Stonebridge Group has begun its 2016 charity campaign for Macmillan Cancer Support by raising over £8,000.

The mortgage and insurance network is backing Macmillan as its chosen charity during 2016 and began its fundraising efforts at the annual conference held this month in East Midlands Conference Centre in Nottingham.

At the annual conference dinner, Stonebridge appointed representative (AR) firms, providers, lenders, and staff members were all asked to dig deep for the charity, with the network committing to double the amount raised.

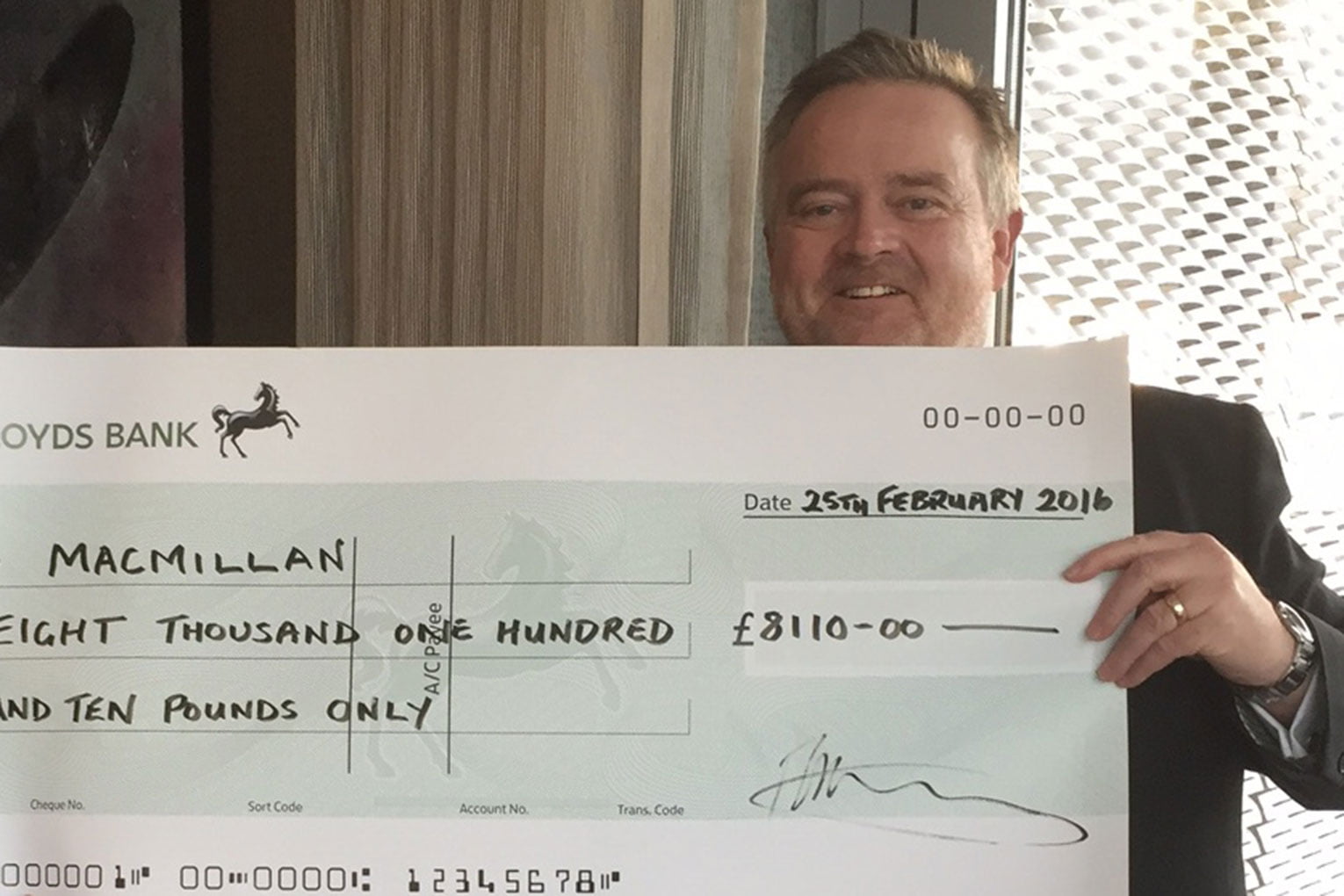

As a result Stonebridge has been able to hand over an initial cheque for £8,110 to Macmillan and will be holding further fundraising drives throughout 2016, again with all money raised doubled by the network.

Richard Adams (pictured), managing director of Stonebridge Group, said: “In the whole of last year we raised just over £15k for two cancer charities, and it is therefore extremely pleasing to have already raised over half that amount for Macmillan in under two months.

“As a business we feel it’s important that we do all we can to support our chosen charity; as can be seen already our staff, lender and provider relationships and AR firms have given us incredible backing to support a charity as important as Macmillan and helping it conduct more of the crucial work it does with those living with cancer and their families. Few of us are not touched in some way by this disease and we therefore want to thank the very kind generosity of all those who attended our conference.

“The work does not stop here however and we have a number of events and charity drives planned for the rest of the year with a real motivation to surpass our efforts last year.”