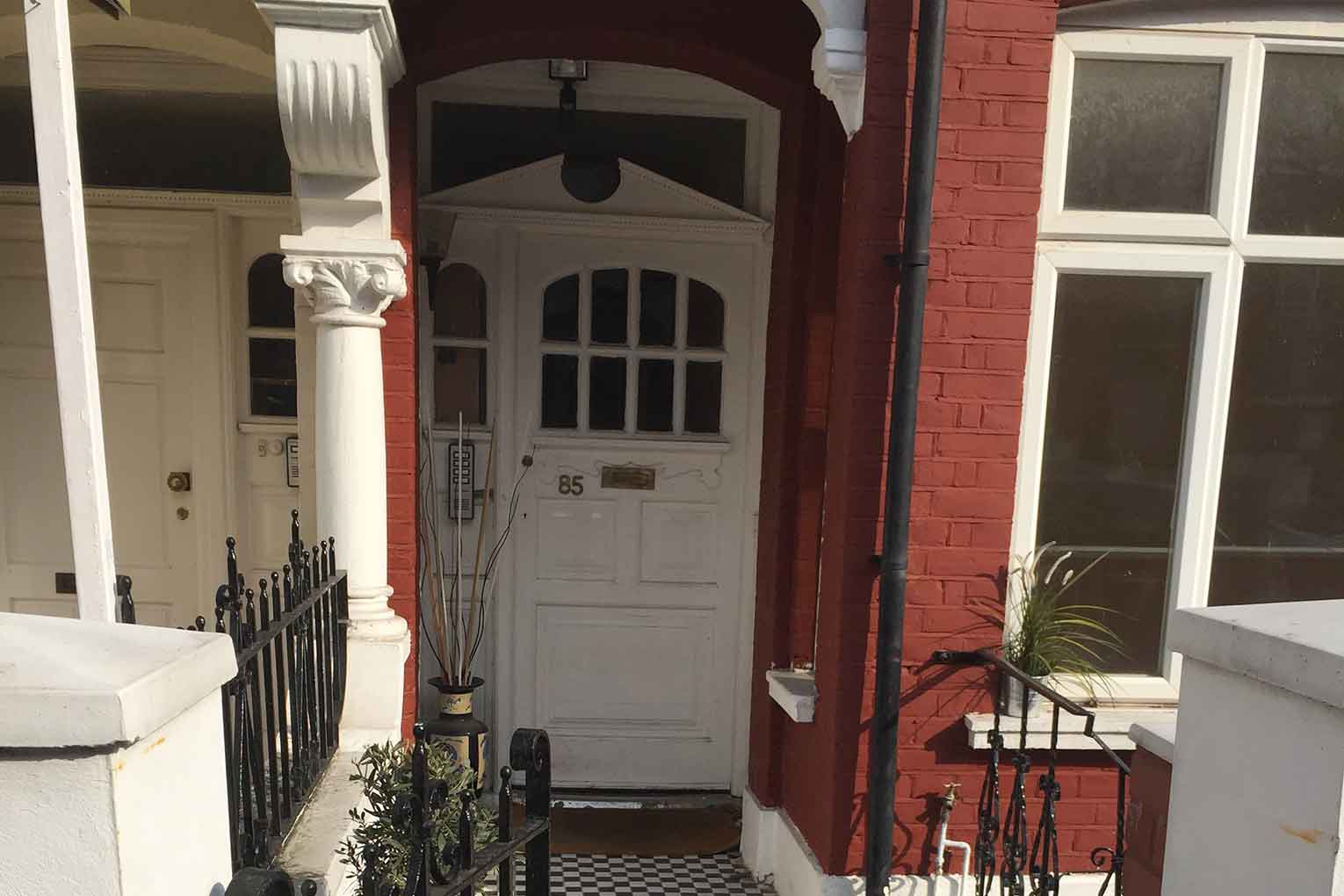

Roma Finance has come to the rescue of a customer, who had been let down by builders, to complete a basement conversion in south London.

The customer wanted to double the value of the mid-terraced property and appointed builders to carry out the work with funds from a £80,000 second charge.

However, after the builders had been paid a substantial deposit and work had commenced, they disappeared.

With the property falling into disrepair and amid a flurry of complaints from angry neighbours, the local authority issued an Enforcement Notice. The borrower, who worked full time in the NHS, didn’t even have the funds for the remedial work let alone the money to complete the project. And his second lender wouldn’t help.

Roma Finance quickly assessed the project and, realising the potential of the property, agreed to lend £250,000 to pay off the second charge, placate the local authority and complete the project. The bridging finance was released in stages subject to ongoing inspections.

At the end of the loan term, due to a backlog at the local authority, there was a three month delay to get the building inspector to undertake the final inspection which meant the borrower was unable to get a Completion Certificate that would have allowed him to re-finance and exit the bridge.

However, Roma Finance granted an extension to the term until Building Control had issued the Completion Certificate which enabled the customer to obtain his re-finance without being defaulted.

Scott Marshall, Roma Finance’s managing director, said: “This was one of those cases which we knew would be worthwhile for all concerned. Several other lenders wouldn’t lend because of the Enforcement Notice, but having met the applicant, we knew the issues were not of his making and we could see the property’s potential.

“We showed our understanding of the problems a customer can have with a project like this and despite setbacks, we stuck by the borrower and helped him realise the full potential of the project, when other lenders might not have been so understanding. It’s often how a lender conducts themselves when things don’t go to plan that differentiates them from competitors.

“We always try to do the right thing by our customers when they get into difficulties and deliver exceptional service backed by prompt, pragmatic underwriting decisions.”

The unnamed borrower added: “I would just like to thank the staff at Roma Finance for being polite, friendly and always accommodating. I needed a bridging loan to fund a basement conversion in West Norwood, London which took longer than expected because of issues with building control. A special mention to Mr Scott Marshall who I found to be a very genuine, honest and kind person.”