Vida Homeloans has launched a new high loan-to-value residential mortgage range aimed at widening access to the housing market.

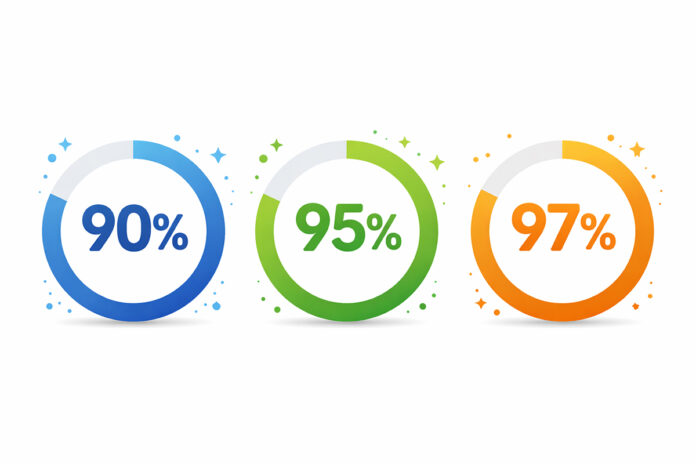

The new Pathway range from Vida offers products at 90%, 95% and 97% loan-to-value, available on two-year and five-year fixed rates.

The lender said the range has been designed to support a broader group of borrowers, with a particular focus on first-time buyers.

For a limited period, all products in the Pathway range are available with no assessment fee. A number of options also include cashback of up to £1,250, payable on completion. Fee Saver products are offered with no product fee and a free valuation.

Alongside the core range, Vida has introduced two-year fixed rate Limited Edition residential products, available up to 95% loan-to-value. These products also benefit from cashback options and the Pathway no assessment fee offer.

FIRST-TIME BUYER BOOST

Ross Williams, head of mortgage product management at Vida Homeloans, said: “The new Pathway range makes the route to homeownership even more achievable for first-time buyers.

“With high LTV options available with a deposit from just 3%, a choice of 2-year and 5-year fixed rates, specialist products for foreign nationals up to 90% LTV, no assessment fees for all products above 85% LTV, and attractive cashback incentives, Pathway helps to get life moving – especially for those taking their first steps into homeownership.”

The lender said the products are also available to home movers and remortgaging borrowers, extending access to the range across the wider residential market.

BUY-TO-LET REDUCTIONS

In addition to the launch of Pathway, Vida has confirmed rate reductions across a number of residential and buy-to-let products, alongside further changes to its application process.

These include the removal of rental evidence requirements on Right to Buy cases, no longer requiring a business plan for buy-to-let portfolio landlord applications, and the reintroduction of the Professional Consultant’s Certificate as an acceptable form of certification where issued by a suitably qualified professional consultant. Vida has also revised its cohabitation policy, including married couples.

The lender said the changes are intended to reduce friction and improve the broker experience.

James Thornton, head of underwriting at Vida Homeloans, added: “We’ve made a raft of improvements behind the scenes to make our application process as efficient and streamlined as possible.

“Brokers will enjoy the benefit across a range of case types, whether residential or buy-to-let. We remain committed to continually enhancing our broker journey, with many more improvements planned for 2026.”