House prices in the UK rose at their quickest pace in two years in November, with annual growth reaching 3.7%, according to the latest data from Nationwide.

On a monthly basis, prices climbed 1.2%, the largest increase since March 2022, leaving values just 1% below the all-time peak recorded in the summer of 2022.

The unexpected acceleration in price growth has defied predictions of a market slowdown, bolstered by solid economic fundamentals.

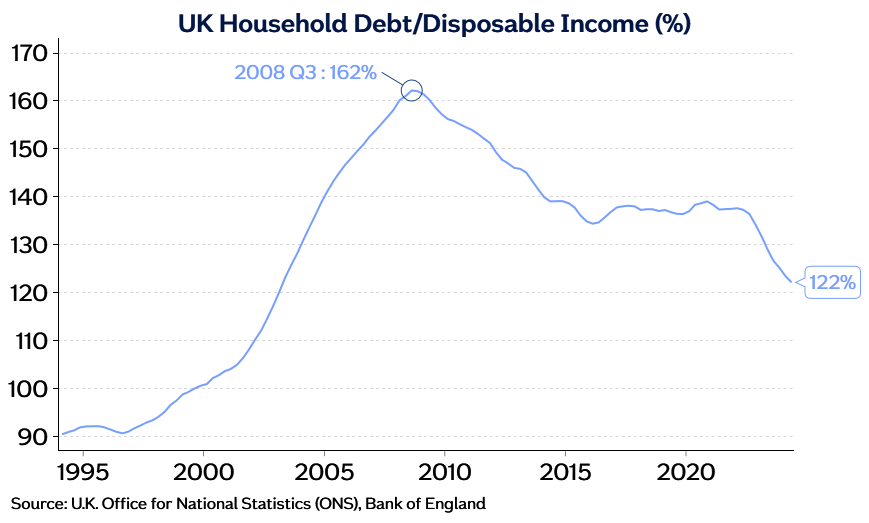

Nationwide attributes the rise to robust labour market conditions, including low unemployment and strong wage growth, coupled with healthier household balance sheets. The lender also noted that debt levels are at their lowest relative to household income since the mid-2000s.

AFFORDABILITY CHALLENGES

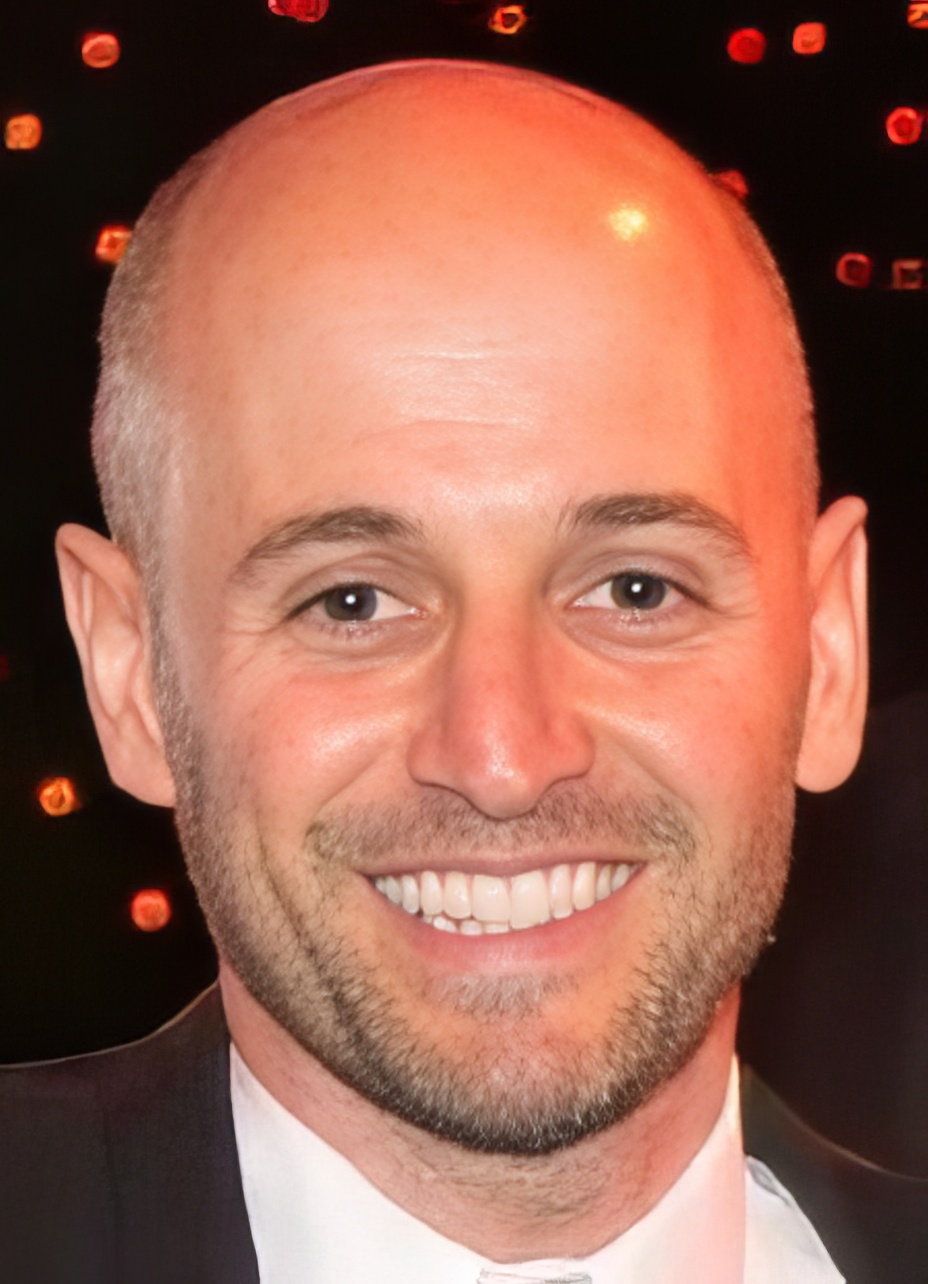

Robert Gardner, Nationwide’s chief economist, expressed surprise at the speed of the rebound, given persistent affordability challenges.

“Affordability remains stretched by historic standards, with house prices still high relative to average incomes and interest rates well above pre-Covid levels,” he said.

He added that the recent surge in activity was unlikely driven by changes to stamp duty announced in the Autumn Budget, as most mortgage applications predate the announcement.

“Housing market activity has remained relatively resilient, with mortgage approvals approaching pre-pandemic levels despite the higher interest rate environment,” Gardner observed.

However, Gardner warned of turbulence ahead. The looming stamp duty changes, set to take effect next April are expected to distort the market in the short term.

“We anticipate a spike in transactions in the first quarter of 2025, particularly in March, followed by a period of subdued activity as occurred after previous stamp duty changes,” he said. “This could temporarily shift the balance of supply and demand, affecting price movements.”

Looking further ahead, Gardner remains cautiously optimistic.

“If the economy continues to recover steadily, as we expect, the housing market should strengthen gradually. Affordability pressures are likely to ease through a combination of modestly lower interest rates and earnings growth outpacing house price inflation,” he predicted.

INDUSTRY REACTION

The data has drawn a mixed response from industry experts, with some warning that broader economic pressures could yet dampen market momentum.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said rising inflation could temper expectations of aggressive interest rate cuts.

“Inflation creeping back up is not the required backdrop for significant rate reductions. The Budget’s measures may fuel inflation further, potentially slowing market activity as borrowers struggle with affordability,” he said.

“Swap rates have eased slightly, but many lenders are still repricing upwards. Borrowers should consult a whole-of-market broker to secure the best deal.”

OPTIMISTIC

Tomer Aboody, director of specialist lender MT Finance, took a more optimistic view. “The continued growth in house prices underscores market confidence, driven by stabilizing mortgage rates and reduced inflation. Sellers and buyers remain keen to transact as affordability improves,” he said.

Aboody added that while the Budget’s full impact is yet to be felt, confidence in the market appears resilient.

“Further rate cuts expected in the new year should reinforce this positive sentiment,” he said.

STAMP DUTY CHANGES

The imminent stamp duty reforms have already begun to shape buyer behaviour.

Guy Gittins, chief executive of estate agency Foxtons, said: “After a period of slower growth ahead of the Budget, the latest data suggests renewed acceleration.

“We’ve seen a significant increase in buyer activity, with higher volumes of viewings and offers, and there’s plenty of stock on the market to meet demand. While house prices are climbing, the market remains balanced.”

And Marc von Grundherr, Director at London estate agency Benham and Reeves, echoed this sentiment.

“The countdown to the stamp duty deadline has supercharged buyer demand, which will inevitably push prices higher in the coming months. Sellers contemplating a move should act now to capitalize on this momentum,” he advised.

LANDLORDS FEEL THE PINCH

The impact of the Budget has been less favourable for landlords and second homeowners, who face an immediate hike in stamp duty on additional property purchases.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, noted that while a feared rise in capital gains tax rates was avoided, the increased tax burden on landlords could cool investor demand.

“The decision not to extend current stamp duty relief thresholds beyond March will likely spur a short-term price surge as buyers race to complete purchases, but prices may soften thereafter,” Haine predicted. However, she added that further interest rate cuts could offer a lifeline.

“Despite the rebound, affordability pressures persist, with house prices still high relative to incomes and interest rates well above their pre-pandemic levels”

Holly Tomlinson, financial planner at Quilter, added: “Despite the rebound, affordability pressures persist, with house prices still high relative to incomes and interest rates well above their pre-pandemic levels.

Holly Tomlinson, financial planner at Quilter, added: “Despite the rebound, affordability pressures persist, with house prices still high relative to incomes and interest rates well above their pre-pandemic levels.

“For first-time buyers, this means higher monthly payments and stretched budgets, underlining the difficult balancing act between rising prices and the cost of borrowing.

“However, the housing market continues to show resilience, supported by low unemployment, rising real incomes, and healthier household balance sheets.

“The rebound in price growth doesn’t appear to have been influenced by the recent Budget changes to stamp duty, as most mortgage applications would have been started before the announcements.

“The prospect of higher stamp duty for some buyers from March 2025 is likely to create a rush to complete purchases early next year.”

“However, the prospect of higher stamp duty for some buyers from March 2025 is likely to create a rush to complete purchases early next year.

“This could create volatility, with a spike in transactions in the short term followed by a potential slowdown later in 2025, as buyers adjust to the new landscape.

“The housing market’s resilience also reflects broader structural issues. With demand outstripping supply and the government falling well short of its target to build 300,000 homes annually, prices are likely to remain under pressure even as affordability constraints persist.

“This dynamic, combined with limited rental supply due to higher costs for landlords, is creating a tough environment for those trying to enter the market.”