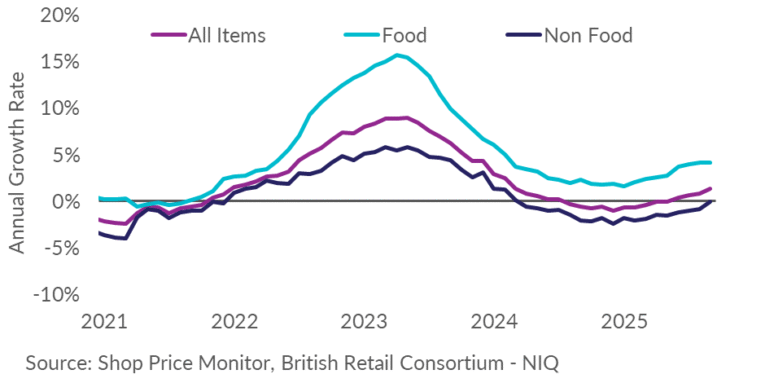

Shop price inflation picked up pace in September, rising to 1.4% from 0.9% in August, as cost pressures spread beyond food and begin to hit households and retailers more broadly.

The latest British Retail Consortium (BRC) Shop Price Monitor shows that non-food prices – which had been falling for 18 months – are now stabilising, slipping just 0.1% on the year compared with a 0.8% drop in August. Food inflation remained stubbornly high at 4.2%, its eighth consecutive month above 4%.

Helen Dickinson, chief executive of the BRC, said the end of non-food deflation “looks set to come to an end” as rising labour, energy and supply-chain costs push up prices across the board.

DIY and gardening products saw notable price rises, while retailers offered heavy discounts on laptops and other electricals to capture back-to-school demand.

Dickinson warned: “Households are finding shopping increasingly expensive. Higher national insurance, wage bills and global cost pressures are feeding through to prices. The new packaging tax coming in October will add yet more pressure – and any tax rises in the Chancellor’s Budget could keep prices higher for longer.”

UNDER STRAIN

The warning comes as consumers, already under strain from two years of elevated food costs, face a new wave of inflationary pressures heading into the final quarter of the year.

Dairy and beef prices remain high, driven by rising input costs for farmers, and the industry expects energy costs to continue rising through the winter.

Mike Watkins, head of retailer and business insight at NIQ, said that with shoppers “increasingly price-sensitive,” retailers are likely to keep leaning on discounts and promotions to sustain sales.