from 62% last year.

The South East alone accounted for roughly a third of all departures from London, the biggest increase of any region.

By contrast, the North West, West Midlands and Scotland recorded a falling share of London buyers, as value-conscious households opted to remain closer to the capital.

There are clear winners and losers at local level.

Chigwell, on London’s northeastern fringe, has seen the sharpest rise in the proportion of incoming Londoners, with the share of homes bought by capital residents climbing by 35 percentage points to 53%.

Chatham, Caterham and parts of Basildon, along with more expensive areas such as Esher and Gillingham, have also gained in popularity.

COOLING DEMAND

Further afield, demand from Londoners has cooled. Sittingbourne recorded the steepest drop, with London’s share of purchases falling to 8% from 21% a year earlier. Billericay, Leighton Buzzard and Gravesend also saw declines, while Portsmouth, Leeds and Derby registered smaller falls.

The composition of London leavers is changing too. First-time buyers accounted for 31.0% of purchases outside the capital, down slightly from 31.5% in 2024 – the first fall since 2019 – as easing mortgage costs helped more remain in London. Those who did buy outside the capital spent an average of £298,360, up £13,450 on last year.

By contrast, existing homeowners are increasingly driving outward moves. Movers accounted for 42.5% of London leavers, up from 39.8% last year, spending an average of £457,480 on their next home – nearly £98,000 more than in 2024 – reflecting increased purchasing power and a swing back towards higher-priced commuter-belt locations.

CAUTIOUS STANCE

Investor and second-home activity has softened, slipping to 26.5% of London-buyer purchases outside the capital, amid a more cautious stance toward tax and regulatory changes.

The emerging picture is of a capital whose outward migration has not vanished but has decisively shortened – with the M25 once again acting as a gravitational pull rather than a line to cross.

PRAGMATIC SHIFT

Aneisha Beveridge, Head of Research at Hamptons, said: “London leavers are moving back into familiar territory.

“While the pandemic pushed buyers deep into the countryside, this year’s moves have concentrated around the M25.

“Falling mortgage rates have eased the pressure to chase affordability hundreds of miles away and the return to office-based working has made proximity matter again.

“It’s a pragmatic shift – people still want more space and are keen to future-proof, but they’re balancing that with connectivity and value.”

AFFORDABILITY DRIVER

And she added: “Looking ahead, affordability will remain the key driver of London outmigration.

“If borrowing costs continue to fall, we expect more households to stay in the capital or move shorter distances.

“The strength of the London market will also play a big role – but with prices unlikely to rise significantly in the coming years, equity gains will remain limited.

“That means aspiration for a large country manor will be tempered by economics for some time yet.”