The number of remortgage completions fell by more than a quarter in August as activity in the market slowed, according to the latest snapshot from LMS.

Completions were down 28% compared with July, while new instructions also fell, dropping 8% on the month.

The pipeline of future business declined slightly by 1%, while the overall cancellation rate rose by 6%.

For those who did remortgage, the financial impact was significant. Borrowers who switched deals in August saw their average monthly repayments rise by £354, with nearly half (49%) reporting an increase. Only 34% were able to reduce their monthly costs.

SHIFTING LOAN SIZES

Loan sizes also shifted, with 45% of borrowers increasing the amount borrowed, compared with 19% who reduced their loans. On average, borrowers who increased their borrowing took on an extra £22,615, while those reducing debt cut their mortgage by £11,327.

Two-year fixed-rate mortgages were the most popular product in August, accounting for 47%of completions, followed by 5-year fixes at 41%.

Security of repayments remained the overriding motivation: 77% of borrowers said they chose a fixed-rate deal to guarantee monthly costs, while 30% remortgaged to release equity.

LONDON DOMINATES

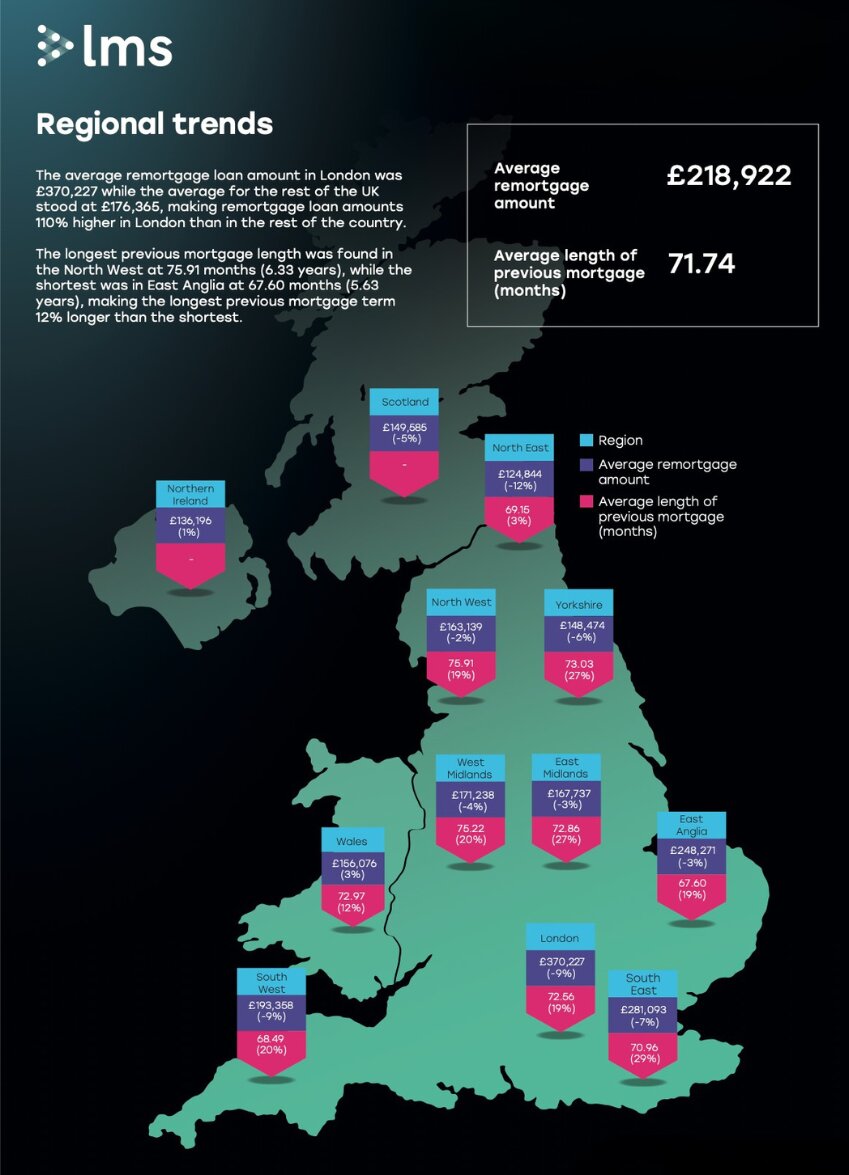

Regionally, London continued to dominate with an average remortgage loan of £370,227, more than double the UK average of £176,365 outside the capital.

Across the UK, the average stood at £218,922, down 6% on July.

Looking ahead, 42% of borrowers expect interest rates to rise again within the next year, while 36% do not anticipate any further increases.

RESILIENT MARKET

Nick Chadbourne (main picture), LMS chief executive, said: “August saw the usual seasonal dip in remortgage activity, but the market remains resilient.

“The popularity of 2-year fixed-rate products suggests borrowers are hedging their bets, looking for short-term protection while keeping options open should rates ease over the next couple of years.

“With households now back into a routine after summer, we expect activity to build as the year progresses, echoing the rebound we saw this time last year.”