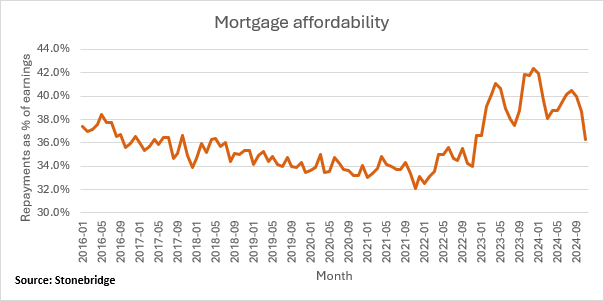

November saw mortgage affordability improve for the second consecutive month, according to new analysis from Stonebridge.

The latest Mortgage Affordability Index from the network shows that monthly repayments accounted for 36.3% of the average borrower’s salary in November.

This is down significantly from 40% in September and 38.7% in October, the data shows.

The last time mortgages were this affordable in relation to earnings was in November 2022, when repayments accounted for 34% of the average borrower’s salary.

Stonebridge said there are several reasons for the improvement: falling mortgage rates, rising wages, and smaller loan sizes.

The average rate on newly drawn mortgages fell from 4.61% to 4.5% between October and November, according to the Bank of England, while Office for National Statistics data shows wages edged up over the same period.

Stonebridge’s internal data also shows borrowers’ average loan size dipped 4.7% in November, easing the strain on borrowers even further.

Stonebridge’s Mortgage Affordability Index:

Stonebridge’s index marries official wage and mortgage rate statistics with its own loan data to determine the relative affordability of mortgage finance in proportion to the average borrower’s earnings.

Rob Clifford, chief executive at Stonebridge, said: “Mortgage affordability improved for the second month in a row in November, offering some much-needed breathing room for borrowers buying or refinancing.

“While rising funding costs have pushed up fixed-rate mortgages since the start of the year, there’s no need for borrowers to panic. There are still plenty of great deals available and borrowing costs remain well below the level they were for much of last year.

“Looking ahead, the outlook looks very encouraging. Markets are predicting up to three rate cuts this year, while the Bank of England governor recently hinted at as many as four reductions in 2025.

“The extent to which the central bank cuts rates will be determined by the path of inflation, of course, but the signs suggest that mortgage costs should reduce throughout 2025, which will provide further relief to borrowers.”

Stonebridge’s Mortgage Affordability Index:

| Month | Mortgage repayments as % of salary |

| November 23 | 41.8% |

| December 23 | 42.4% |

| January 24 | 41.9% |

| February 24 | 39.7% |

| March 24 | 38.1% |

| April 24 | 38.8% |

| May 24 | 38.8% |

| June 24 | 39.6% |

| July 24 | 40.1% |

| August 24 | 40.5% |

| September 24 | 40.0% |

| October 24 | 38.7% |

| November 24 | 36.3% |

| Long-running average | 35.9% |