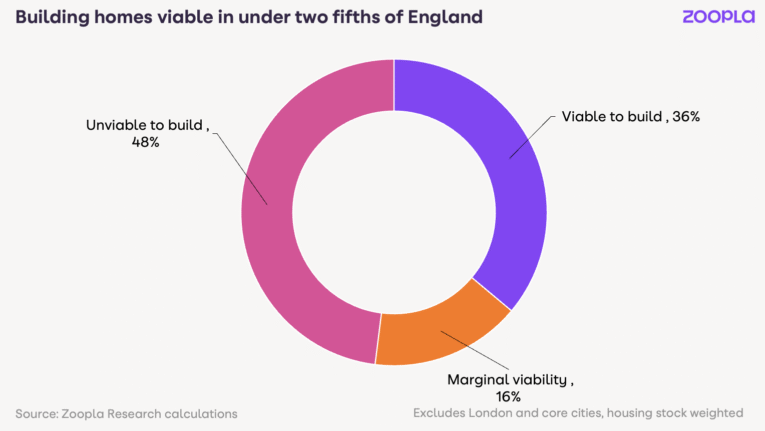

The government’s flagship target to deliver 1.5m new homes over the next five years is at risk with new research from Zoopla showing it is not financially viable to build across almost half of England.

The property portal’s latest analysis finds that 48% of the country is effectively off-limits for viable development, while conditions are “challenging” across nearly two-thirds (64%).

The report highlights a growing mismatch between where homes are needed, where developers can afford to build and where buyers can afford to live.

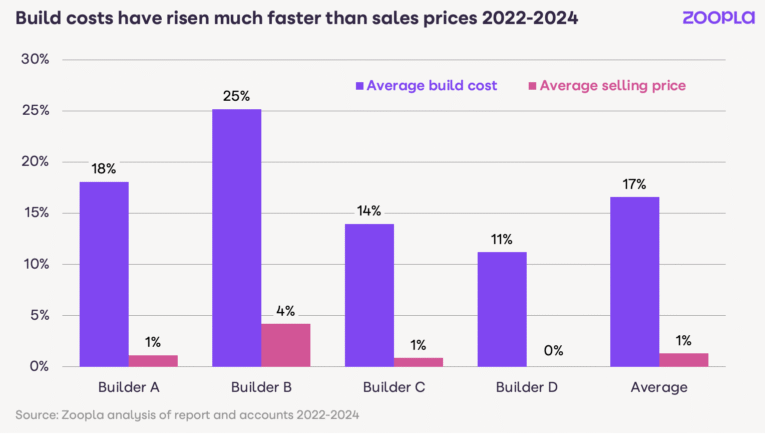

The viability crisis is being driven by spiralling costs. Analysis of major housebuilders’ accounts shows the cost of delivering a home has risen by 17% since 2022, compared with just a 1% rise in sales prices.

Smaller builders, who deliver nearly a third of new homes, are thought to be under even greater strain from higher borrowing costs, rising material prices and new regulatory burdens, including the Building Safety Levy and forthcoming Future Homes Standard.

FINANCIAL PRESSURES

At the same time, demand has weakened. The end of the Help to Buy scheme in 2022, combined with higher mortgage rates, has curbed appetite in the new build sector.

Housing associations, which typically account for up to a quarter of new homes purchased via Section 106 agreements, have also scaled back activity amid mounting financial pressures.

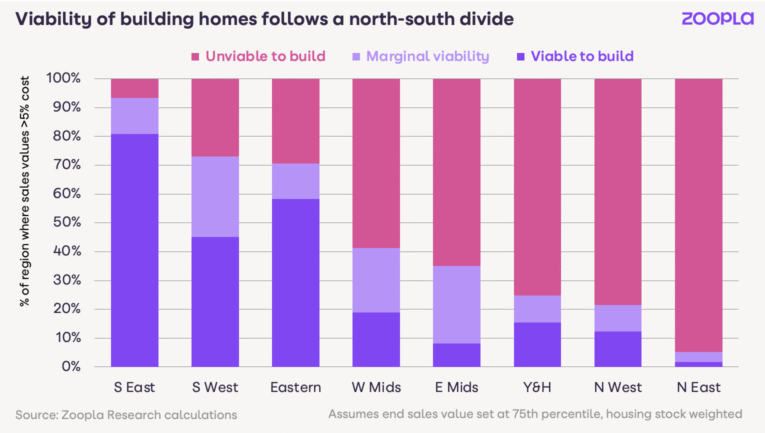

NORTH SOUTH DIVIDE

In southern England, two-thirds (64%) of areas have house prices high enough to make new development viable, compared with just 13% in the Midlands and 10% in the North. Yet these same southern markets are often the least affordable for buyers, limiting demand and slowing sales.

By contrast, in regions where homes are more affordable to buy, developers struggle to make schemes stack up financially.

FIRST-TIME BUYER SUPPORT

Richard Donnell, executive director at Zoopla, said: “While the Government says it wants to ‘build baby build’, our analysis shows this can currently only be achieved across half the country – and usually in places that are already expensive for consumers. It is much harder to build homes where they are genuinely affordable.”

Zoopla is calling for further planning reform, a review of new policy costs, targeted funding for affordable housing and renewed support for first-time buyers.

HOUSE PRICES

Donnell added: “The government can’t control the price of raw materials, but it can influence the cost of regulation. Without further reform, rising costs will continue to threaten delivery, and we can’t rely on higher house prices to make development viable.”

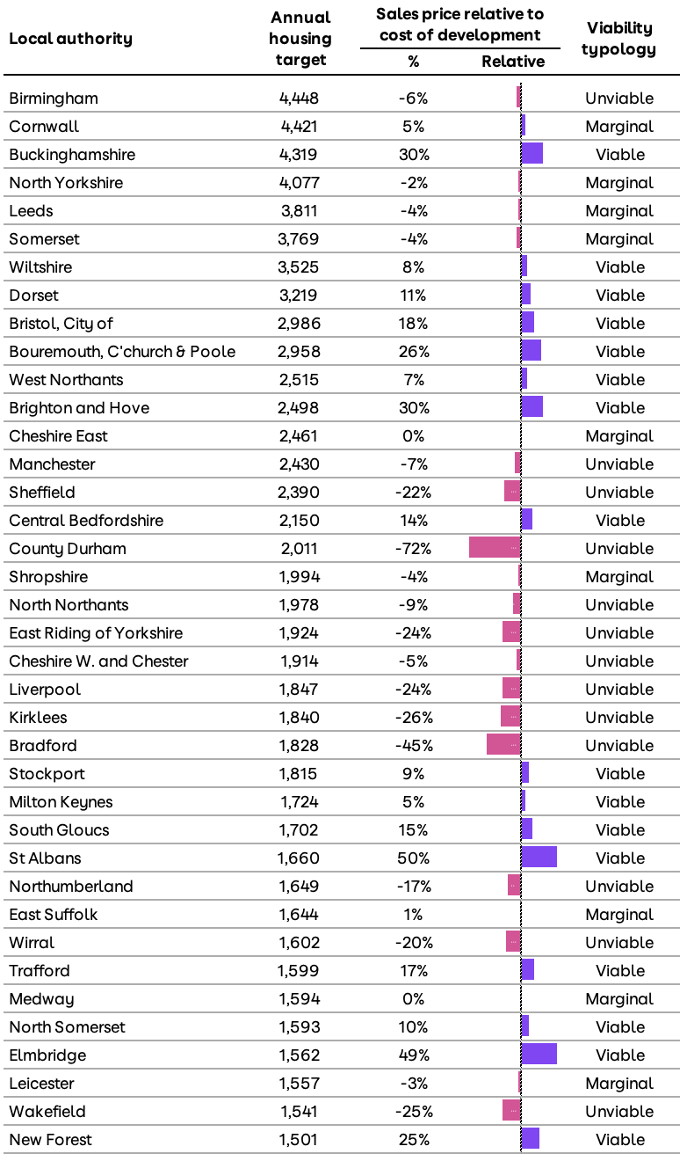

With planning approvals already down 23% since 2022, the report warns that 37% of the official housing target lies in areas classed as unviable, casting serious doubt over the government’s ability to meet its ambition.

Viability of home building across English local authorities ex London

Source: Zoopla