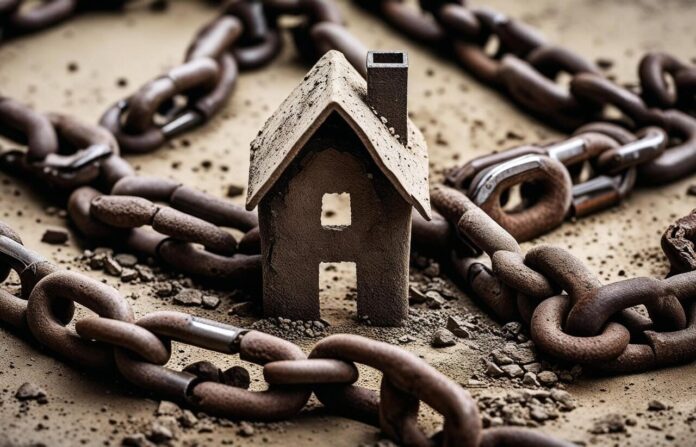

Britain’s home-buying system is in need of a “thorough overhaul”, according to new research that highlights the misery faced by thousands of homeowners caught in housing chains.

The study, carried out by specialist lender Together, found that 60% of homeowners had been tied up in a property chain at some point, with almost a quarter delayed in the past five years. With the latest English Housing Survey showing 618,000 households moved in the past year, Together estimates that almost 49,000 chains were formed in the same period.

CHAIN DELAYS CAUSING MISERY

More than half of those in a chain said the experience had put them off making offers on other homes, while two-thirds reported that it was more stressful than saving for a deposit. Almost six in 10 buyers admitted they had been so frustrated they had considered walking away from their purchase altogether.

Together’s findings echo industry concerns about the length of time it takes to complete a sale. Current figures suggest it takes an average of 109 days from sale agreed to exchange – 65% longer than in 2007.

Although most respondents said they waited two to three months, some reported waiting four to five months, while more than 5% were delayed by six months or more.

PRESSURE ON RENTAL MARKET

Together warned that these delays are not only leaving buyers and sellers stressed, out of pocket and unable to move on, but are also blocking the wider market, making it harder for first-time buyers to step onto the ladder and adding to pressures in the rental sector.

The lender said there is growing evidence of frustrated buyers and sellers turning to bridging loans to break free from chains. A quarter of those who had used bridging finance said it had enabled them to secure a purchase, and 59% of those in chains said they would consider such finance if it guaranteed a way forward.

Ryan Etchells, chief commercial officer at Together, said: “While a common occurrence, maddening property chains can ramp up the costs involved with buying a home, and add to the emotional stress and admin that home movers have to deal with.

“Our property market is broken and needs a thorough overhaul; we must take steps to address it.

“This is why it’s important to increase the awareness of simple solutions like bridging as a significant portion of potential buyers and sellers simply aren’t aware of how beneficial these loans can be.”