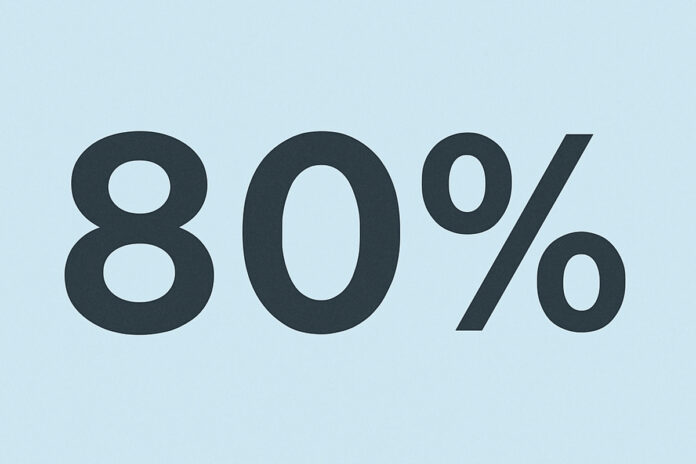

Darlington Building Society has announced a significant enhancement to its buy-to-let offering, with the maximum loan to value increased from 75% to 80% across its range, including products for expat borrowers and holiday let investors.

The move is accompanied by the launch of new five-year fixed-rate mortgages, with headline rates starting from 5.19%.

Effective immediately, the revised range is intended to give intermediaries greater scope when advising landlords looking to refinance former residential properties, raise capital, or secure fixed deals on holiday lets that allow for personal use.

The new five-year fixed rates include a standard buy-to-let product at 5.19% with a £999 fee, alongside expat and holiday let variants both priced at 5.49%, also with a £999 fee.

All products feature a reduced interest coverage ratio (ICR) stress test of the pay rate plus 1%, designed to support affordability at higher loan to value levels.

Darlington’s existing criteria remain unchanged and continue to stand out for their flexibility, with no minimum income requirement, eligibility for first-time buyers and landlords, and personal use allowances of up to 90 days per year on holiday let mortgages.

The decision to extend lending up to 80% LTV is a direct response to broker demand, particularly within the expat segment where higher LTV remortgages have traditionally been harder to obtain.

The Society’s head of mortgage distribution, Christopher Blewitt, said: “We’ve built a buy-to-let range that genuinely works for brokers, with real-world criteria and products that support clients across a variety of situations.

“The increase from 75% to 80% LTV is a direct response to broker feedback and gives more room for landlords needing to raise capital or repurpose a previous residential property.

“Whether it’s an expat looking to remortgage their former UK home onto a buy-to-let, or a holiday let owner looking to optimise cash flow, these changes give brokers another practical option.”

The product refresh follows Darlington’s announcement in June that it has joined the Mortgage Intelligence panel, widening its intermediary distribution and increasing broker access nationwide.