Housing market activity has picked up pace and defying the traditional seasonal lull as buyers take advantage of increased mortgage affordability though rising stamp duty costs and a flood of new listings are putting downward pressure on prices.

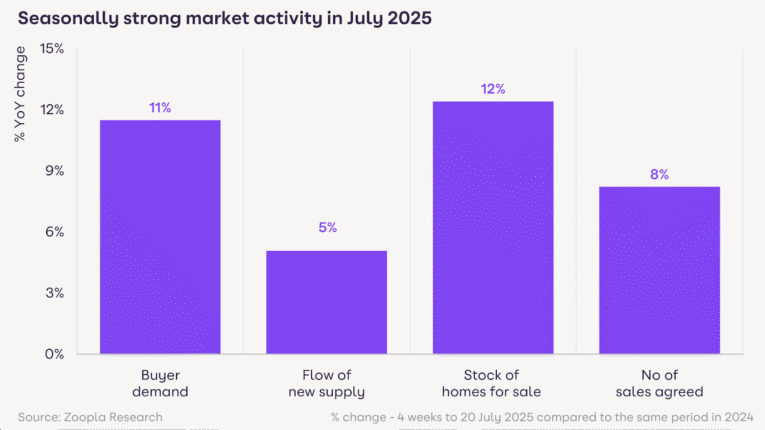

The latest House Price Index from Zoopla shows buyer demand is up 11% year-on-year, with sales agreed up 8%, driven by looser lending rules and a rush to complete transactions before the August holiday slowdown.

The number of homes on the market has hit a five-year high, averaging 37 per estate agency branch, giving buyers more choice and negotiating power.

Zoopla attributes much of this renewed activity to recent changes in mortgage affordability assessments, which have significantly boosted buyer purchasing power.

MORTGAGE MOMENTUM

Borrowers can now take out loans worth up to 20% more than three months ago at the same interest rate, lifting a major constraint that had dampened demand in early 2024.

However, this increased transactional momentum is not translating into faster price growth.

UK house price inflation has slowed to 1.3%, with the average home now valued at £268,400 – just £3,350 more than a year ago. This marks a sharp deceleration from the 2.1% annual growth recorded in December 2024, though it remains above last June’s low of 0.4%.

Richard Donnell, executive director at Zoopla, said: “The housing market is broadly in balance. We’re seeing healthy levels of demand and sales, but this isn’t sparking faster price inflation.

“In fact, more homes for sale, particularly across southern England, is re-enforcing a buyer’s market, keeping price rises in check.

“Many more home buyers are paying stamp duty since April and want this extra cost reflected in the price they pay. While mortgage rates are holding steady, less stringent affordability testing has boosted buying power and is supporting more sales despite increased uncertainty.”

HOUSE PRICES

And he added: “At the start of the year, we predicted house prices would rise just 2%, at the lower end of forecasts for house price inflation.

“Prices are on track to be 1% higher over 2025, half the level forecast. Greater supply of homes for sale and mortgage rates remaining higher than expected are the key reasons for weaker growth. Low house price inflation is not a bad thing so long as there is enough market confidence for people to list their homes and make bids to buy homes.”

STAMP DUTY PUTS BRAKE ON INFLATION

The end of temporary stamp duty reliefs in April has introduced a new headwind to price growth, particularly in southern England.

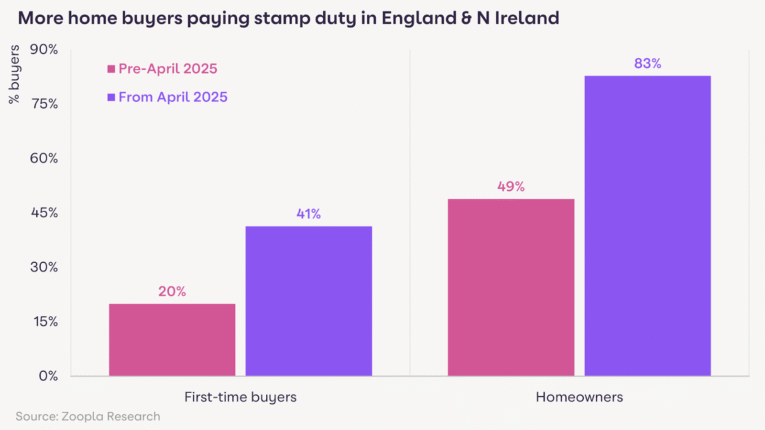

According to Zoopla, 83% of buyers now pay stamp duty, up from 49% earlier this year, adding up to £2,500 to the average purchase – a cost now being factored into buyer negotiations.

The impact is most pronounced in London and the South East, where higher property values mean stamp duty bills are steeper.

A first-time buyer in the capital now pays £6,100 in stamp duty on an average purchase – compared to zero just months ago. While first-time buyers still benefit from reduced rates, 41% are now liable for stamp duty, more than double the 19% affected before April.

REGIONAL DIVIDE

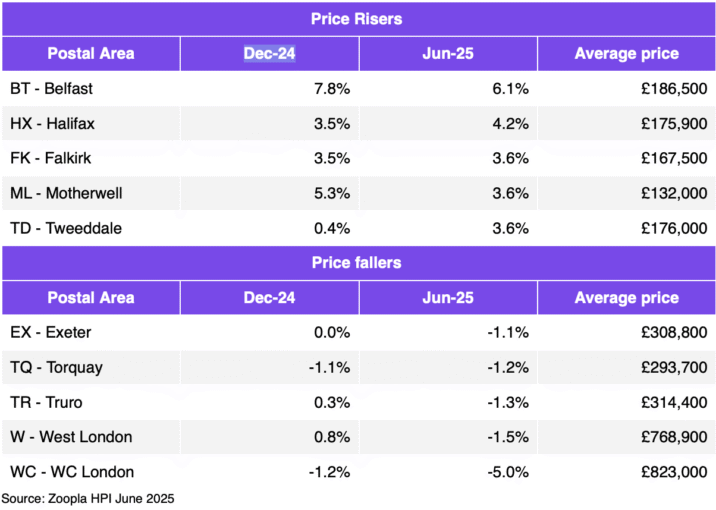

While the national picture reflects subdued growth, regional variation is stark. Northern Ireland leads the market with prices up 6.1%, and Belfast even higher at 7.8%. In contrast, southern regions such as the South East and London are seeing minimal inflation, with growth of just 0.2%, and some markets – like Truro (-1.3%), Torquay (-1.2%), and Exeter (-1.1%) – recording outright price declines.

Despite weaker price growth, market confidence appears resilient, with a growing consensus among analysts that low, steady inflation coupled with greater housing supply may represent a healthier long-term environment for both buyers and sellers – especially as borrowing power improves and political uncertainty begins to clear.