Zoopla has urged MPs to consider abolishing stamp duty to boost housing mobility and economic growth during an evidence session of the House of Commons Treasury Select Committee on property taxation this week.

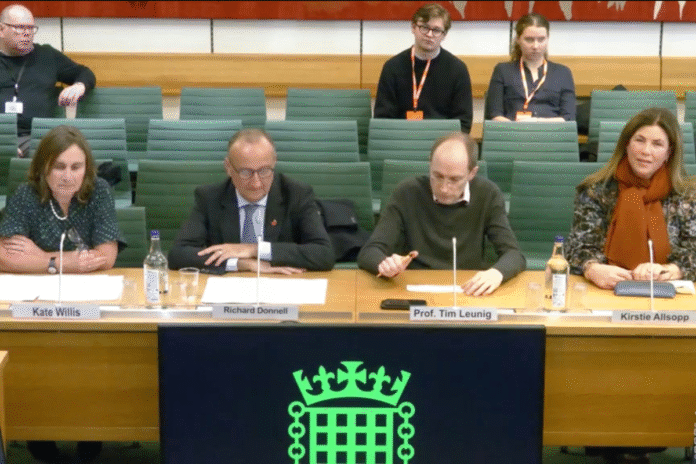

Appearing before MPs, Richard Donnell, Executive Director of Research at Zoopla, joined Kate Willis from the Chartered Institute of Taxation, Professor Tim Leunig of Public First Consulting, and TV presenter and property expert Kirstie Allsopp.

Zoopla shared detailed insights drawn from its data on how current property tax policy is influencing buying and selling decisions among homeowners, first-time buyers and landlords, and set out five key recommendations for reform.

And after the grilling it said it would continue to work with policymakers to ensure data-driven evidence informs future tax reform, representing the interests of estate agents, developers and homeowners across the UK housing market.

ABOLISH STAMP DUTY LAND TAX

Zoopla told MPs that stamp duty remains one of the biggest barriers to home moves, adding cost and friction to transactions while hitting labour mobility and economic growth.

Around 70% of stamp duty receipts come from homes worth more than £500,000, with average buyers in towns such as Aldershot and Southend now facing £7,500 – £10,000 in additional costs.

Donnell warned that while abolition would support more moves, it would require wider reform of council tax to make the system fairer and offset the £11 billion raised annually by SDLT.

REFORM COUNCIL TAX

Zoopla backed calls to modernise council tax, which raises almost £50 billion a year, suggesting that reform could replace stamp duty with a value-based property levy.

The company cited proposals from the Onward think tank that would reduce moving costs for many households, though acknowledged the implementation challenges.

NO CAPITAL GAINS TAX ON MAIN RESIDENCES

Zoopla warned MPs against proposals to extend Capital Gains Tax (CGT) to main homes, describing the idea as a “non-starter”. Around 20% of housing sales already incur CGT, raising £2 billion from second-home and investment property disposals.

MANSION TAX UNWORKABLE

Donnell dismissed the idea of a mansion tax as “expensive to administer and low-yielding”, with fewer than 1% of UK homes valued over £2 million.

AVOID MORE TAX ON PRIVATE LANDLORDS

Zoopla also cautioned against any new measures that would add to landlords’ tax burden, warning this would shrink supply further.

The number of homes in the private rented sector has remained flat since 2016, contributing to rising rents and affordability pressures for lower- and middle-income households.

AFFORDABILITY CONCERNS

Speaking after the session, Donnell said: “Our consumer data shows there is a strong appetite to move home, but the affordability of housing – including the cost of buying – is a key barrier for many households, especially in southern England.

“Reducing the cost of stamp duty to support more home moves and increased labour mobility would be very welcome in the short term but costly at the same time.”

“Property is not the place to look for quick wins on taxation.”

He adds: “Property is not the place to look for quick wins on taxation, but there is a strong case for longer-term reforms that see the removal of stamp duty and the introduction of a proportional property tax that replaces council tax and eases the barriers to home moves.

“While it’s easy to model reforms to property tax on paper, selling them to homeowners and executing any change will be a far greater challenge and needs to be approached with care.”

Watch the session HERE.

Main picture: (Left to right) Kate Willis from the Chartered Institute of Taxation; Richard Donnell, Executive Director of Research at Zoopla; Professor Tim Leunig of Public First Consulting and TV presenter and property expert Kirstie Allsopp.