The UK rental market is showing signs of a significant shift, with new data from Zoopla today revealing the slowest annual growth in rents since July 2021.

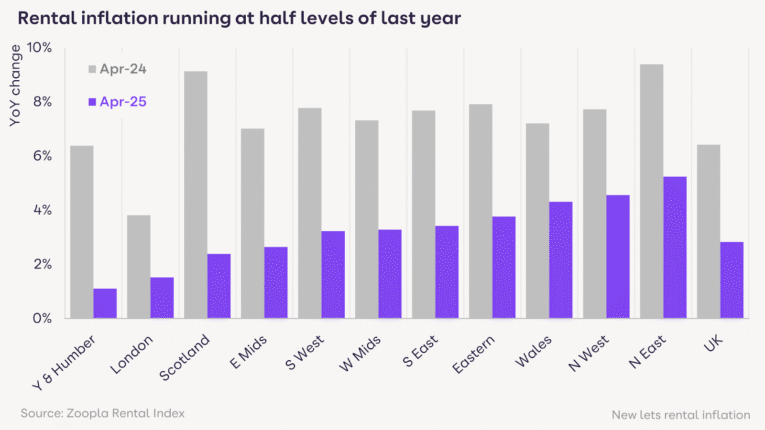

The average rent for new tenancies rose by just 2.8% in the year to April 2025 – down from 6.4% a year ago – signalling the end of a post-pandemic boom that has stretched tenant budgets across the country.

The average rent now stands at £1,287 per month, up £35 over the past year. Growth has slowed in all UK regions, most notably in Yorkshire and the Humber, where rental inflation has dropped to 1.1%, and in London, where rents rose by just 1.5%. Inner-city areas such as NW and WC London have begun to record slight year-on-year declines.

Scotland has seen growth fall from 9.1% to 2.4%, with Dundee rents down 2.1% on last year. Even areas that had previously experienced strong demand, such as Leeds and Bradford, are now seeing rents stall or fall.

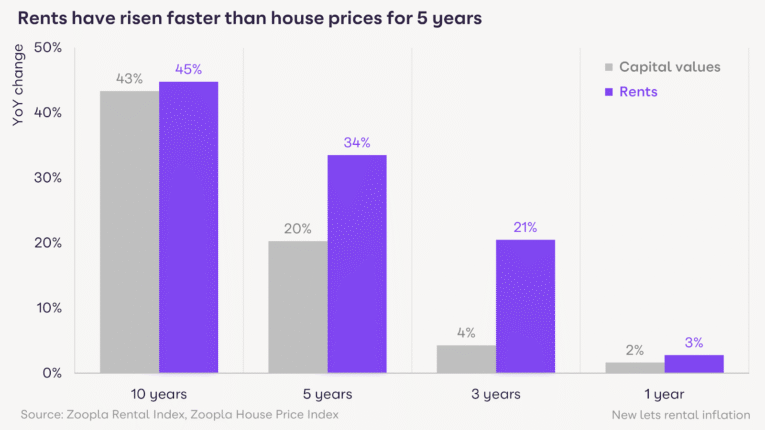

Despite the slowdown, rents have risen 21% since 2022 – five times faster than average house prices. Over that time, tenants have faced an average annual rent increase of £2,650.

The easing in rental inflation is largely driven by falling demand. Zoopla reports a 16% drop in demand over the past year, as lower migration, affordability pressures and improved access to mortgages push more higher-income renters towards home ownership.

Yet supply remains a key concern. While rental stock is up 17% year-on-year, it is still 20% below pre-pandemic levels.

A retreat by private landlords and a slowdown in new investment are limiting growth in the rental sector – especially at the affordable end of the market.

Zoopla forecasts UK rents will rise by 3–4% over the remainder of 2025, with the pace of growth continuing to moderate.

But with structural supply issues unresolved and affordability stretched, pressures on renters – particularly those on low incomes – are likely to persist.

LOWEST LEVEL FOR FOUR YEARS

Richard Donnell, Executive Director of Research at Zoopla, said: “Rents rising at their lowest level for four years will be welcome news for renters across the country.

“The average annual cost of renting is over £2,500 a year higher than three years ago, the same as the increase in average mortgage repayments for homeowners.

“While demand for rented homes has been cooling, it remains well above pre-pandemic levels sustaining continued competition for rented homes and a steady upward pressure on rents.”

“The pressures are particularly acute for those with little hope of buying a home.”

And he added: “The pressures are particularly acute for lower to middle incomes with little hope of buying a home and where moving home can trigger much higher rental costs.

“The rental market desperately needs increased investment in rental supply across both the private and social housing sectors to boost choice and ease the cost of living pressures on the UK’s renters.”

UPWARDS PRESSURE REMAINS

Tom Bill, head of UK residential research at Knight Frank, said: “Rental value growth has cooled over the last year but upwards pressure remains thanks to tight supply.

While some demand has transferred to the sales market as mortgage rates edge lower, a number of landlords have sold due to the tougher regulatory and tax landscape.

“As the Renters’ Rights Bill comes into force over the next 12 months, the upwards pressure on rents could intensify if landlords see added risks around the repossession of their property and void periods.”

MORE RENTAL HOMES NEEDED

Louisa Sedgwick, Managing Director of Mortgages at Paragon Bank, said: “It’s positive that supply pressures in the rental market ease over the period and rent inflation has tempered, although demand is still significantly higher than pre-pandemic levels, with stock remaining depressed compared to that period.

“This long-term structural rental market supply demand imbalance will only deteriorate unless action is taken to boost the number of rental homes available, particularly as population growth and household formation is forecast to accelerate over the next few years.

“It is important that the economic and regulatory environment is one that provides landlords with the confidence to not only remain in the sector, but to grow their portfolios and provide much-needed new rental stock.”