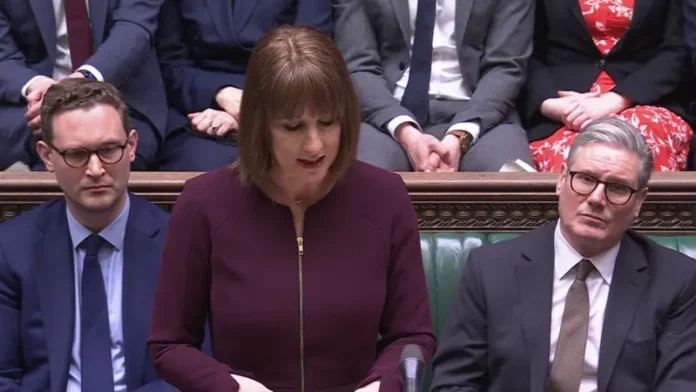

Chancellor Rachel Reeves has reaffirmed the government’s commitment to bringing inflation down to 2% by 2027, despite growing economic uncertainty.

Delivering her Spring Statement, Reeves acknowledged that the UK’s growth forecast for 2025 has been cut in half by the Office for Budget Responsibility (OBR), dropping from 2% to just 1%.

She attributed the downgrade to global economic instability but insisted that her fiscal rules on stability and investment had been met two years ahead of schedule.

Announcing further adjustments to welfare reforms set out last week, Reeves confirmed that planned cuts would reduce spending in the welfare budget by £4.8 billion.

The chancellor emphasised the need for close collaboration with the Bank of England to steer the economy towards its inflation target.

She pointed to the role of the independent Monetary Policy Committee in guiding inflation back to 2%, down from its peak of 11% under the previous Conservative government.

Reeves argued that achieving this target would provide the economy with “the stable platform it needs to grow.”

This morning borrowers got a surprise boost as inflation fell more than expected last month, dropping to 2.8% from 3% in January.

DAMP SQUIB

Rob Clifford, chief executive of Stonebridge, said: “While the Spring Statement was a damp squib for the mortgage market, it was encouraging to hear that the OBR believes the government’s recent planning reforms will boost housebuilding by 170,000 homes by 2029/30.

“Successive governments have tried and failed to tackle the planning system, so it’s encouraging to see meaningful reforms finally making a difference.

“It’s important to note that the OBR’s forecast is based solely on changes to the National Planning Policy Framework.”

“It’s important to note that the OBR’s forecast is based solely on changes to the National Planning Policy Framework, which restores housebuilding targets and requires councils to release low-quality ‘grey belt’ land for development.

“Crucially, it does not yet account for the impact of the Planning and Infrastructure Bill, which is still making its way through Parliament.

“This is a great step forward, but we need to go much further. The UK has consistently fallen short of building enough homes, and we need to be delivering well in excess of 300,000 per year to start making up for past failures.

“If the government can achieve that, it will help unlock the dream of homeownership for a generation of would-be buyers. If it falls short, housing will only become more unaffordable, pushing homeownership further out of reach for young people. The stakes couldn’t be higher.”

DIDN’T DO MUCH

Jeremy Leaf, north London estate agent and a former RICS residential chairman, said: “Our first wish was granted – the Chancellor didn’t do much, if anything, to deter existing activity in the housing market.

“The first way of dealing with a problem is to recognise it and the Government seems to have realised that there is a housing crisis.

“It has been widely accepted that affordable housing in particular is insufficient and improving planning is a significant contributor to that aim.

“Rachel Reeves said herself that it is too slow so the extra funding announced yesterday in the social and affordable homes programme is good news, although we still need more detail of where, when and how those spades are going to be in the ground.

“We are disappointed there wasn’t more direct assistance for the private sector.”

“We are disappointed there wasn’t more direct assistance for the private sector, particularly SMEs who cumulatively can make such a big difference to the overall problem. Builders won’t build unless it is profitable for them to do so and there is reasonable prospect of adequate demand for the product envisaged. It would have been good to see some recognition of this.

“It also seems a little unfair on those who have moved heaven and earth to take advantage of the stamp duty concession before it disappears but who may not make it, through no fault of their own.

STAMP DUTY DEADLINE COULD HAVE BEEN EXTENDED

“The deadline could perhaps have been extended for those transactions in solicitors’ hands from the beginning of February as a small respite. Looking forward, a broader review into the impact of stamp duty on the market and making it less of a deterrent, particularly at the first-time buyer end, would have been welcome.

“We were sorry not to see anything supporting landlords to stay in the sector.”

“We were sorry not to see anything supporting landlords to stay in the sector because it is not just a question of keeping house prices in check but also rents, which have softened a little lately but are still too high.

“Overall, it’s a six out of ten. Could do better and hopefully this will improve to an eight out of ten in the next few months if these policies are seen to be making a contribution.”

EXTREMELY DISAPPOINTING

Rightmove’s property expert Colleen Babcock said: “It’s extremely disappointing that the government have not used the Spring Statement as an opportunity to extend the impending stamp duty deadline for those currently going through the home-moving process.

“We estimate over 70,000 buyers are going to miss the deadline and complete in April instead, and a third of those are first-time buyers.

“Our data shows that a typical first-time buyer now faces average monthly mortgage payments of £940 compared with £590 per month five years ago.”

“Given the current challenges faced by first-time buyers, our data shows that a typical first-time buyer in Britain now faces average monthly mortgage payments of £940, a 59% increase compared with £590 per month five years ago.

“Over that same period rents have increased by 40% across Great Britain. So, while we welcome the government’s focus and investment to help build more affordable homes, we’re keen to hear more about how this, or other incentives, can help more first-time buyers.”

MISSED OPPORTUNITY

Tony Hall, head of business development at Saffron for Intermediaries, said: “Today was a missed opportunity to help the estimated 75,000 people who are expected to miss next week’s stamp duty deadline.

“As a result of the existing backlog, we’re hearing from brokers that cases opened as early as January are unlikely to close in time, dealing unexpected tax blows onto many prospective homeowners.

“We should be helping these people get onto the property ladder – for instance, through progressive affordability criteria that takes into account rent payments – rather than creating more hurdles for them to overcome in order to realise their housing aspirations.

“A silver lining from today’s Spring statement was planning reforms taking centre stage.”

“That being said, a silver lining from today’s Spring statement was planning reforms taking centre stage, with the Chancellor setting out ambitious plans to build 1.3 million homes in the UK over the next five years. However, while the commitment to accelerate

housebuilding is welcome – especially 18,000 social and affordable homes – there is apprehension from the market on whether these targets can realistically be met, given the structural challenges that have long constrained property development.”

AFFORDABILITY CHALLENGES WILL PERSIST

Matt Harrison, Commercial Director at finova Broker, said: “It’s disappointing to see that the Spring statement has not introduced any meaningful measures to support homebuyers in light of the upcoming stamp duty changes.

“With the tax-free threshold set to drop in April 2025, we are already seeing a rush of buyers trying to complete transactions before the deadline, which is likely to be followed by a sharp slowdown later in the year. This pattern of market peaks and troughs is becoming all too familiar and does little to promote long-term stability.

“A more measured approach would have been welcomed.”

“A more measured approach, with policies aimed at sustaining steady growth rather than fuelling short-term spikes, would have been welcomed by both buyers and industry professionals.

“Without intervention, affordability challenges will persist, and many prospective homeowners may find themselves priced out of the market. A more strategic, long-term vision for the housing sector is sorely needed.”

NOTHING FOR FIRST-TIME BUYERS

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “The Spring Statement was underwhelming as far as the housing market is concerned.

“The Chancellor missed an opportunity to boost all-important transactions by extending the stamp duty concession or introducing some discount for downsizers.

“She also did nothing for first-time buyers – a significant shame.”

“She also did nothing for first-time buyers, with no incentives or assistance to get them on the housing ladder – a significant shame as first-time buyers are the lifeblood of the market and enable existing homeowners to move up the ladder.

“Housebuilding, easing planning rules and improving the supply of new homes is vital but there was very little detail as to how these targets will be delivered.”

EASE MORTGAGE REGULATIONS

Richard Donnell, Executive Director at Zoopla, says: “The housing market needs a strong and growing economy to support housing supply.

“It’s promising to see the Government focusing on longer-term impact by boosting funding for new homes and avoiding short-term measures like stamp duty holidays that don’t really help with the fundamental challenges in the housing market.

“The top priority should be an easing of mortgage regulations, which will support first-time buyers, an important buyer group for homebuilders and the broader market.

“This would also help the rental sector, where there are still 12 people chasing every home for rent, with those on low incomes bearing the brunt. Increased funding for social housing is essential in the upcoming Spending Review to help support housing delivery and boost the stock of social rented homes, which has been static for 30 years.”

STAMP DUTY REFORM NEEDED

Michael Cook, chief executive of Leaders Romans Group, said: “Given the challenge of making £15 billion worth of cuts to public spending, today’s Spring Statement was never going deliver everything on the property industry’s wishlist.

“That said, two significant pieces of good news stand out amongst some otherwise depressing statistics. And this goes to show the faith that the government has its our sector to deliver much needed growth.

The first is the £2bn top-up for the Affordable Homes Programme which will provide up to 18,000 new social and affordable homes. With demand for rental properties outpacing supply, it’s good to see the government helping to address this need.

“The government rarely addresses social housing in its broadest sense – homes for sale as well as for rent.”

However, it seems a missed opportunity that the government rarely addresses social housing in its broadest sense – homes for sale as well as for rent.

“At very little cost to the taxpayer, the government could do much more to champion shared ownership as an affordable and practical way of addressing this country’s housing crisis and enable first time buyers to get a foot on the housing ladder.

“The £600m for construction training is also very welcome. But again, there is a cost-free solution to the skills shortage which has been overlooked. Again it concerns communication. The various trades and professions that make up the construction sector deserve greater respect and recognition.

“There is undoubtedly a long-overdue need for a comprehensive reassessment of stamp duty.”

“There is undoubtedly a long-overdue need for a comprehensive reassessment of stamp duty.”

Unfortunately this may have to wait until a future spending review, but in the meantime, I would hope that the government sets about considering changes to what can be a very damaging tax – one that can cost the Treasury, rather than benefitting it, bearing in mind the unintended consequence of discouraging people to move up the property ladder.”

NO STAMP DUTY U-TURN

Matt Thompson, head of sales at Chestertons, said: “We have met a lot of first-time buyers who held out hope for the Chancellor to make a U-turn on stamp duty thresholds in today’s Spring Forecast.

“As this hasn’t been the case, first-time buyers will now have to ensure that their budget can cover the cost increase which means some might compromise on location or type of property.

“Although the rush of first-time buyers has slowed down, demand remains strong.”

“Although the rush of first-time buyers that the market has seen earlier this year has slowed down, demand remains strong as mortgage rates are still attractive enough to motivate buyers to get on the property ladder.”

“Earlier this year, the news reported an exodus of wealthy individuals from the UK amid the abolition of Non-Dom tax breaks.

“Although the Chancellor decided to soften those changes, it had already alienated a demographic that is key to the UK’s long-term economic growth.

“We are pleased that Rachel Reeves has taken the backlash into consideration and decided not to introduce a mansion tax for the time being which could see some HNWIs deciding to stay or return to the UK.”

GETTING BRITAIN BUILDING

Ben Thompson, deputy chief executive, Mortgage Advice Bureau, said: “While the Chancellor has reinforced the government’s commitment to get Britain building again, and declared that households will be £500+ a year better off on average, there was little else for aspiring first time buyers or home movers to get excited about in today’s Spring Statement.

“The focus now must shift towards more direction and innovation from regulators and lenders to support a larger pool of borrowers and open up the housing market.

“Responsible lending proposals to consider relaxing affordability criteria and LTI caps would be welcomed with open arms.”

“Responsible lending proposals to consider relaxing affordability criteria and LTI caps, and the development of mortgage products that focus on rental track records are just some of the options that would be welcomed with open arms, making homeownership more accessible and affordable.

“We’ve also long campaigned that those who buy or retrofit their homes to a higher EPC rating should be rewarded.

“This is alongside pushing for more concrete investment to encourage retrofitting 29 million of UK homes. We believe this can be achieved through offering a stamp duty refund to those who buy and then retrofit to an EPC rating of C or above, and we hope this will be reconsidered by the government in the future.”

PLANNING REFORMS A STEP FORWARD

Jonathan Handford, managing Director at national estate agent group Fine & Country, said: “The planning reforms announced in today’s Spring Statement are a significant step forward for the UK housing sector – especially for first-time buyers struggling to get onto the property ladder.

“For too long, an outdated and restrictive planning system has held back housebuilding, creating a chronic undersupply of homes, particularly in high-demand areas.

“These reforms will help to unlock land, cut red tape, and support responsible development, ensuring more high-quality homes are built where they are needed most.

“The Office for Budget Responsibility (OBR) has forecast that these changes will drive housebuilding to its highest level in over 40 years, with an extra 170,000 homes delivered by 2029 to 2030 – boosting annual supply by 30% after a decade of stagnation.

“More homes mean more options for buyers, easing affordability pressures and making homeownership a more realistic goal for many.”

“More homes mean more options for buyers, easing affordability pressures and making homeownership a more realistic goal for many.

“The housing market is a pillar of the UK economy, and long-term stability is key.

“Alongside planning reform, the government should consider further support, such as a modernised Help to Buy scheme and targeted stamp duty reductions.

“A planning system that prioritises responsible development – combined with policies that support first-time buyers – will unlock opportunities, increase affordability, and create a stronger, more accessible property market for all.”

NOTHING NEW

John Phillips, chief executive of Spicerhaart and Just Mortgages, said: “With the backing of the latest OBR forecasts, the Chancellor lauded housebuilding figures that the OBR predicts will be at a 40-year high by the end of this parliament – with 1.3 million homes putting it in ‘touching distance of its target’. If this is achieved – and it’s a big if – this would clearly be fantastic news.

“It was good to see further funding earmarked for affordable housing, as well as additional funding for the next generation of construction workers – although both were announced in advance.

“Today’s statement really offered nothing new and once again demonstrates the clear disconnect within government.”

“Today’s statement really offered nothing new and once again demonstrates the clear disconnect within government between supply-side measures and tangible action and support to actually address affordability challenges faced by potential buyers in today’s housing market.

“We have long called for greater support – such as equity loan schemes or for existing schemes like Shared Ownership – to help people buy and ultimately support demand for new houses.

“The housing market plays a critical role in driving economic growth. While increasing supply is absolutely critical, we need measures now to give buyers the ability to buy – not just to enable people to achieve their homeownership goals, but to give the economy the adrenaline shot it needs.”

JUST RHETORIC

Richard Pike, chief of sales and marketing at Phoebus Software, said: “The Spring statement was a chance for the government to take meaningful action on the UK’s housing challenges, but it fell short.

“With housebuilding targets under pressure and affordability concerns growing, we needed bold, practical measures – not just rhetoric.

“The 2025 UK economic growth forecast has been halved to just 1%, which will inevitably impact business confidence. In an uncertain economic climate, clear policy direction is needed to support investment in housing and ensure developers, lenders, and buyers have the confidence to move forward.

“Despite Labour’s commitment to boosting housebuilding, the real test lies in delivery.”

“Despite Labour’s commitment to boosting housebuilding, the real test lies in delivery. While the OBR forecasts housebuilding will reach its highest level in over 40 years by 2029/30 as a result of planning reforms, it will still fall short of the 1.5 million homes target, but if 1.3 million homes are built, that would still be an excellent result.

“The government must do more to unlock existing supply, particularly in affordable and later-life housing. Greater support for SME developers and a move towards reassessment of stamp duty could have helped create a more dynamic and accessible market at a time when economic uncertainty risks slowing progress further.

“For lenders and intermediaries, making property transactions smoother and more efficient should be a priority.”

“For lenders and intermediaries, making property transactions smoother and more efficient should be a priority.

“But with no clear commitment to improving digital infrastructure or fostering innovation in mortgage technology, the barriers that slow down home purchases remain firmly in place. Hopefully the excellent work we and others are involved in with OPDA will help in this area.

“This was a missed opportunity to put forward real solutions to the housing crisis. The industry needs more than warm words – it needs decisive action.”

UNDERWHELMING

Mark Tosetti, chief executive, Conveyancing Alliance (CAL), part of Movera, said: “After an underwhelming Spring Statement, especially concerning the property market, it now appears the sector must pull itself up by it’s bootstraps. Let’s focus on the areas we can improve internally.

“We know the government has committed to digital transformation; we too must continue to commit to this.

“We as an industry must continue to invest in people, in innovation and tech.”

“We as an industry must continue to invest in people, in innovation and tech, and in other enablers that support the ambition of individual brands and ultimately builds the whole sector up with it.

“Investing in our platforms to drive efficiency, quality and turnaround times, deploy best-in-class solutions can help break down blockers across the industry.

“This was not a defining Statement for the Chancellor, but that doesn’t stop it being one for the sector.”

POTENTIAL GAME-CHANGER

Iain McKenzie, chief executive of The Guild of Property Professionals, said: “The Chancellor’s Spring Statement highlighted the potential impact of Labour’s planning reforms, with the OBR forecasting a 40-year high in housebuilding.

“If realised, this could be a game-changer for the housing market, helping to address supply shortages and improve affordability.

“It remains frustrating that it is not being treated as a priority.”

“However, while the government acknowledges the housing market’s significant influence on the wider economy, it remains frustrating that it is not being treated as a priority. Increased housing market activity drives consumer spending and economic growth, yet little was said about measures to stimulate transactions and support buyers.

“We need more than just planning reforms to truly unlock the potential of the property sector. Stamp duty reform, mortgage accessibility, and targeted incentives for buyers and sellers must all be on the agenda if we are to create a sustainable and thriving housing market that benefits both individuals and the economy as a whole.”

REAL SUPPORT NEEDED

Damien Druce, commercial director at Black & White Bridging, said: “I will say this about the Spring statement – it didn’t provide any shocks to the system. Of course, this also means it said little at all.

“We’ve seen from the latest UK Construction PMI figures that overall construction activity has seen its steepest decline since May 2020, with residential building falling to 39.3 – it’s lowest level since early 2009 outside the pandemic.

“These are not the signs of an industry primed to deliver 1.5 million new homes by the end of this parliament.”

“New orders are dropping at their fastest rate in nearly five years, job losses are accelerating, and costs are rising. These are not the signs of an industry primed to deliver 1.5 million new homes by the end of this parliament.

“The Spring Statement has proposed changes to the National Planning Policy Framework (NPPF) to deliver 1.3 million of the 1.5 million homes.

“But are planning policies the real ‘blocker’ here? Independent data suggests no. The number of planning applications submitted in the year to September 2024 was the lowest since records began in 2005.

“The industry needs real support. This support should be in the form of financial incentives for SME developers and the much-talked-about change to the planning system. Because if not, it could easily collapse into rubble.”

NOT EARTH SHATTERING

Melanie Spencer, sales and growth lead at Target Group, said: “Much to the dismay of the mortgage market and the wider housing sector, there was nothing really earth shattering to come out of today’s statement.

“It was interesting to see the OBR predict that the Government will come close to its housebuilding targets by the end of the parliament, although we still lack any further updates on how potential borrowers will be supported in buying these properties.

“It would have been great to see changes to the Lifetime ISA to make it fit for purpose in today’s climate and property market.”

“In just one measure, it would have been great to see changes to the Lifetime ISA to make it fit for purpose in today’s climate and property market.

“The same is also true for measures to help speed up the homebuying process, with no further progress announced – leaving lenders, platform providers and technology firms to do much of the heavy lifting.

“As announced prior, the Chancellor focused on reforms to the welfare system, all while aiming to cut some of the fat to make the government leaner and more efficient. She confirmed the use of AI tools to help modernise the state.

“Given that we have already seen examples of bias within government AI systems – ones detecting welfare fraud no less – the government will have to tread the same careful line as financial services when implementing AI systems and make use of key partners and integrations to deliver innovation and efficiency while minimising risk.”

PLANNING REFORM STEP IN RIGHT DIRECTION

Felicity Barnett, lender operations manager, Mortgage Advice Bureau, said: “Today’s announcement that planning reforms will ensure housebuilding reaches a 40-year high, with 1.3m homes predicted to be built over the next five years, is a step in the right direction.

“Now, our industry must ensure we’re doing everything we can to, as Rachel Reeves highlighted, “come within touching distance” of the 1.5m target.

“In the context of rising rents, house prices, and the cost-of-living, demand for more affordable housing has never been greater – especially in a post Help-to-Buy world.

“Rather than rinsing and repeating old products, we need to apply outside of the box thinking.”

“Following these latest announcements, more innovation from lenders is needed. Rather than rinsing and repeating old products, we need to apply outside of the box thinking to enact real change. Focus must shift to how we can open up the contracting market, as opposed to increasing share.

“More emphasis needs to be placed on the first time buyer market. As an industry, we must now work as a collective to lower the current average first time buyer age of 35+, providing those in their twenties with more accessible, affordable options to get on the property ladder.

“There needs to be a marked shift in boosting the number of renters transitioning to become first time buyers.”

“In particular, there needs to be a marked shift in boosting the number of renters transitioning to become first time buyers.

“These are prospective homeowners who are currently trapped by strict affordability criteria. For starters, more could be done at government level to fully realise Shared Ownership’s true potential, but this still won’t be enough on its own to achieve housebuilding targets.

“We’ll wait with bated breath to see how the FCA’s proposals to relax mortgage lending rules develop in the next few months.”

MISSED OPPORTUNITY

Simon Webb, managing director of capital markets and finance at LiveMore, said: “The Spring statement may have been a missed opportunity, but that doesn’t mean we stand still.

“If anything, it reinforces the need for the industry to take the lead in driving change for mid-to-later-life borrowers, many of whom struggle to access suitable mortgage products despite being financially responsible.

“We know the challenges – rigid affordability criteria, a lack of mortgage flexibility, and a tax system that discourages downsizing.

“While government support would have helped, the sector has the expertise and capability to push forward regardless.”

“While government support would have helped, the sector has the expertise and capability to push forward regardless. By investing in innovation, improving digital infrastructure, and modernising lending criteria in line with today’s financial realities, we can break down barriers and provide more options for later life borrowers.

“Collaboration will be key. Lenders, brokers, and policymakers must work together to make the later life mortgage market more accessible.

Expanding mortgage flexibility, streamlining application processes, and developing new products that better reflect later-life incomes are all within our reach.”

LACKED AMBITION

Richard Sexton, commercial director of surveying portal HouzeCheck, said: “I was disappointed, frankly. First, I don’t buy this idea that the spring statement exists purely to offer an update on the economic and fiscal position.

“Think back to 2019 – Philip Hammond’s spring statement was full of announcements. I felt this iteration, on the other hand, lacked ambition.

“Reeves was certainly very unwise to neglect the property market.”

“Reeves was certainly very unwise to neglect the property market – there was nothing new in there about meeting the 1.5m homes target, however positive that would be for UK housing.

“Second, I wanted to see more investment in digital training. If AI skills were more readily available, the surveying profession could leverage tech more to improve efficiency and decision-making in residential valuation.

“We’re already starting to use tech to prompt valuers as they are surveying a property and to ensure they report accurately and consistently. With more access to AI, we could accelerate the profession’s adoption of tech, surpassing the use of AI to provide humans with tech guard rails.

“If Reeves were serious about chasing growth, she would have invested money in boosting the country’s AI training. So, I felt this spring statement missed the mark.”

CERTAINTY AND STABILITY

Hannah Gurga, ABI Director General, said: “Certainty and stability are crucial for economic growth, and we support the approach the Government has set out in its Spring statement to deliver this.

“The insurance and long-term savings sector has a vital role to play in the growth mission, including through the commitment to invest £100 billion in UK productive finance over the next ten years. This includes infrastructure, the transition to green energy and building new homes.

“It’s vital that new homes are fit for the future.”

“We support the Government’s planning and infrastructure reforms, but it’s vital that new homes are fit for the future, able to withstand adverse weather and are not built in areas at risk of flooding.”

NOT A BUDGET

Jamie Jenkins, director of policy at Royal London, said: “Today’s Spring Statement was largely just that, and not a Budget, which is now reserved for the Autumn. Hopefully, the nation’s finances spring forward, but don’t fall back.

“As widely expected, the Chancellor has committed to having one fiscal event each year, sticking to the Government’s self-imposed fiscal rules, and not raising the three main rates of tax on working people. There were no new tax rises announced, rather, a focus on reducing the welfare bill as already widely trailed.

“We can expect more detail on this in the coming weeks.”

“If there were anything that could be viewed as a ‘rabbit from the hat’ it was that the OBR has attributed a significant uplift to growth forecasts against the planning reforms announced.

“There were no concrete announcements on pensions or ISAs, but a brief mention of the former in the speech, and a reference to a forthcoming consultation in the accompanying papers on the latter.

“In both cases, the focus will be on generating greater investment in the UK economy, and specifically growth sectors. We can expect more detail on this in the coming weeks.”