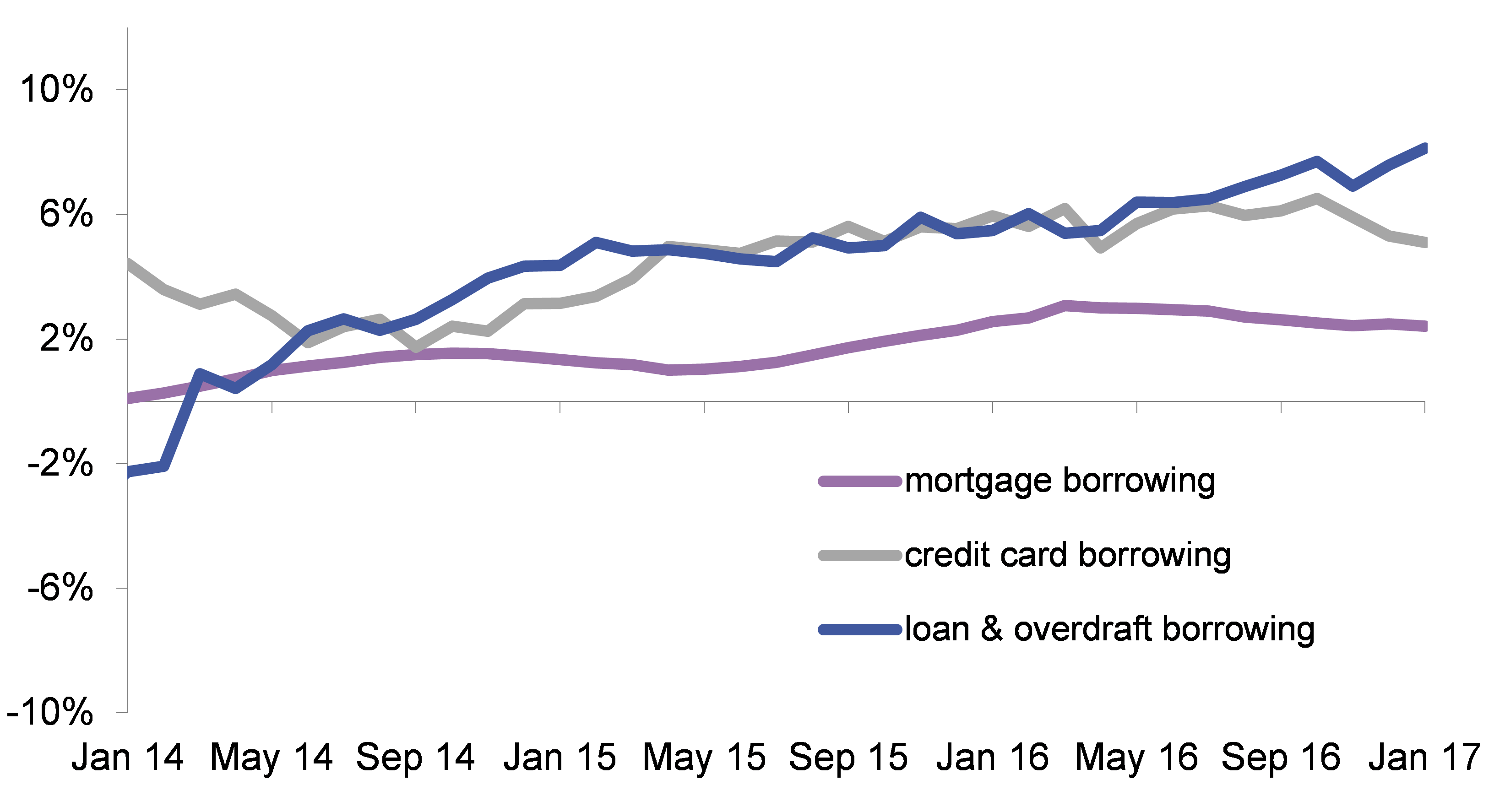

Latest high street banking data from the British Bankers’ Association (BBA) shows that consumer borrowing through overdrafts, loans and credit cards grew at an annual rate of 6.7%.

Gross mortgage borrowing totalled £13.8 billion in January, 6.3% higher than the same period last year. Net mortgage borrowing was 2.4% higher in January than a year ago.

Remortgaging approvals in January were 15.7% higher than January 2016, driven by historically low interest rates.

Net mortgage borrowing was 2.4% last month, higher than in January 2016.

Eric Leenders, BBA managing director for retail banking, said: “The new year saw homeowners make the most of historically low interest rates by taking advantage of competitive re-mortgage offers. Nearly 29,000 of these deals were approved last month – 16% higher than January last year.”

Annual borrowing growth rates

Number of approvals

Mortgage approvals

House purchase approval numbers of 44,657 were 2.5% lower than in January 2016 but 2.5% higher than December and above the 2016 monthly average of 41,320.

Remortgaging approvals of 28,862 in January were 15.7% higher than those in January 2016 and though lower than December’s approval numbers they are still above the 2016 average of 25,987.

Other advances were 15% higher than a year ago and the highest since January 2014.

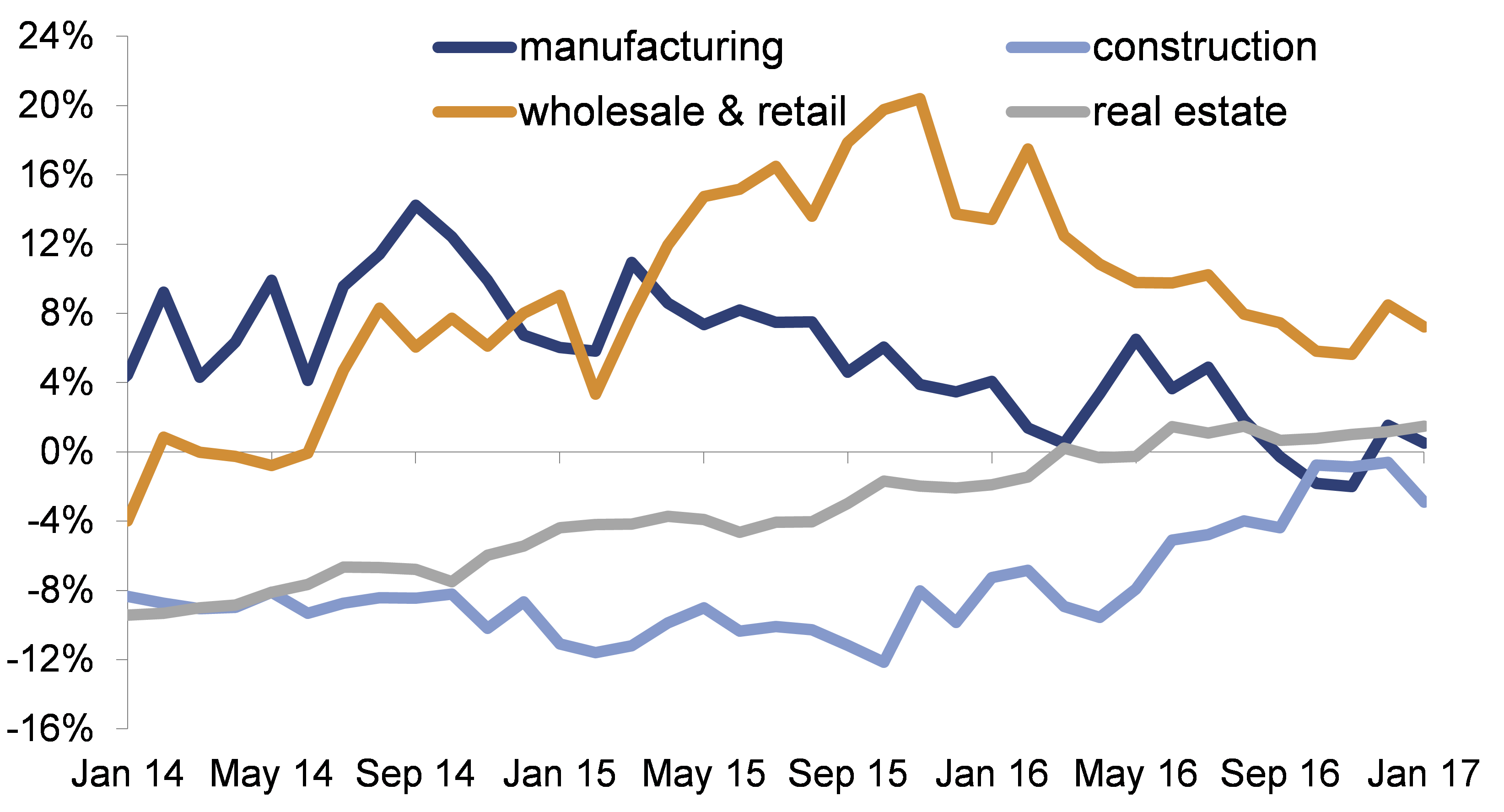

Business borrowing annual growth rates

Personal deposits annual growth slowed slightly in January to 4%.

Non-financial companies deposits grew at an average annual rate of over 8% in 2015 but fell back in 2016 to an average annual rate of 5% and are currently growing at an annual rate of 3%.