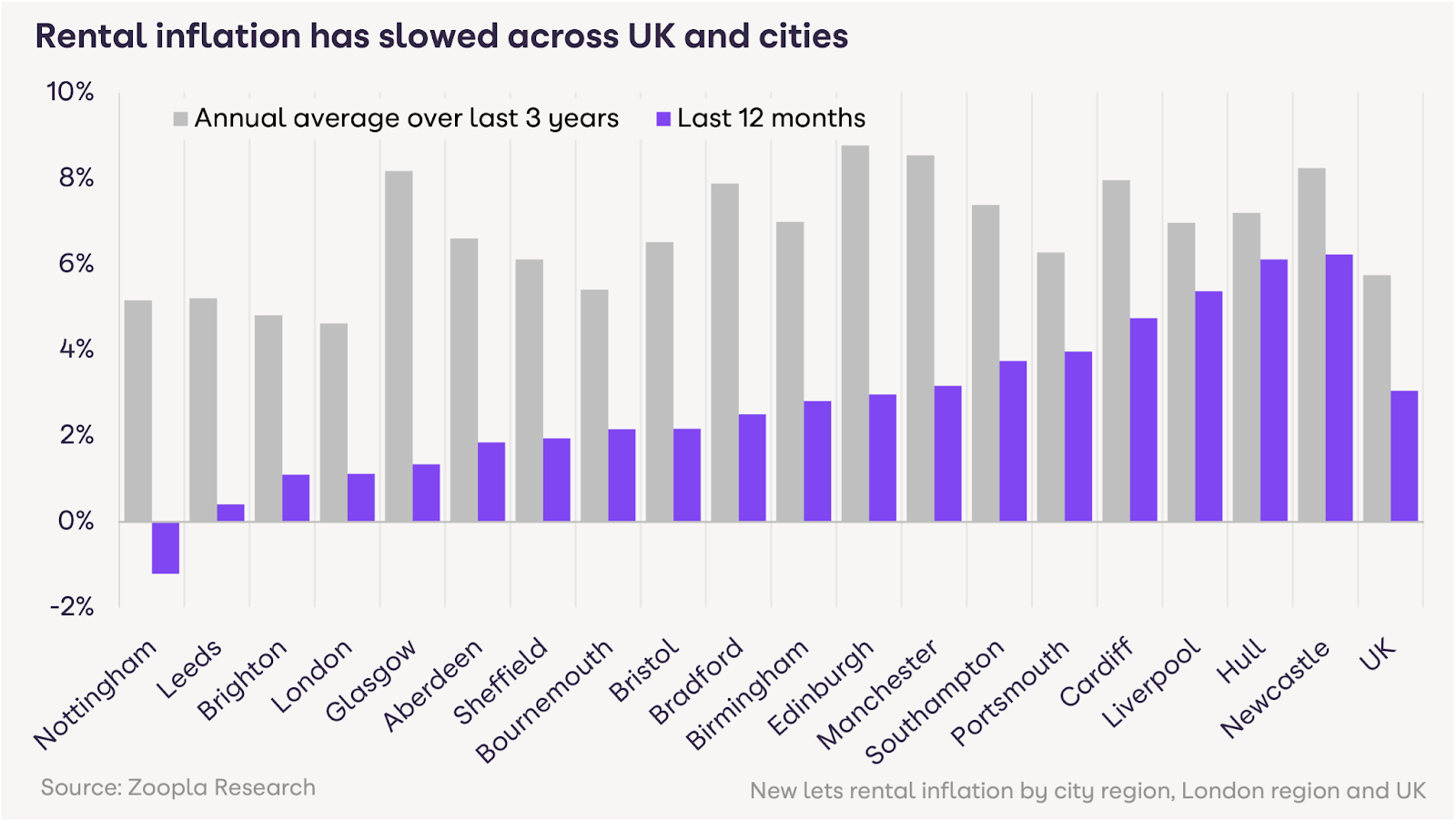

The latest analysis from Zoopla reveals that UK rents for new lets have increased by 3% over the past year, significantly down from the 7.4% growth recorded a year ago.

While this slowdown signals an easing of pressure on tenants, broader market challenges persist, particularly for landlords and mortgage professionals navigating an evolving regulatory landscape.

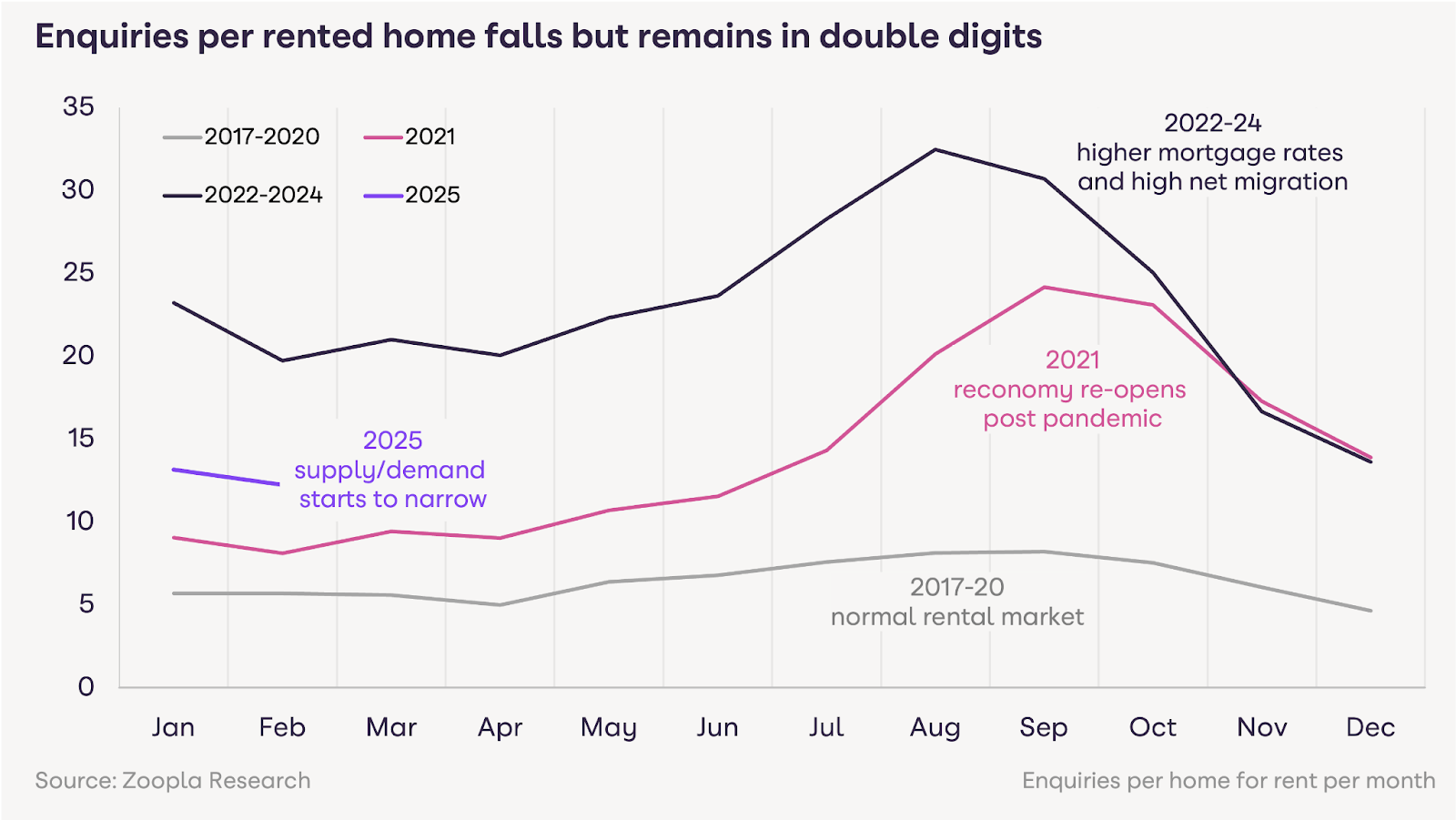

Zoopla says that a significant trend in the rental sector is the narrowing supply-demand imbalance.

The number of homes available to rent has increased by 11% year-on-year, while demand has dropped by 17%.

This shift is attributed to lower immigration levels and improved first-time buyer activity, reducing competition in the rental market.

However, despite these changes, rental affordability remains a pressing issue, limiting further declines in rental inflation.

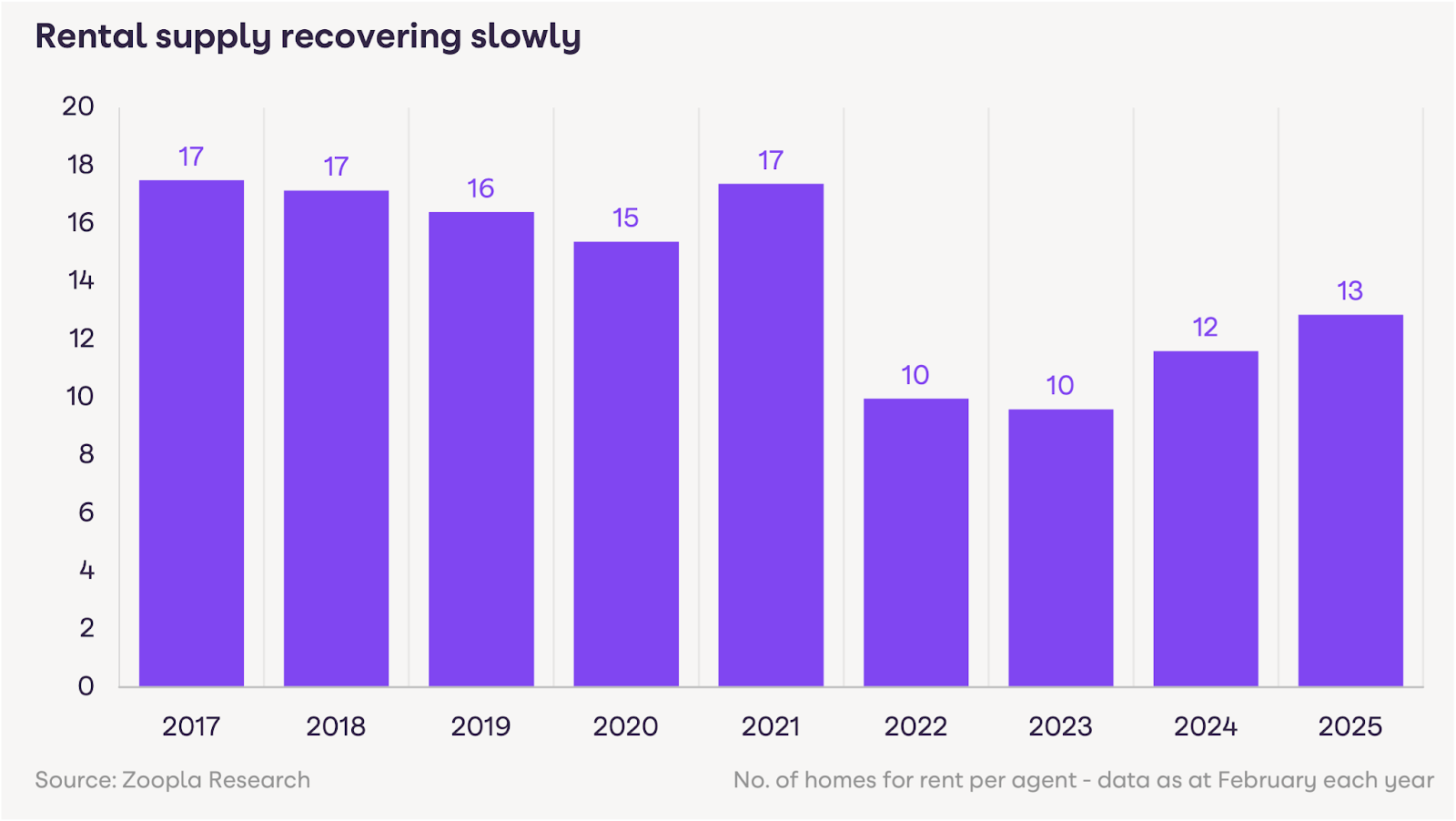

The average rent for a new let now stands at £1,284 per month, with letting agents holding an average of 13 rental properties – an improvement from the low of 10 in 2023 but still 22% below pre-pandemic levels.

Additionally, the Office for National Statistics (ONS) reports that private renters saw the highest rise in living costs of any demographic in 2024.

REGULATORY PRESSURES

The private rental sector in England is facing a series of policy changes, most notably the Renters’ Reform Bill.

These reforms are expected to increase operational complexities and costs for landlords, potentially deterring new investment in the sector.

Since the 2016 tax changes and subsequent rise in mortgage rates from 2022, investment in private rental housing has stagnated, keeping the total number of rental homes across Great Britain at approximately 5.5 million. With demand continuing to outpace supply, rental prices have climbed by 24% over the past three years.

RENTERS’ REFORM BILL CHANGES

The proposed changes under the Renters’ Reform Bill, alongside stricter energy efficiency requirements mandating rental properties achieve an EPC rating of at least ‘C’ by 2028, may further limit available stock.

Almost 45% of rental homes require upgrades to meet these standards, while 16% of private rental properties with current ‘E’, ‘F’, or ‘G’ ratings face removal from the market.

REGIONAL TRENDS

Rental demand has cooled across most UK regions, except for the West Midlands, where supply remains constrained. London has seen the slowest rental inflation at 1.1%, while Northern Ireland leads with a 9% increase.

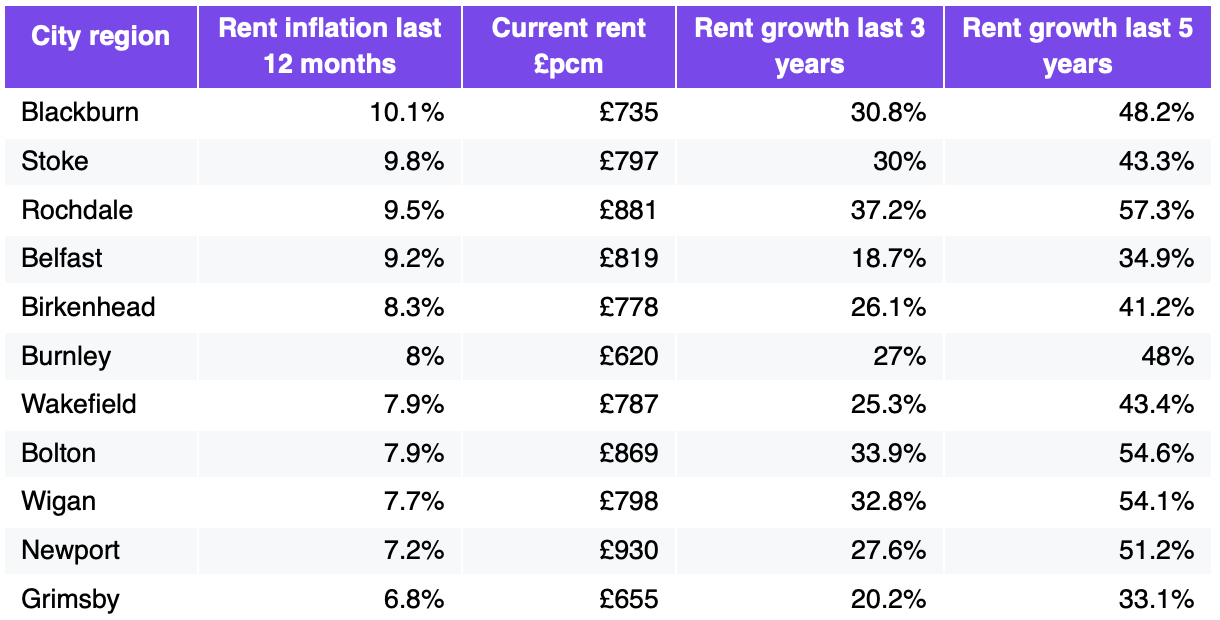

Other high-growth areas include the North East (6.3%) and smaller cities such as Blackburn (10.1%), Stoke (9.8%), and Rochdale (9.6%). Meanwhile, Nottingham has experienced a -1.2% decline in rents, demonstrating the impact of localised supply and demand factors.

WELCOME NEWS

Richard Donnell, Zoopla’s executive director, said: “Rents are rising more slowly than average earnings, which will be welcome news for renters after three years where rents have risen rapidly.

“Affordability remains the primary constraint on rental inflation rather than increased supply and greater choice of homes for rent.

“We expect demand for rented homes to continue to exceed available supply in 2025, keeping a steady upward pressure on rents.”

NEGATIVE IMPACTS

And he added: “The overall stock of private rented homes is unlikely to increase in size in the coming years due to rental reforms and policy changes impacting levels of new investment.

“It’s important that reforms in the private rented sector are designed and rolled out to minimise the negative impacts on available supply, which hit those with lower incomes hardest.

“We expect rents to increase by 3-4% per cent over 2025 as slower growth in large cities is offset by faster growth in more affordable markets.”