Private renters have seen their monthly housing costs rise more sharply than mortgaged homeowners over the past three years with average rents now £221 a month higher than in 2022, according to new analysis from Zoopla.

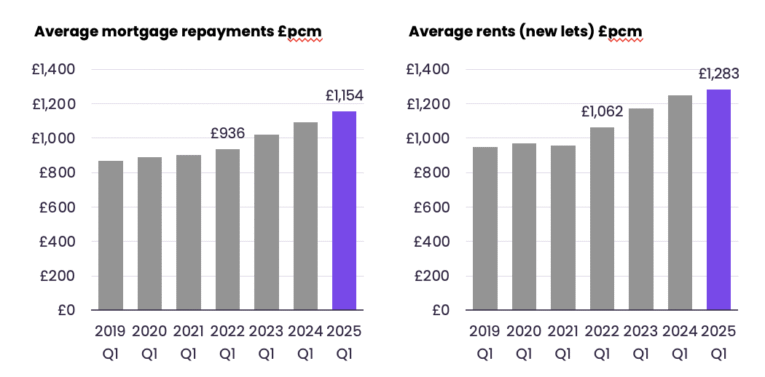

The property portal found that average private rents across the UK now stand at £1,283 per month, compared to £1,154 for average mortgage repayments on outstanding home loans.

While mortgaged homeowners have seen their monthly costs increase by £218 since 2022 due to rising interest rates, renters have faced an even greater jump, driven by surging demand and a stagnating supply of homes to let.

While landlords have pulled back on new investment, the rental market has struggled to keep up with rising demand, particularly during 2022 and 2023.

TIGHTER MORTGAGE CONDITIONS

A strong labour market, increased migration for work and study and tighter mortgage conditions for first-time buyers all contributed to a sharp rise in rental competition.

Source: Zoopla

Certain areas have seen especially rapid rent inflation. In towns such as Oldham, Wigan, and Bolton, rents have surged more than 31% in three years, albeit from a relatively low base. In London, where rents are already the highest in the country, tenants have faced the biggest monetary increases – up to £400 per month – particularly in more affordable outer boroughs such as Ilford.

Although strong wage growth over the last three years has helped absorb some of the impact, Zoopla warns that low-income renters and those reliant on housing support are experiencing a disproportionate financial strain.

AFFORDABILITY RULES

Meanwhile, the mortgage market has shown resilience despite interest rate hikes, thanks to post-2015 affordability rules that stress-tested borrowers’ ability to withstand higher repayments. Unlike renters, mortgage holders benefit from gradually reducing their debt through capital repayment.

As conditions begin to stabilise, Zoopla says that annual rental growth for new lets has slowed to its lowest rate in four years, as demand tapers off amid falling migration and improved mortgage options for buyers.

Nevertheless, the chronic under-supply of rental properties continues to exert upward pressure on rents, and analysts say a long-term solution will require a meaningful increase in housing stock across all tenures.

HIGHER MORTGAGE RATES

Richard Donnell, Executive Director at Zoopla, said: “A shift to higher mortgage rates raised alarm over how mortgagees would be able to afford higher repayments over the last three years.

“The sales market has been resilient thanks to mortgage regulations that ensured borrowers could afford higher mortgage rates. Renters have faced similarly steep increases in the cost of renting in recent years with rents pushed higher on strong demand and limited supply of homes for rent which has hit lower income renters hardest.”

LOWEST FOR FOUR YEARS

And he added: “Rental inflation for new lets has slowed to its lowest rate for four years which will be welcome news for Britain’s private renters.

“The quickest way to alleviate high rents is to grow the stock of homes for rent in both the social and private rented sectors. Growing housing supply is a key Government target and it’s vital that the stock of rented homes is expanded across all tenures.”