The dream of returning to one’s childhood hometown is slipping out of reach for millions of Britons, as two decades of house price growth have significantly outpaced earnings in many parts of the country, according to new analysis from property portal Zoopla.

More than half (52%) of Britons say they would consider returning to their hometown if affordability allowed.

But as regional inequalities widen, for many, the road home remains financially out of reach.

REGIONAL DISPARITIES

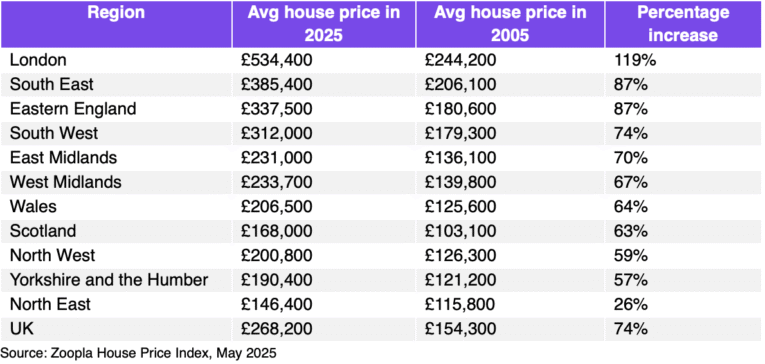

UK house prices have risen by 74% since 2005, from an average of £113,900 to £268,200. Despite house price-to-earnings ratios remaining broadly stable at 6.4, stark regional disparities mean that affordability has worsened sharply in many areas, particularly in the South East and Eastern England.

While London posted a 119% rise over the 20-year period, it is commuter belts like Elmbridge in Surrey and St Albans in Hertfordshire that illustrate the scale of change.

In Elmbridge, average prices jumped from £338,800 to £712,700 – a 110% increase – driven by its proximity to London and high quality of life.

St Albans saw similar growth, with prices rising 108 per cent to £622,100, underlining the ongoing appeal of historic commuter towns.

AFFORDABILITY PRESSURES

However, affordability pressures are mounting. House price-to-earnings ratios in the South East have risen from 7.8 to 8.6, and from 7.1 to 7.7 in Eastern England.

Even traditionally more accessible areas, like Great Yarmouth and Southampton, have seen substantial growth, with average prices up 77% and 63% respectively.

In contrast, the North East remains the most accessible region for those seeking to move “home.”

Property values have risen just 39% since 2005, while affordability has improved significantly – house price-to-earnings ratios have fallen from 5.7 to 4. Sunderland recorded the lowest growth of any major UK location, with average prices rising just 22% to £124,000.

Other northern regions have seen similar trends. In the North West, Blackpool’s prices have climbed only 26% to £124,300, while in Yorkshire, Hull has seen a 49% increase to £115,900.

FINANCIALLY UNATTAINABLE

Daniel Copley, consumer expert at Zoopla, said: “Our latest analysis certainly brings to light the profound impact that two decades of house price growth has had on the dream of ‘returning home’.

“UK house prices have soared by 74% since 2005, making that nostalgic return financially unattainable for many, especially in hotspots in the South East and Eastern England.

“However, the picture is far from uniform across the UK. Our data shows that while some areas have seen dramatic increases, house prices have risen slowly, in line with incomes in northern regions. This means that for some, the dream of returning to their roots might be much more attainable than they think.”