Loosening lending rules with mortgage stress testing rates closer to 6-7% would help more middle to higher income renters access home ownership and ease some of the pressure in the rental market without causing a boom in house prices, Zoopla has claimed.

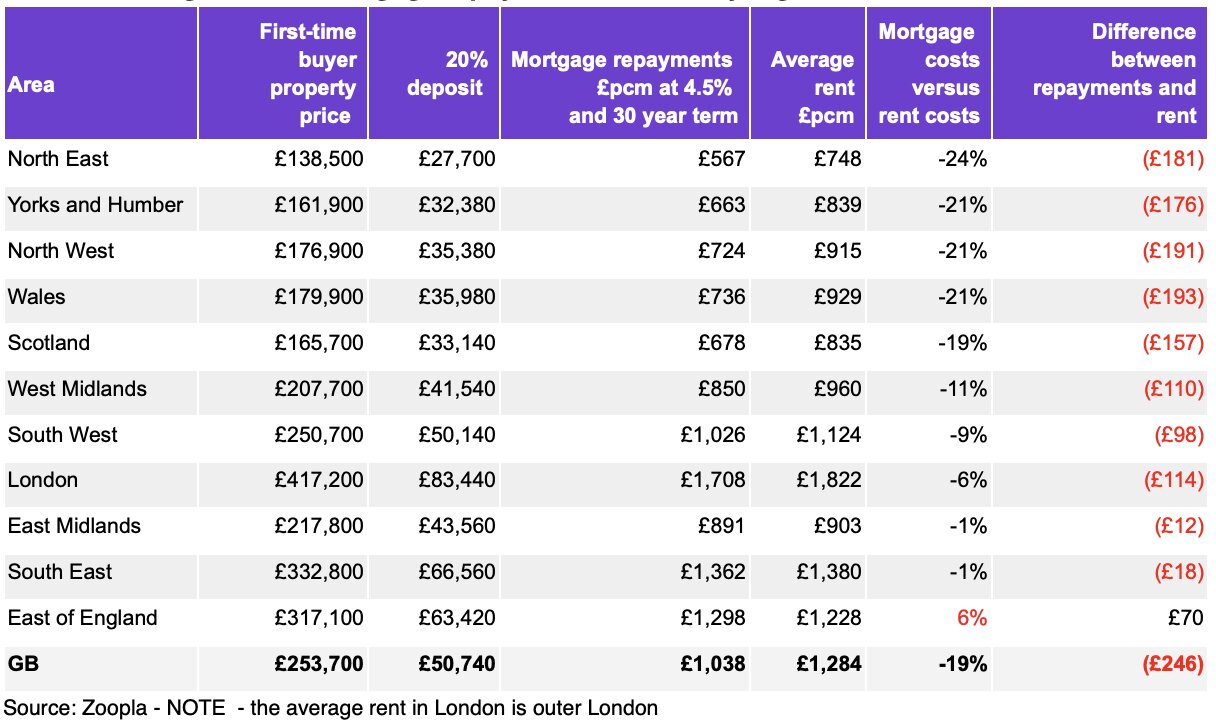

Latest research from the property portal reveals that first-time buyer mortgage payments (£1,038 per month) are 20% lower than average rents (£1,248 per month) across Great Britain.

But Richard Donnell, Executive Director at Zoopla, says that mortgage regulations introduced in 2015 to prevent boom and bust have stymied home ownership aspirations for those on middle incomes.

CHEAPER TO BUY

The property portal’s analysis shows that it is cheaper to buy than rent across all areas of the UK, with the exception of the East of England, where it is 9% more expensive.

The cost of buying versus renting are close both across the South East and the East Midlands regions, with the widest gap in the North East where mortgage repayments are 24% below rents.

Buying costs are more than 30% below rental costs in Glasgow (-46%) and Edinburgh (-32%) and areas in northern England including Newcastle (-34%) and Liverpool (-31%) as well as Cardiff (-31%) in Wales.

Buying costs more than renting in 10% of postal areas led by Harrogate where buying costs 15% more than renting followed by Watford (+7%).

In areas with higher house prices the cost of getting a first home is higher which prices out more first-time buyers and puts extra pressure on the rental market, pushing rents higher.

AFFORDABILITY CHALLENGES

Whilst buying is cheaper than renting across the majority of Great Britain, affordability challenges still remain.

Raising a deposit is a significant constraint for first-time buyers. An average 20% deposit on a typical first-time buyer home ranges from £27,700 in the North East, to £83,400 in London. Many first-time buyers rely on family support for help with deposits, with 63% admitting that they received help from family members when buying their first home.

Mortgage regulations introduced in 2015 mean that first-time buyers also have to demonstrate to their lender that they can afford a higher mortgage rate to ensure that they have the ability to afford their mortgage if borrowing costs were to increase.

Mortgage regulations introduced in 2015 mean that first-time buyers also have to demonstrate to their lender that they can afford a higher mortgage rate to ensure that they have the ability to afford their mortgage if borrowing costs were to increase.

Many lenders are currently ‘stress testing’ affordability at an 8% mortgage rate. This tilts the renting versus buying balance, pushing monthly mortgage repayments above the cost of renting across all regions and countries of the UK. This varies from 10% higher in the North East to over 50% higher in the East of England.

While these regulations stopped boom and bust in house prices as mortgage rates fell and then increased over 2022-23 they have created an extra hurdle for first-time buyers, stoking demand for rented homes, and pushing rents higher.

HIGHER HURDLE

Donnell says: “There remain challenges facing first-time buyers, especially those on average incomes or with small deposits.

“Mortgage regulations introduced in 2015 to stop a housing market boom and bust have created a higher hurdle to home ownership for those on middle incomes, who can afford to make rental payments but are unable to prove they can afford higher mortgage ‘stress’ rates should borrowing costs increase in the future.

“The more first-time buyers priced out of home ownership, the greater the pressure on the private rental market and rental levels.”

NO LOOSE LENDING

And he adds: “Proposals to review regulations around mortgages are welcome. We do not want to return to the loose lending that preceded the global financial crisis.

“A modest loosening in lending rules with mortgage stress testing rates closer to 6-7% would help more middle to higher income renters access home ownership and ease some of the pressure in the rental market without causing a boom in house prices.”

*Zoopla’s analysis assumes an average 20% deposit is paid, which equates to £50,740, for a typical first-time buyer priced property (£253,700). First-time buyer deposits tend to be larger in London (30%), where affordability considerations mean putting down a large deposit is needed to improve access to buying a home.