AIG Life has stated that 18.3 million people are living with what it has termed ‘illness denial’, as they are failing to accept they are at risk of disease or developing a serious medical condition in their lifetime.

54% of people don’t believe they will suffer from cancer, stroke or heart disease – the three major causes of death in the UK.

The business says day to day illness denial means people are missing out on benefits of the huge advances in healthcare which are enabling more to live healthy lives for longer and AIG believes that being realistic and practical about the likelihood of falling ill can help millions benefit from rising longevity across the UK.

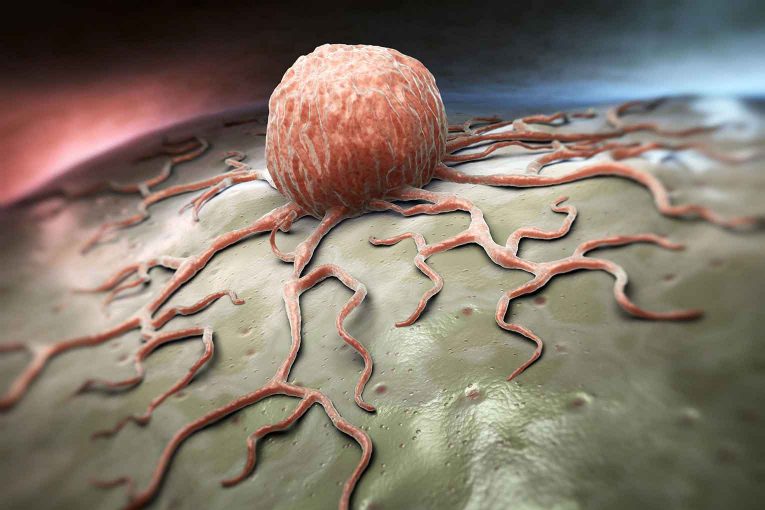

The detailed study says hope is beating reality – just 22% questioned expect to be affected by cancer in their lifetime. Yet for those born after 1960 the risk statistically is 50%, which adds up to 14.2 million living in a state of cancer denial alone.

Data shows 38% of cancer cases including lung, bowel and skin melanoma are preventable with lifestyle changes. Early diagnosis also has a huge impact on survival chances with NHS cancer screenings, which are in place for bowel, breast and cervical cancer, providing a vital service.

Research shows illness denial affects heart disease too – only 17% believe they will be affected while official statistics show heart and circulatory diseases cause 26% of all deaths. Strokes are the leading cause of death and disability in the UK but only 7% believe it could affect them.

77% of adults say they would experience financial problems if they developed a serious illness in the next six months, with 26% saying they would have significant financial problems.

Having financial protection in place would relieve the potential pressure on family and friends – 34% of people say they need would rely on friends and family for financial support if they suffered serious illnesses in later life.

Debbie Bolton, head of underwriting and claims strategy at AIG Life, said: “Illness denial is understandable as nobody wants to think about the worst happening to them and we all like to believe it won’t be us or our loved ones.

“It’s comforting to know that we are all living longer and government statistics show that around one in three children born today can expect to live to see their 100th birthday and their parents and grandparents can look forward to long lives too. However, our extended lives mean we may live in poor health for longer and sometimes with more than one serious illness.

“Taking a realistic and practical approach to the risk of illness and the need for financial protection will help us all to plan for the future. If we also take steps to improve our lifestyle we can move into our later years in good health.”

Dr Meg Arroll, chartered psychologist and scientist, added: “The AIG Life survey highlights the fundamental disconnect between public health information and individuals’ beliefs of their own risk of illness. In other words, even though there have been numerous campaigns which clearly state the high frequency of health conditions like cancer, heart disease and stroke, this information does not directly equate to individuals’ personal perception of risk.

“Research shows that many people demonstrate an optimism bias, whereby they believe they are less likely to experience key health conditions than data would suggest. Cognitive factors that lead to this misconception include: a lack of personal experience of a condition: a belief that if symptoms have not yet appeared, they are unlikely to in the future; believing that a condition is uncommon.

“In addition, our evaluation of our own illness risk is based on selective focus. For example, many people diminish their own risk-increasing behaviours such as poor diet, smoking and lack of exercise and justify these in terms of the risk-reducing actions they are engaged in (‘Even though I don’t exercise regularly, I try to eat my five-a-day so overall I’m healthy’).

“There is also a proximal aspect in play here – it can be difficult to forego immediate rewards in order to prevent poor health outcomes in the distant future, particularly in situations of low perceived control, self-efficacy and motivation. Therefore, health behaviour change programmes must not only educate us about our risks of developing illness, they should also address cognitive errors such as optimism bias which lead to health-limiting behaviours.”