Royal London has reported a record year for protection payouts, disbursing over £751 million to customers and their families in 2024.

The mutual insurer paid 98.7% of all protection claims made during the year, supporting 65,385 individuals and businesses through periods of illness, bereavement and financial disruption.

The total includes, for the first time, claims linked to policies transferred from Aegon’s individual protection business, which formally moved to Royal London on 1 July 2024.

The figures published today show the depth of financial support across a range of products. Term life and terminal illness claims accounted for nearly £270 million, with average payouts of £93,000 and £132,000 respectively.

The figures published today show the depth of financial support across a range of products. Term life and terminal illness claims accounted for nearly £270 million, with average payouts of £93,000 and £132,000 respectively.

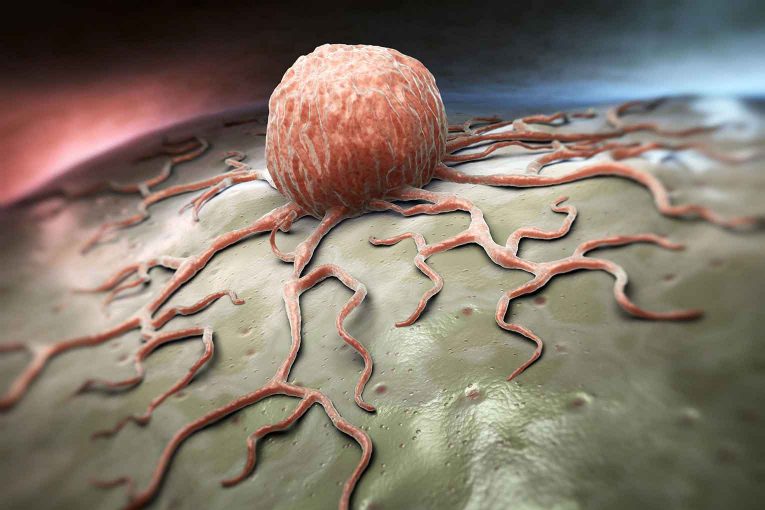

Critical illness claims reached over £180 million, with 2,675 customers receiving an average of more than £67,000. Cancer was the leading reason for claim, representing 64% of all critical illness cases, followed by heart attack and stroke.

Income protection claims totalled over £8 million, providing crucial financial relief to 1,259 policyholders unable to work. Whole of life claims reached £286 million, with an average payout of £5,000 and a claims acceptance rate of 99.98%.

SUPPORT SERVICE GROWTH

Beyond financial payouts, the insurer’s holistic support service, Helping Hand, continued to expand. More than 5,400 customers signed up in 2024, with 979 receiving one-to-one support from a dedicated nurse.

The service gives policyholders and their families access to a range of health and wellbeing resources, including virtual GPs, physiotherapy, mental health support and bereavement counselling.

Helping Hand also supported preventative care through partnerships with Thrive, for mental health, and Track Active Me, for musculoskeletal advice.

Of those who received nurse support, 19% had a cancer diagnosis, 17% needed help with mental wellbeing, and a further 17% were assisted with musculoskeletal issues.

“Paying a claim is our moment of truth”

Craig Paterson, chief underwriter at Royal London, said the results demonstrated the importance of protection insurance in everyday financial planning.

“Publishing our claims statistics shows how crucial it is to have a financial safety net for when the unexpected happens,” he said.

“Paying a claim is our moment of truth – and in 2024 we delivered on that promise, with a record-breaking year for claims paid to customers.

“While we have always had a strong track record in paying claims, we’re always looking to improve the claims experience for our customers, making it easier for them to claim and pay claims faster. For instance, we’re now able to settle more life insurance claims without requiring medical evidence.”

ALL AGES

Royal London also highlighted that life shocks affect people of all ages. The youngest claimant in 2024 was just 19 years old, and a quarter of all claims were made by customers under the age of 45.

As part of its ongoing commitment to supporting health resilience, the mutual has pledged to donate a further £1.2 million to Cancer Research UK in 2025.

The funding will support research into hard-to-treat cancers, projects aimed at earlier diagnosis, and initiatives to increase cancer awareness in underserved communities.