The UK housing market is showing early signs of stabilisation, according to the latest RICS Residential Market Survey for June 2025, though broader economic uncertainties continue to weigh on sentiment.

For the first time since December last year, buyer demand has turned marginally positive.

The net balance for new buyer enquiries rose to +3% in June, up sharply from -22% in May, suggesting a modest rebound in buyer interest.

Similarly, the net balance for agreed sales improved to -3%, from -25% in May, indicating that while activity remains muted, conditions are beginning to level out.

SUBDUED EXPECTATIONS

Sales expectations over the near term have also turned positive, with a net balance of +6% – a notable shift from the -2% recorded in May.

Source: RICS

However, expectations for the next 12 months remain more subdued, with a net balance of just +5%, highlighting fragile market confidence.

On the supply side, new instructions to sell cooled slightly, falling from a net balance of +7% in May to +3% in June.

However, 16% of surveyors reported an increase in property appraisals compared to the same period last year, suggesting supply levels remain relatively stable.

REGIONAL VARIATIONS

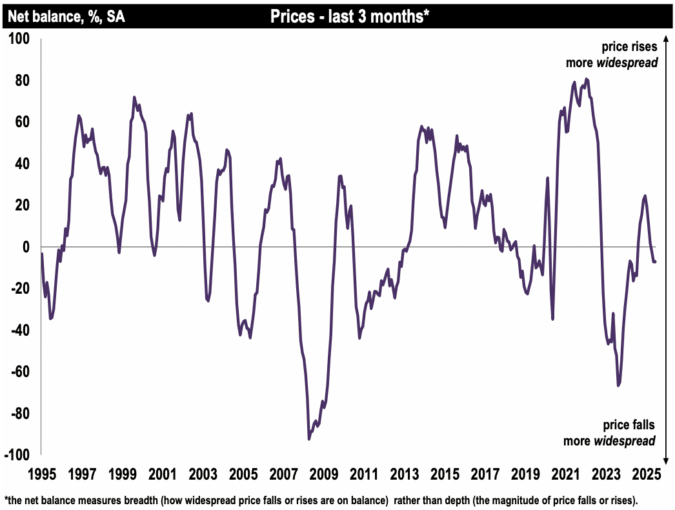

House prices continue to exhibit regional divergence. The national net balance held at -7%, reflecting a broadly flat to slightly negative price environment.

Prices continued to fall in London, the South East, and East Anglia, while gains were reported in Northern Ireland, the North West, East Midlands, and Scotland.

CHALLENGING RENTAL SECTOR

In the rental sector, the picture remains challenging. Tenant demand was flat in June (net balance -2%), while landlord instructions continued their downward trend at -21%.

Despite this, 24% of respondents expect rents to rise over the next three months, although this marks a moderation from +43% in May.

FRAGILE CONFIDENCE

Tarrant Parsons, Head of Market Research at RICS, said: “The market appears to be settling following earlier disruption linked to stamp duty changes.

“While sentiment has improved modestly, confidence remains fragile amid ongoing economic uncertainty at home and abroad.”

NUMBERS NEED TO IMPROVE

Tomer Aboody, director of specialist lender MT Finance, said: “Activity in the market continues to strengthen as buyers return after the lull following the end of the stamp duty holiday.

“First-time purchaser numbers in particular are picking up as interest rates remain steady and lenders more flexible when it comes to mortgage approvals.

“However, sales numbers still need to improve as this will benefit the wider economy, not just the housing market. Some encouragement is required via a reform in stamp duty to encourage those moving up the ladder, as well as those downsizing, to take the plunge.”

GUESS THE TAX RISE

Tom Bill, head of UK residential research at Knight Frank, addeds “Demand is recovering after the March stamp duty deadline meant transactions were pulled forward into the first quarter of the year.

“However, as buyers return, they have a lot of stock to choose from, which is putting downwards pressure on prices.

“Rate cut expectations have grown over the last six weeks due to weak UK economic data, which should support demand over the second half of the year and produce modest single-digit price growth in 2025.

“A re-run of last year’s game of ‘guess the tax rise’ ahead of the Budget is the biggest risk for sentiment.”