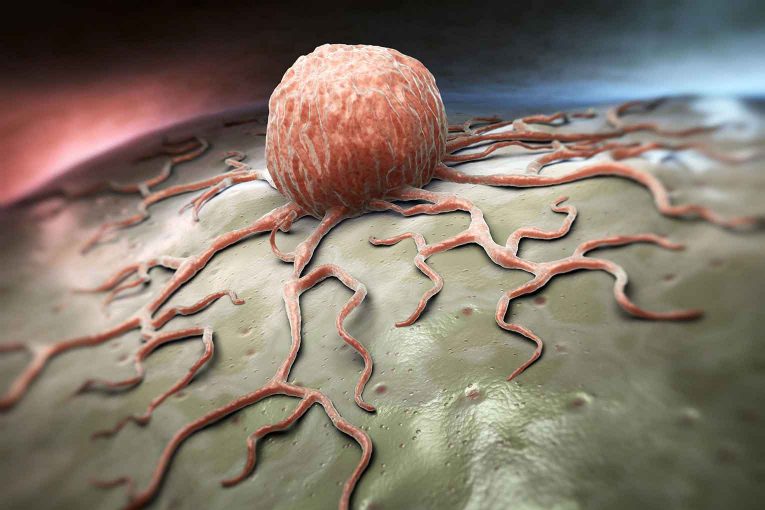

Royal London has made changes to its critical illness cover (CI) for three of the most common areas for claim – cancer, heart conditions and multiple sclerosis – allowing the business to pay out in a wider range of circumstances.

The enhanced CI sees the addition of full payments for both heart failure and peripheral vascular disease with by-pass surgery. Heartbeat abnormalities and aortic aneurysms have been added as new additional cover conditions, whilst illness definitions have been updated and expanded to cover a wider range of treatments including thoracotomies and endovascular repairs.

Royal London’s CI now includes additional cover conditions for four additional cancers, whilst low grade prostate cancer claims will now be payable upon diagnosis, without the requirement for treatment.

The definition of testicular cancer has also been widened to incorporate benign tumours.

Restrictions on claims for multiple sclerosis requiring symptoms to be present at the time of claim have been removed; meanwhile the definition of Parkinson’s disease cover has been updated in accordance with latest ABI Statement of Best Practice.

Royal London has also improved its Enhanced Child CI cover by adding a new definition for surgical repair of an atrial or ventricular defect. This is a congenital condition most commonly diagnosed at birth or during early childhood.

Christina Rigby, product specialist at Royal London, said: “We have made these enhancements to our critical illness cover to ensure claims are paid, regardless of the different treatments clients may receive.

“By expanding and adding to these key definitions and focusing on the most common areas for claim, Royal London continues to fully protect customers when it matters most.”

Alan Higgs, head of research at the Financial Technology Research Centre, said: “The critical illness market has become fiercely competitive in recent times and Royal London has made significant strides with its latest enhancements. The removal of the requirement for any surgery if diagnosed with low grade prostate cancer is great to see as this condition is often very slow to spread and often treated by watchful waiting.

“For females, Royal London have added a definition for Ovarian Tumour of borderline malignancy/low malignant potential. Overall it is clear that Royal London have targeted high incidence conditions and as such improved their standing in the market by providing clear, concise and comprehensive definitions.”