Lower-priced areas delivered the strongest house price growth in 2025 as affordability, connectivity and access to jobs overtook prestige locations as the key drivers of buyer demand.

Analysis from Rightmove shows that the biggest jumps in asking prices last year were overwhelmingly concentrated in markets priced well below the national average.

Of the 50 locations where average asking prices rose the most in 2025, 43 had prices below the national average of £368,031.

Across the top 50 growth areas, the average asking price was £270,711 – almost £100,000, or 26%, lower than the UK average. Nationally, average asking prices at the end of 2025 were 0.6% lower than a year earlier, masking strong regional divergence.

AROUND THE REGIONS

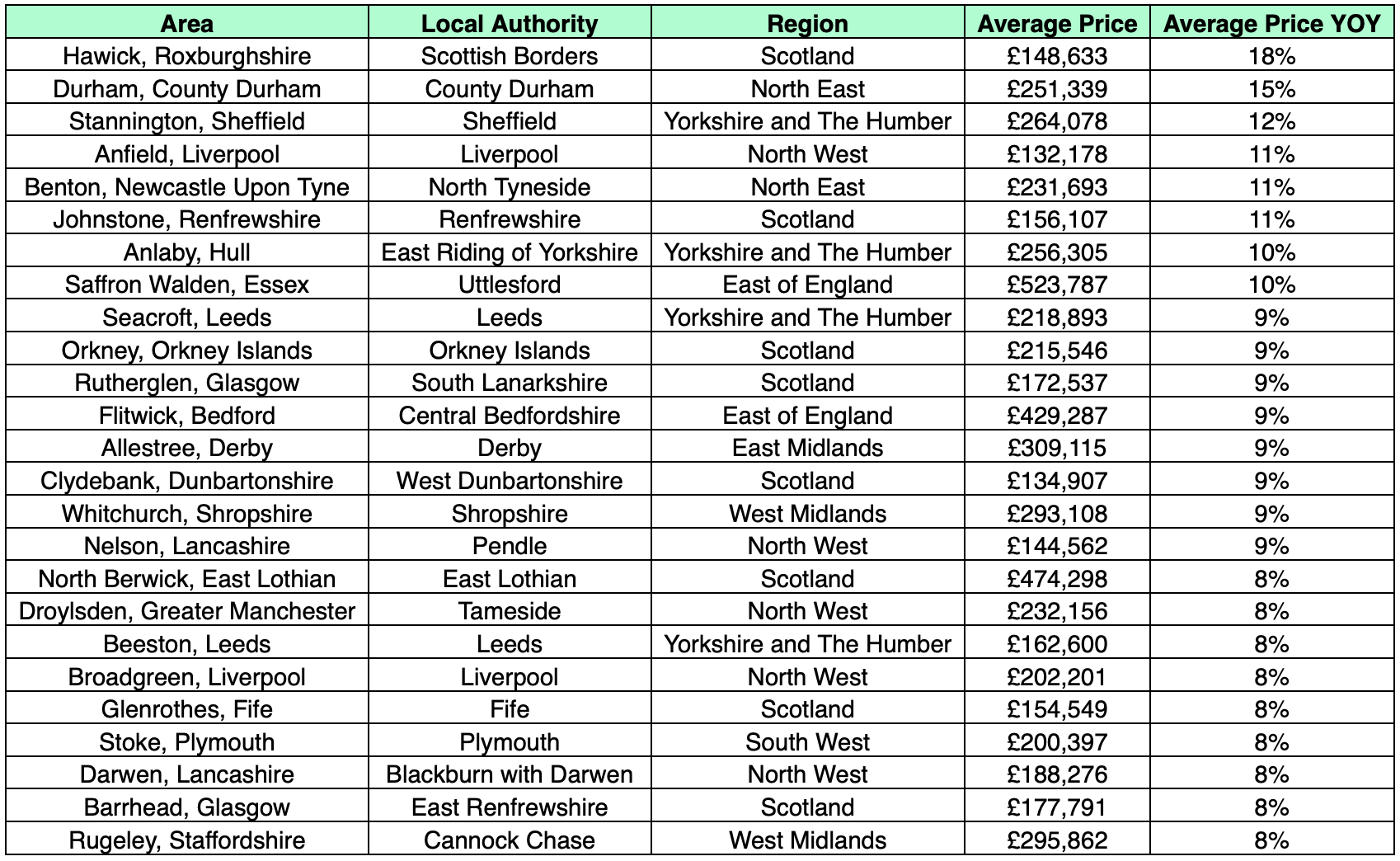

Hawick in Roxburghshire topped the national growth table, with average asking prices rising by 18% to £148,633. Durham followed with a 15% increase to £251,339, while Stannington in Sheffield ranked third after prices climbed 12% to £264,078.

Scotland was the most represented region in the top 50 growth list, accounting for 12 locations, followed by the North West and Yorkshire & The Humber with eight each. London, where the average asking price stands at £679,782, failed to register a single area in the top 50.

GROWTH AREAS

Rightmove’s analysis also highlights the growing appeal of suburban and fringe-city locations.

The top 10 growth areas include neighbourhoods outside Sheffield, Liverpool, Newcastle, Hull and Glasgow as buyers balance affordability with the need for manageable commutes as office attendance increases.

Many of the fastest-growing areas are also close to universities and major NHS trusts, reinforcing the link between employment hubs, rental demand and buyer competition.

AFFORDABLE PRICES

Colleen Babcock (main picture, inset), Rightmove’s Property Expert, said: “There is typically a larger pool of buyers who are looking to move within more affordable price brackets.

“Therefore, locations with more homes that fall under the average asking price can see more demand from buyers, and that underpins house price growth in those areas.”

GREAT EXPECTATIONS

Mary-Lou Press, President of NAEA Propertymark, said: “Buyer demand continues to be strongest in areas where homes remain comparatively affordable, particularly in locations that offer good transport links, access to employment, and proximity to key services such as schools, universities, and hospitals.

“While national average asking prices have softened slightly, the growth seen in lower-priced markets highlights how stretched affordability remains for many buyers.

“As a result, purchasers are adjusting their expectations on location and prioritising value for money, which is driving increased competition and price growth in these areas.

“However, limited housing supply remains a critical factor underpinning these trends. In many of the areas experiencing the fastest growth, agents report low stock levels, particularly for homes suitable for first-time buyers, which continues to place upward pressure on prices.”

2025 PRICE HOTSPOTS