Shop price inflation accelerated in August, driven by higher food costs and new government-imposed expenses on retailers according to the latest BRC-NIQ Shop Price Monitor.

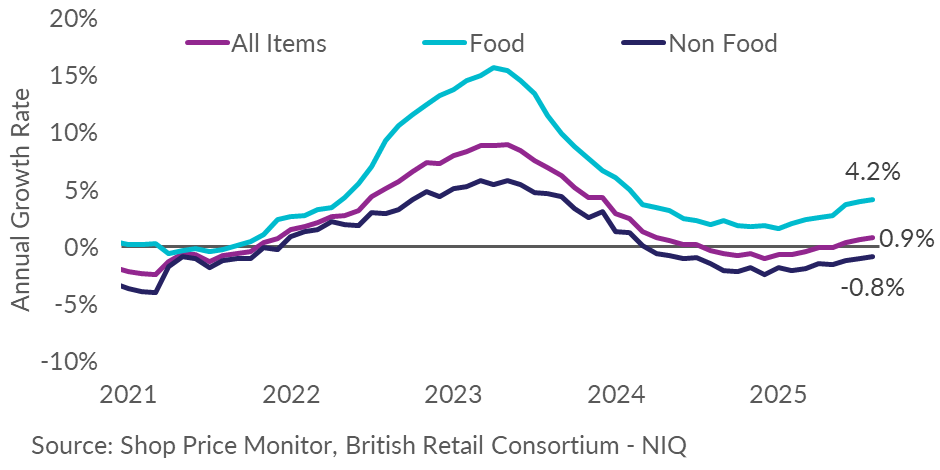

The Monitor, formerly known as the Shop Price Index, showed overall shop price inflation rising to 0.9% year on year, up from 0.7% in July and the highest rate since March 2024.

Food remained the main driver, with prices up 4.2% on the year compared with 4.0% in July.

Fresh food inflation climbed sharply to 4.1&, against 3.2% a month earlier, while ambient food inflation eased to 4.2% from 5.1%.

HIGHEST RATE

Helen Dickinson, Chief Executive of the British Retail Consortium, says: “Shop price inflation hit its highest rate since March last year, fuelled by food price rises.

“This adds pressure to families already grappling with the cost of living. Staples such as butter and eggs saw significant increases due to high demand, tightening supply, and increased labour costs.

“Chocolate also got more expensive as global prices of cocoa remain high owing to poor harvests. There was some respite for parents ahead of the new academic year, with lower prices for clothing, books, stationery, and computing.”

“Retailers continue doing everything they can to limit price rises.”

And she adds: “Retailers continue doing everything they can to limit price rises for households, but as the Bank of England acknowledged, the £7bn in new costs flowing through from last year’s Budget has created an uphill battle for retailers.

“That is why over 60 retail CEOs recently wrote to the Chancellor with a call to ensure there are no further taxes rises on retail this Autumn.

“The planned business rates reforms present an opportunity to deliver a meaningful reduction in retail, hospitality and leisure bills, ensure no shop pays more as a result and help retailers keep prices low for customers.”

PRICES FALLING

Non-food categories saw continued price declines, albeit at a slower pace, with prices falling 0.8% year on year compared with a 1.0 per cent drop in July.

Mike Watkins, Head of Retailer and Business Insight at NIQ, adds: “The uptick in prices reflects several factors: global supply costs, seasonal food inflation driven by weather conditions, the conclusion of promotional activity linked to recent sporting events, and a rise in underlying operational costs.

“As shoppers return from their summer holidays, many may need to reassess household budgets in response to rising household bills.”

The BRC has urged the government to act on business rates and resist further tax increases, warning that additional cost pressures risk embedding higher inflation in consumer prices.