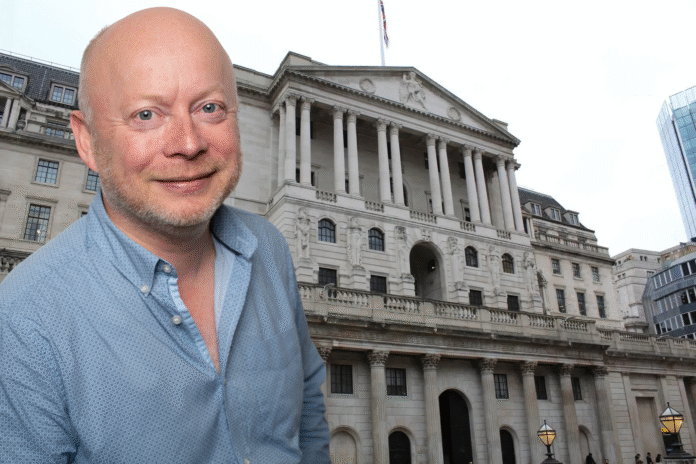

The Bank of England’s expected decision to cut interest rates this week could reignite house price growth and further disadvantage first-time buyers, according to Colin Bell, founder and COO of mortgage lender Perenna.

Bell (main picture, inset) warned that while a reduction in the base rate would be welcomed by many existing homeowners and older sellers it could have the opposite effect on aspiring buyers who are already struggling to access the housing market.

The Bank’s anticipated quarter-point cut would bring the base rate down to 4% following a prolonged period of monetary tightening to combat inflation.

UNINTENDED CONSEQUENCES

While the move would offer some relief to mortgage holders and businesses critics warn it could trigger unintended consequences in the housing market by stoking further price rises, particularly in areas with chronic undersupply.

Bell said: “A cut this Thursday will mean one thing for certain – the housing market will continue to heat up. For existing owners wanting to sell and upgrade their home, or older generations cashing out and downsizing for their retirements, this is music to their ears. For first time buyers, it’s more like a screeching violin solo they’re being told they should enjoy.”

“A cut to rates will simply pour petrol on a long-burning fire of rising house prices.”

And he added: “Another cut to rates will simply pour petrol on a long-burning fire of rising house prices – great for owners, disastrous for buyers trying to get on the ladder for the first time.”

Perenna, which offers long-term fixed-rate mortgages of up to 30 years, has positioned itself as a disruptor in the UK mortgage market, arguing that structural change is needed to enable more people to buy homes, especially in younger age groups.

Bell reckons the biggest blocker on housing affordability is the overall price – not monthly payments.

ROSE-TINTED GLASSES

“As rates fall in an effort to stimulate economic growth, we need to take off our rose-tinted glasses and be honest with our young people,” he said.

“We should stop acting like rate drops are a silver bullet solution to their housing woes. In fact, a rate cut this Thursday might just be the worst thing possible for first time buyers who simply can’t get over the house price hurdle, let alone secure a low-rate mortgage.”

He added: “We need innovation in the market to change the status quo – whether that is lower deposits, changing stamp duty, continued regulatory reform including LTI cap changes, different products or something else entirely, we cannot keep going as we are and expect different outcomes.”