The UK housing market recorded its strongest May in four years, with the number of home sales agreed reaching levels not seen since the post-pandemic boom of 2021, according to Zoopla’s latest House Price Index.

Sales volumes have surged as a combination of improved mortgage affordability, greater supply, and seasonal demand has enticed buyers back into the market.

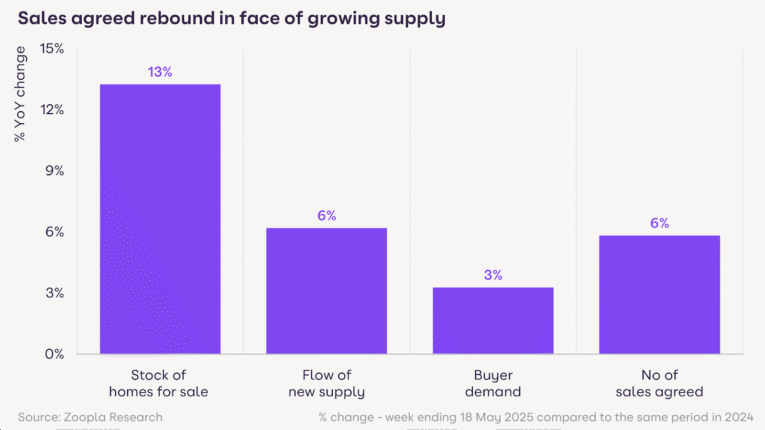

The number of homes available for sale is up 13% on the same period last year, providing greater choice for purchasers and encouraging movement in a market that had previously been subdued by high mortgage costs.

BETTER AFFORDABILITY

One of the key drivers of the resurgence is a shift in how lenders assess mortgage affordability. Borrowers are now able to secure up to 20% more financing than earlier this year, increasing their purchasing power and helping to underpin the growth in sales.

Zoopla reports that the average UK house price now stands at £268,250 – a 1.6% year-on-year increase, or an additional £4,330 in value over the last 12 months.

However, price sensitivity remains: the average property is currently selling at a 3% discount to asking price, or roughly £16,000 below listed values – a figure that has remained stable in recent months.

MORTGAGE RESET SUPPORTS RECOVERY

Mortgage rate volatility over the past three years has reshaped the housing landscape. After sales declined sharply in 2022 and 2023, as rates peaked near 6%, 2024 has seen a rebound, driven by improved lending terms and greater consumer confidence.

Although the end of temporary stamp duty reliefs in April and the Easter holiday created a brief lull, activity has quickly picked up.

Sales agreed in May are now 6% higher than a year ago. Lenders’ willingness to adjust affordability assessments is helping buyers cope with still-elevated borrowing costs – a crucial factor in maintaining market momentum.

NORTH WEST HOTPSPOT

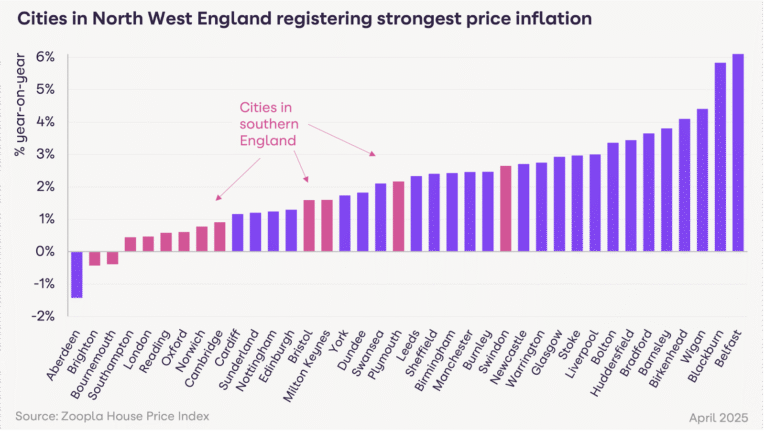

While national figures point to a measured recovery, regional data shows a divergent picture.

House price growth continues to be led by more affordable regions, particularly in the North West and Northern Ireland.

Blackburn (5.8%) and Belfast (6.1%) top the list for annual house price gains. Cities such as Wigan (4.4%) and Birkenhead (4.1%) have also seen strong growth, supported by robust employment trends and spillover demand from pricier urban centres like Manchester (2.5%) and Liverpool (3%).

“House prices are rising fastest in areas where affordability remains within reach and housing demand is underpinned by local economic strength,” said Richard Donnell, Executive Director at Zoopla.

In contrast, Aberdeen continues to underperform, with prices down 1.4% year-on-year amid weak economic conditions and continued underinvestment in the local oil and gas sector.

SOUTHERN ENGLAND SUPPLY UP BUT PRICES FLAT

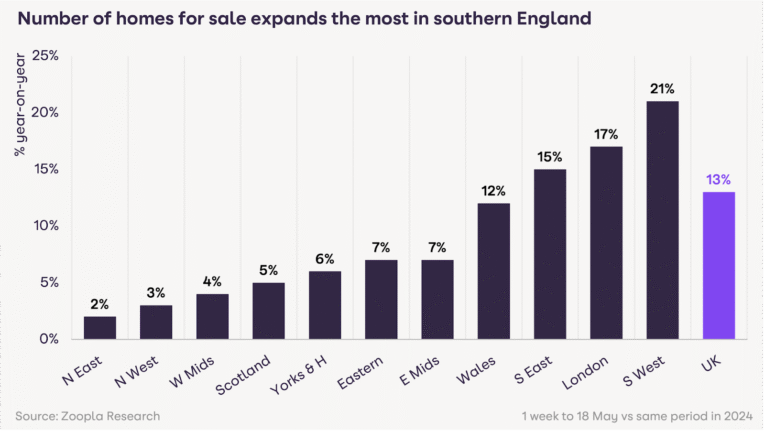

In southern England, a sharp rise in available housing stock is tempering price growth.

There are now 21% more homes for sale in the South West than a year ago, 17% more in London, and 15% more in the South East. This boost in supply is giving buyers more negotiating power and keeping price inflation subdued.

As a result, price growth across the southern regions remains below 1%, ranging from 0.5% in the South East to 0.9% in the South West – well below the national average.

“The housing market remains highly localised,” said Donnell. “While northern cities are experiencing stronger sales and price growth, southern markets are grappling with affordability challenges and a surge in listings that is keeping pricing power in check.”

CONTINUED MOMENTUM

With affordability improving and stock levels rising, the outlook for the second half of 2024 remains broadly positive, though dependent on sellers adopting realistic pricing strategies.

Zoopla’s data shows that overpriced homes are struggling to attract offers, while competitively priced properties are often securing sales quickly.

“We expect sales volumes to continue rising over the coming months, with UK house prices on track to end the year around 2% higher,” Donnell added. “But sellers will need to remain grounded. Price sensitivity remains a defining feature of this market, and success depends on recognising that buyers have more choice – and more power – than in previous years.”