Smartr365 has launched a new MortgageKanban feature.

MortgageKanban is a scheduling and workflow management tool for brokers to manage mortgage applications from start to finish in a visual way. The new feature helps brokers to streamline their workflow and manage client cases all in one place.

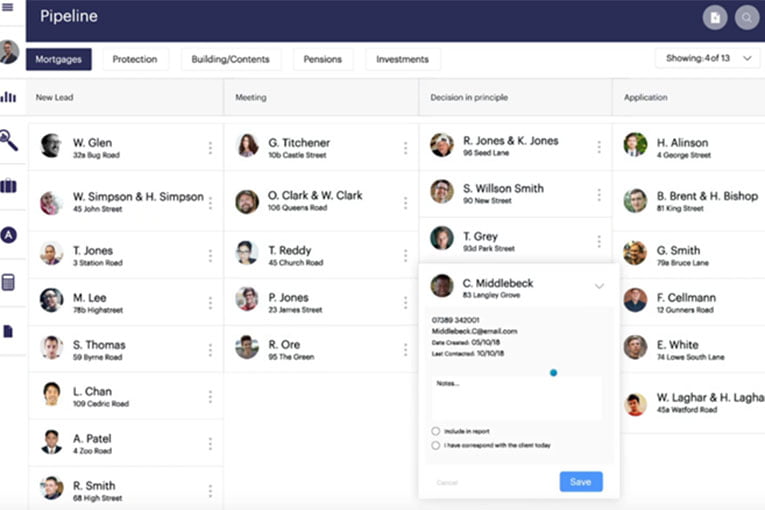

Smartr365’s MortgageKanban breaks down the mortgage application process into a series of visual steps, represented by ‘cards’. The worktool gives a clear overview of all client cases, displayed by appropriate status or ‘swim lanes’. New leads, client meetings, DIPs, mortgage completions and payment of procuration fees are all displayed as cards within the system. Cards move from left to right across the board once each step is completed.

The MortgageKanban also has a filter option to allow brokers to focus on a specific part of the process. As each case progresses, MortgageKanban triggers certain automations, depending where the case is at in the process. For example, automated email notifications, client review meetings or generating re-mortgage opportunities to free up time for brokers to focus on advice.

Mark McKenna, commercial director at Smartr365, said: “Smartr365 is committed to creating a frictionless, digital mortgage process, and that means giving brokers the tools they need to deliver the best possible service to customers. We’ve spent months researching and asking brokers what they would consider the fastest and easiest way to process a mortgage – and this is how our MortgageKanban was created.

“We believe this is one of the most efficient ways to process a mortgage today and is a step towards creating a fully digital mortgage experience – which we feel is going to be possible in the very near future.”