The Nationwide Building Society is today (Tuesday 31 March) temporarily withdrawing ‘high’ loan to value (LTV) mortgage lending.

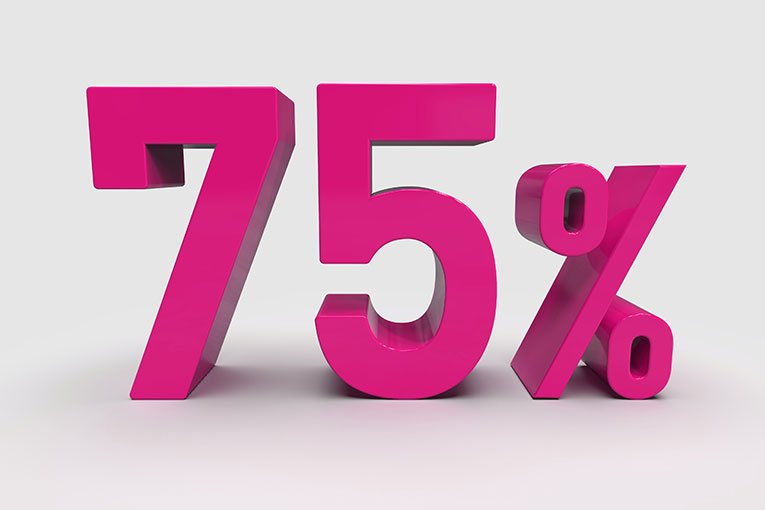

The move, which does not impact existing applications, means all fixed rate and tracker mortgages above 75% LTV will be withdrawn from sale, either online or via brokers, for remortgage, first time buyer and new house purchase customers.

Existing members moving home, taking further borrowing or switching product will not be impacted by the changes. The temporary withdrawal of products above 75% LTV also applies to the Society’s buy-to-let arm, The Mortgage Works.

Existing applications, where a product has already been reserved, will continue to progress.

The Society will continue to offer mortgages at 75% LTV and below. While face-to-face meetings are currently not taking place due to coronavirus, applications and appointments are still able to be held over telephone and Nationwide Now – the Society’s high-definition video service in branch.

This latest announcement follows on from Nationwide and TMW introducing enhanced measures to support existing mortgage applications. These include three-month mortgage offer extensions when the existing offer is within 30 days of expiry as well as alternative valuation methods, such as automated valuation model (AVM).

Sara Bennison, who is responsible for the Nationwide’s products and propositions, said: “As the UK’s second largest mortgage lender, and as a member-owned organisation, we need to maintain the levels of service expected of us in the face of an extremely high number of enquiries about existing mortgages and ongoing applications.

“That is why we have taken this decision on a temporary basis although, by continuing to offer home loans up to 75% loan to value, we can continue supporting the housing market.

“We continue to monitor for any updates to government advice and, in this ever-evolving situation, we ask members and brokers to bear with us and thank them for their patience.”