Halifax has introduced changes to its lending criteria designed to make it easier for non-UK nationals to purchase a permanent home in the UK.

The adjustments, which take effect from 14 November, focus on lowering minimum income requirements for borrowers who have lived in the country for at least one year.

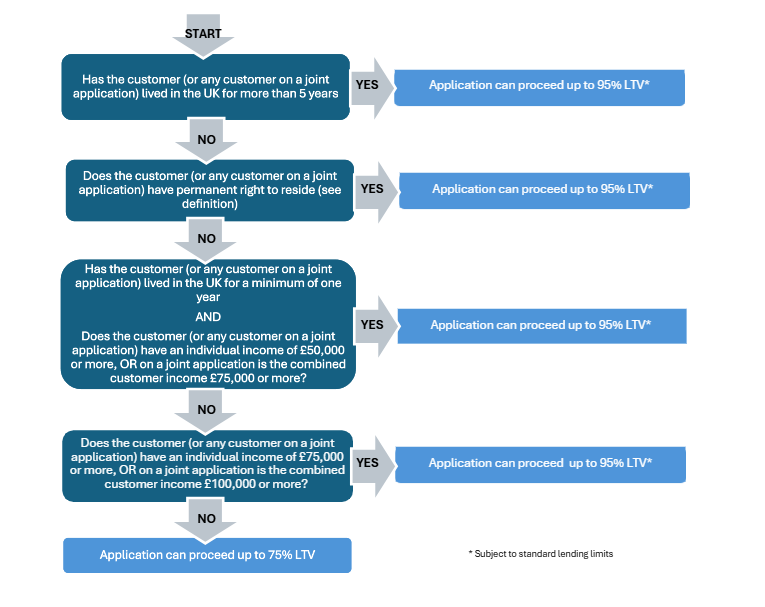

Under the revised criteria, applicants who have been resident in the UK for a minimum of one year will now need an individual income of £50,000, or £75,000 for joint applications, to access lending up to 95% loan to value. This represents a reduction from the previous thresholds and is intended to broaden access for a segment of the market Halifax says has been underserved.

For applicants with less than one year’s UK residency, the previous minimum income thresholds remain in place: £75,000 for individuals and £100,000 for joint applications. Those who do not meet this higher income level may still be able to proceed, but borrowing will be restricted to a maximum of 75% loan to value.

Halifax has issued a flow chart to help brokers navigate the updated rules, setting out the residency and income combinations that determine whether applicants can borrow up to 95% loan to value or fall under the 75% ceiling.

Amanda Bryden, head of Halifax intermediaries and Scottish Widows Bank, said: “The feedback we’ve received shows the market for non-UK national’s wanting to buy a permanent home has been underserved and that there is demand for a greater level of mortgage lending.”

She added that lowering the income thresholds “increases the opportunities for home ownership and for brokers to extend the products and services they offer to clients they may previously not have been able to support.”