Demand for larger homes has driven growth in UK property prices over the past year with latest research from Halifax revealing that as easing interest rates improved mortgage affordability, annual property price growth reached +3.7% in January 2025, up from just 1.0% at the start of 2024.

In cash terms, prices increased by £10,431, with the average cost now at £294,818, surpassing the previous peak in August 2022 during the pandemic-era property boom.

The analysis – based on data from the Halifax House Price Index – reveals significant variations in price growth across different property types and regions.

PROPERTY TYPES

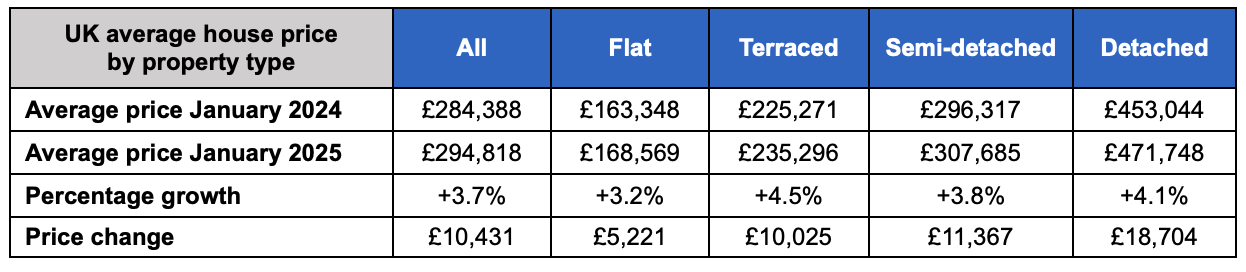

Terraced houses lead the way with annual growth of +4.5%, reaching £235,296, while detached properties increased by +4.1% to £471,748.

Meanwhile flats saw the slowest growth at +3.2%, with an average price of £168,569. Semi-detached houses rose by +3.8%, averaging £307,685.

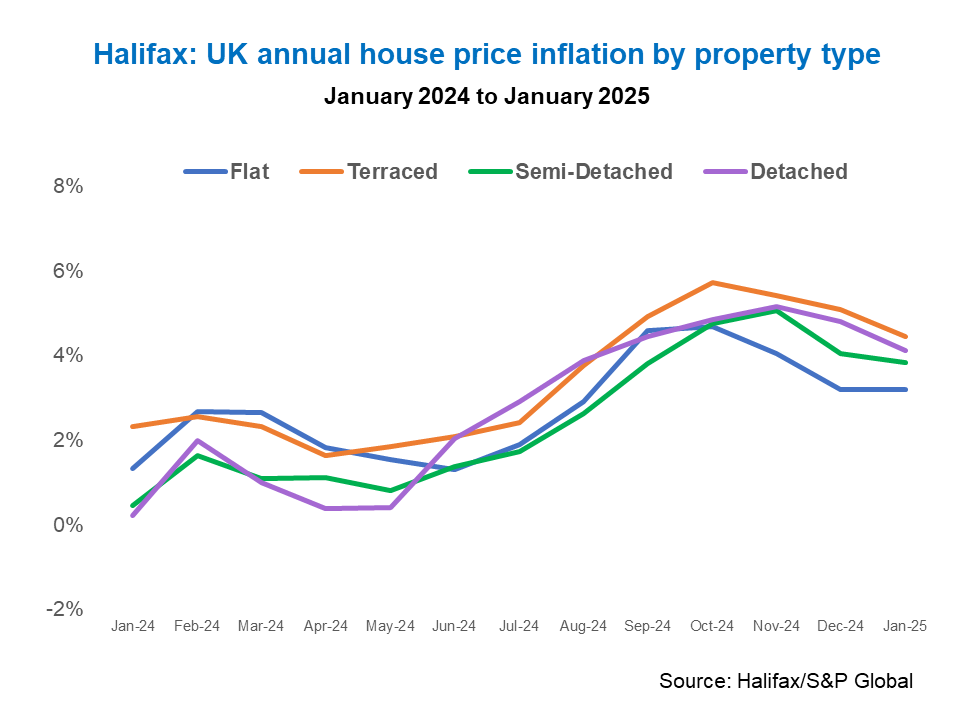

Price growth for flats fluctuated significantly over the last year, from +1.3% in January 2024 to a peak of +4.7% in October, before easing to +3.2% at the start of 2025.

Despite this, the average price of £168,569 remains just £1,824 below the peak recorded in August 2022.

Regionally, the North East saw the strongest growth in flat prices, rising by +15.1% (£13,141) to £100,123, while the East Midlands experienced a slight decrease of -0.6% (-£705).

TERRACED HOUSES

Terraced homes led house price growth for much of the last year, peaking at +5.7% in October 2024. They began 2025 at +4.5%, with the average price now at £235,296, up by £10,025 over the last year.

The North East saw the biggest annual increase for terraced houses at +8.4% (£10,263), while Yorkshire and Humberside had the slowest growth at +2.7%.

SEMI-DETACHED

Semi-detached houses recorded growth of +3.8% over the last year, increasing by £11,367 in cash terms, with the average price now at £307,685.

Northern Ireland saw the biggest increase at +7.0% (£11,835), while Scotland had the slowest growth at +0.7%.

DETACHED HOUSES

At the top end of the size scale, detached houses saw annual growth of +4.1% (£18,704). The average price of £471,748 is above the pandemic-era peak set in September 2022 (£471,333) and just shy of the new high set in September last year (£472,984).

Northern Ireland recorded the strongest annual growth at +15.2% (up £35,857), while London had the weakest at +0.9%, though it still has the most expensive detached properties in the UK (£944,526). This is around five times more than the cheapest in the North East (£190,757).

Amanda Bryden, Head of Halifax Mortgages, said: “The fortunes of different property types tend to ebb and flow depending on broader market conditions.

“This time last year, the average price of a flat had risen more quickly than a detached house, as buyers adjusted to higher borrowing costs and sought to compensate by targeting smaller properties.

“Now, as interest rates have started to ease, it’s once again those homes offering more space which are fuelling demand. And that’s not just a short-term trend; over the last decade, bigger properties have tended to outperform smaller homes when it comes to price growth.”

BIGGER CHALLENGES

And she added: “This has caused the gap between the rungs on the housing ladder to widen further, presenting a bigger challenge to those looking to make the step up. However, that only tells part of the story. Slower growth among smaller homes is helpful for first-time buyers, and we saw a big rebound in that market last year, with a fifth more stepping onto the ladder.

“If you look beyond the UK picture to the individual nations and regions, there’s huge variance in average price performance for different property types, with many areas offering more value for money”.

FIRST-TIME BUYERS

The first-time buyer market rebounded last year, as a fifth more stepped onto the ladder.

Once again improved mortgage affordability saw larger properties experience the strongest price growth, with terraced homes rising by +3.5%, semi-detached houses by +2.9%, and detached properties by +2.8%. Flats lagged behind at +1.8%.

Flats account for around 27% of first-time buyer purchases in the UK, varying significantly by region, from 71% in London to just 4% in the East Midlands.

One category where flats buck the trend is new builds. While overall growth over the last year for newly built properties was +3.1%, for new build flats it was much higher, at +6.7%.

Terraced (+3.6%), semi-detached (+2.2%) and detached (+2.4%) houses all trailed behind in annual property price inflation.

Buyers of new builds continue to pay a significant premium compared to existing properties, at £33,514 overall and up to £71,865 for flats.

PROPERTY GAPS

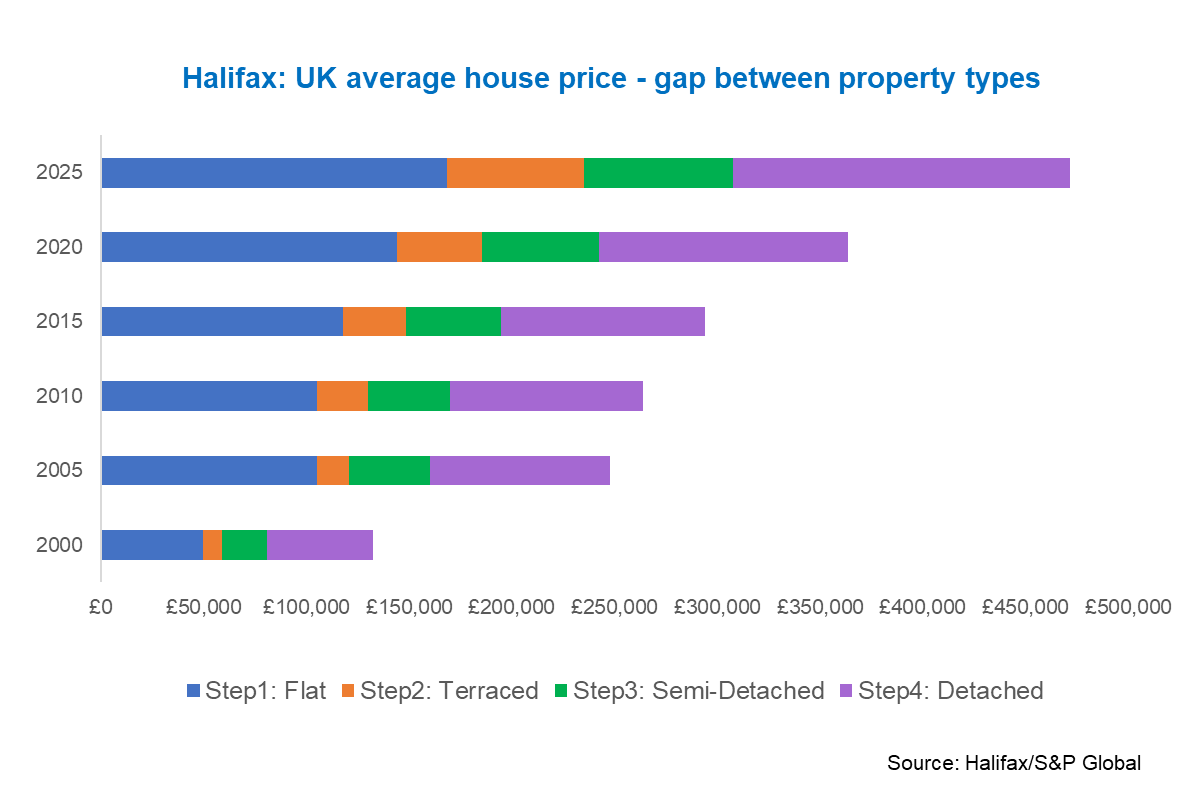

The cost gap between property types is widening. Since the turn of the century, the cost gap between different property types has widened significantly.

In the year 2000, the cost of the average flat was just £49,905. An extra £9,105 would get a terraced house, a further £22,006 a semi-detached house, and an additional £51,655 on top of that would secure a detached property.

Fast forward to 2025, and the cost of the average flat is now £168,569. An extra £66,726 would be needed for a terraced house, a further £72,389 for a semi-detached house, and another £164,063 for a detached property.

However, in relative terms, the cost of a flat compared to a detached house – a measure of the gap between the rungs of the housing ladder – has only increased slightly from 2.7 times in 2000 to 2.8 times in 2025.

PAST 10 YEARS

Over the last five years – a timeframe which includes both the pandemic-era housing market boom and subsequent slowdown as interest rates rose – house prices have increased at a faster pace than in the preceding five-year period (+25.1% vs +23.8%).

This trend is true for all for all property types except flats, which rose by +16.7% compared to +22.3% in the previous five years.

That’s in contrast to detached houses, which saw the highest growth of +29.6% over the last five years (vs +23.7% in the preceding period), adding more than £100,000 to the average value since 2020.